Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Opening Statement from the November 2021 Dividend Gems

Opening Statement from the November 2021 Dividend Gems

Originally published on November 14, 2021 (pre-market release)

Fed to Reduce its Bond-Buying Program

During the recent Fed meeting (November 3) Fed chairman Powell announced the highly anticipated start of a reduction to its monthly purchases of $120 billion of U.S. Treasury and agency mortgage bonds, beginning with a reduction of $15 billion ($10 billion U.S. Treasuries and $5 billion mortgage-backed securities) in November, followed by an additional $15 billion in December.

Because the taper announcement was expected by most investors, the 10-year U.S. Treasury yield did not soar and the stock market did not selloff unlike the aftermath of the taper announcement in 2013 which caught investors by surprise.

The Fed plans to reduce its monthly purchases in a stepwise manner as needed and expects to end the stimulus by June 2022. Meanwhile, Powell emphasized that the end of tapering would not necessarily mean that interest rates would be raised soon after. The Fed intends to begin raising rates once the labor market is near full employment along with moderately elevated inflation.

Although Powell gave no set timeline for future rate hikes, we believe there is a good chance the Fed will begin to hike rates by the end of 2022. We have been issuing this forecast for most of 2021. Investors have gradually entered our camp. This is of course in contrast with the Fed’s initial forecast of the first rate hike beginning at the end of 2023.

It is important to keep in mind that the Fed’s interest rate expectations assume that inflation will subside by mid-2022. Although we generally agree with this estimate, we cannot be certain because high energy prices are adding to the transient nature of inflation and could add to supply chain issues to cause a more lasting inflationary environment.

Inflation Watch

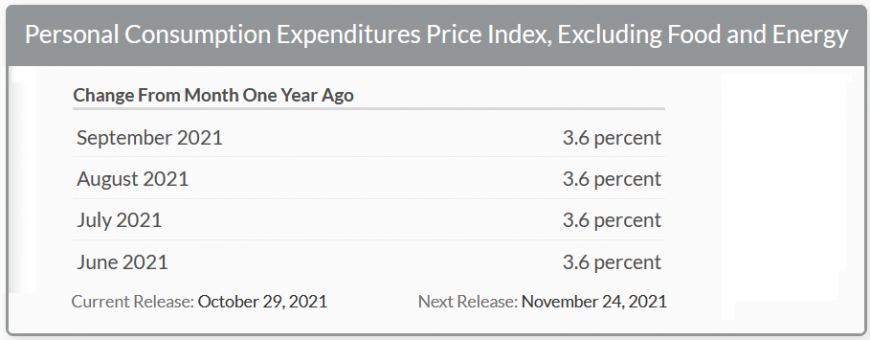

In the Intelligent Investor and other research publications we have been discussing the impact of high energy prices as well as rising minimum wages in many large companies as two factors that could help keep inflation higher than the Fed wants for a longer time. Based on the latest inflation data, we view persistent and/or higher inflation as a higher possibility.

Part of the difficulty surrounding inflation forecasting is due to the fact that inflation is in large part determined by the timing and extent of increases to the Federal funds rate. If the Fed waits too long to respond to inflation by raising the Fed funds rate, it will increase the chance of a more lasting inflationary environment and/or will lead to a more rapid pace of rate hikes, all of which could lead to a severe selloff in the equities markets.

Earnings

With just over 90% of S&P 500 companies having reported financial results for Q3 2021, 80% of the companies in the index have reported a positive earnings surprise, while 76% reported a positive revenue surprise.

Meanwhile, the blended earnings estimate (which includes actual earnings plus estimates of companies that have not yet reported) is just over 39% for Q3. Once all companies have reported, we estimate Q3 earnings growth will come in at just under 40%.

Q4 estimates are currently just over 21%. Because positive revisions for Q4 are coming in at a fairly low rate, we do not believe Q4 earnings growth will exceed 25%, but this would still be quite impressive.

Finally, although the current estimate for full year 2021 earnings growth continues to increase, it remains under 45%. We have been forecasting full year earnings growth above 45% but probably won’t make it to 50%.

The forward 12-month price-to-earnings ratio of the S&P 500 is currently about 21.3. While the Fed’s tapering is expected to (theoretically) reduce the appeal of equities in favor of fixed income, we believe it will take (at least) several months of tapering before long yields rise sufficiently to entice investors. Looking past 2022, higher interest rates are going to put downward pressure on equity valuations.