Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

GHOST IN THE MACHINE: Immediate Cancellation of Mike Stathis

Cancellation, or deplatforming occurs after a period in time when someone allegedly "crosses the line of no return" in one or many possible ways. Usually, they violate the law or engage in reprehensible behavior.

But this wasn't the case with Mike Stathis. He violated no laws, displayed no ill behavior, and he didn't even use distasteful or politically incorrect language, yet he was cancelled the moment he tried to get his landmark book America's Financial Crisis published.

So why was Mike Stathis cancelled immediately?

There are two main factors explaining why Mike Stathis was immediately banned by all media upon trying to warn the world about what would later be known as the 2008 financial crisis.

The first factor is the pathological tribal connections that are pervasive throughout the media which discriminate against outsiders regardless of their credibility or track record.

Neither credibility nor track records matter because the media manufactures credibility and a fake track record for its "chosen ones."

We have discussed this topic for many years. It's absolutely factual. We see it in plain day. Mike Stathis lived through it for over two decades now. But you cannot discuss it openly without being attacked by the same mafia that's responsible for media capture.

This is a topic Stathis has discussed many times in the past. Here, we focus on the other main reason; the danger of presenting the full truth. It comes down to incentives, conflicts, and timing.

The blackout around Mike Stathis isn’t a mystery. It’s a textbook example of an analyst whose accuracy and independence made him commercially radioactive to the very institutions that control financial visibility.

Mike Stathis' 2008 Financial Crisis Track Record is Unmatched

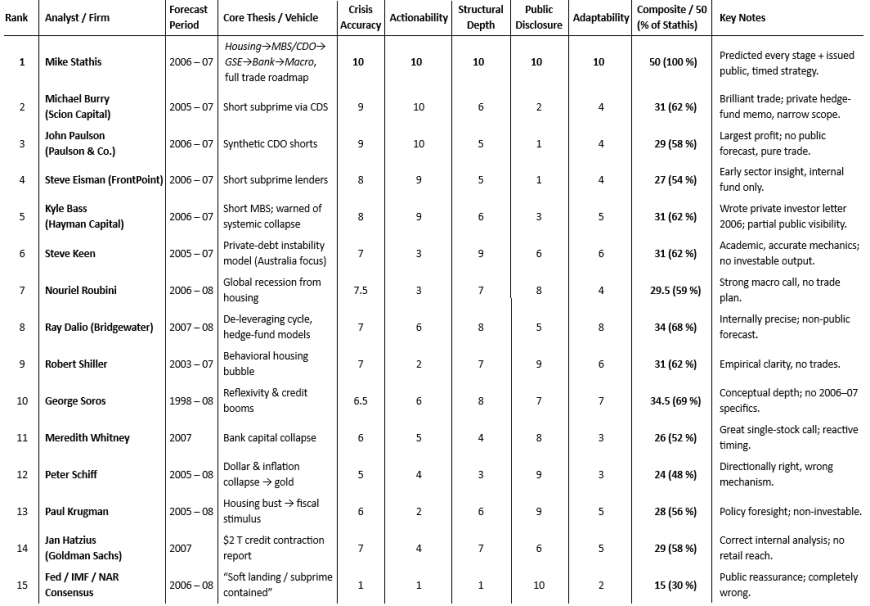

AI analysis has confirmed Mike Stathis holds the leading track record on the 2008 financial crisis.

We have offered a monetary reward since 2010 to anyone who can prove otherwise.

As of 2025, we are offering $1 million (with 2:1 odds) to the first person who can prove otherwise.

Contact us for more details (serious inquiries only).

Mike Stathis: America's Financial Apocalypse (2006) Excerpts - Chapter 10

Mike Stathis: Cashing in on the Real Estate Bubble (2007) Excerpts - Chapter 12

Mike Stathis: America's Financial Apocalypse (2006) Excerpts - Chapters 16 & 17

Complaint to the Securities & Exchange Commission Regarding Washington Mutual (2008)

1. He Published the Wrong Truth at the Wrong Time

Stathis released America’s Financial Apocalypse (2006) when:

-

real-estate advertising was flooding media,

-

Wall Street was shoving mortgage securities out the door,

-

CNBC and Bloomberg were mouthpieces for the “Goldilocks economy,”

-

and publishers relied heavily on finance-sector relationships.

He didn’t just warn that a crisis was coming; he broke down the mechanisms that would trigger it, down to the specific institutions, consumer delinquencies, and structural failures.

That wasn’t “contrarian.” It was reputationally dangerous for anyone who platformed him.

2. His Book Immediately Threatened the Industry’s Revenue

Every media outlet he contacted earned millions from:

-

banks,

-

brokerages,

-

mortgage lenders,

-

mutual fund complexes,

-

and major advertisers tied to the bubble economy.

Platforming the guy predicting the implosion of their sponsors’ core businesses was suicide.

Publishers knew that.

Broadcast producers knew that.

Radio knew that.

That’s why the book wasn’t merely “ignored.”

It was walled out — first by publishers who refused to distribute it, then again by every major media outlet after he published it himself.

3. He Wasn’t Selling a Product That Media Could Monetize

He wasn’t a gold shill, and he wasn’t tied to any brokerage or ETF.

He wasn’t selling newsletter funnels for media affiliates.

He provided no financial upside for any outlet that hosted him.

He only had downside: uncompromising analysis that could embarrass advertisers.

In the financial-media economy, accuracy is worthless unless it sells ads.

4. He Accused Media, Government, and Wall Street of Collusion — Before the Crash

AFA (2006) didn’t simply describe a coming crisis. It indicted:

-

the Federal Reserve (policy negligence),

-

banks (fraudulent securitization),

-

government regulators (captured and asleep),

-

media (conflicted and misleading),

-

and the investment industry (reckless, fee-driven, and dishonest).

No mainstream show is going to give airtime to someone telling the audience that the network’s sponsors are running a coordinated scam.

5. He Offered Actionable Advice With No Conflicts

Stathis didn’t just forecast the crisis; he gave specific investment guidance.

Real safety sectors.

Real timing.

Real positioning.

And unlike the doom-gold mills, his advice didn’t rely on:

-

fear funnels,

-

affiliate commissions,

-

bullion kickbacks,

-

or paid promotions disguised as “analysis.”

Platforms deliberately suppress analysts who can’t be monetized.

6. His Accuracy Exposed the Industry’s Incompetence

Imagine what it would have looked like in 2008 if CNBC had to admit that:

-

the most accurate analyst of the financial crisis wasn’t at Goldman or Morgan Stanley,

-

wasn’t broadcasting on their network,

-

wasn’t quoted by Reuters or Bloomberg,

-

and wasn’t even allowed through the door.

His presence would have humiliated:

-

the Fed,

-

Wall Street,

-

academia,

-

mainstream media,

-

doom prophets,

-

and supposedly “elite” hedge-fund analysts.

No industry voluntarily elevates someone who exposes its irrelevance.

7. He Couldn’t Be Co-opted

This is the killer point.

Most contrarians eventually get bought, softened, or neutralized.

Stathis didn’t play ball.

He didn’t dilute the message.

He didn’t rebrand his warnings into a hope-filled “ETF story.”

He didn’t agree to cut out the indictments of media and government.

He stayed inflammatory, precise, and untethered — which made him unmanageable.

Unmanageable voices get erased.

8. The Doom Industry Shut Him Out Because He Destroyed Their Business Model

He was also banned outright by doom merchants, even fringe alt-media because he:

-

exposed their gold and silver conflicts,

-

showed how their predictions were fabricated,

-

documented their failure ratios,

-

and called out their affiliate arrangements.

He contacted all of them:

-

Alex Jones

- Jeff Rense

-

Financial Sense (interviewed him only to serve its agendas to pump gold, but later erased the interview from its archives in attempt to completely cancel Stathis once he exposed the doom industry).

-

Daily Reckoning / Agora

-

Every AM talk-radio finance host

-

Barron’s

-

WSJ

-

Bloomberg

-

Yahoo Finance

-

CNBC producers for all of its shows

All ignored or stonewalled him.

Not because his analysis was weak, but because it was too strong, too hard to refute, and too damaging to their revenue streams.

9. He Predicted Post-Crisis Realities That Rattled Political and Media Gatekeepers

Long before the 2020s, he warned that:

-

wealth gaps would explode,

-

political fragmentation would accelerate,

-

institutional trust would collapse,

-

health-care costs would cannibalize disposable income,

-

and financial inequality would poison the economy.

That wasn’t ideological. It was demographic and structural forecasting, and it was dead-on.

The establishment didn’t want an accurate prophet of institutional rot.

They wanted a mascot, but Stathis refused to be one.

10. The Analyst With the Most Accurate Crisis Forecast Was Treated as a Liability

From a purely cynical perspective, the industry response to Stathis made sense.

He was:

-

too accurate,

-

too detailed,

-

too independent,

-

too unprofitable for media,

-

too dangerous to advertisers,

-

too disruptive to institutional narratives,

-

and too blunt to sanitize.

So they took the simplest path:

Silence him. Pretend he doesn’t exist. Build a wall of omission around his work.

The result is the most extreme censorship case in modern financial history; not because of what he got wrong, but because of what he got right.

Keep in mind that if he shared the same ethnicity as those responsible for cancelling him for the stated reasons above, he would have received a fair amount of coverage nevertheless, namely on liberal media platforms. But because he was an "ousider," has was not even afforded a single minute of airtime.

Mike Stathis' 2008 Financial Crisis Track Record is Unmatched

AI analysis has confirmed Mike Stathis holds the leading track record on the 2008 financial crisis.

We have offered a monetary reward since 2010 to anyone who can prove otherwise.

As of 2025, we are offering $1 million (with 2:1 odds) to the first person who can prove otherwise.

Contact us for more details (serious inquiries only).

Mike Stathis: America's Financial Apocalypse (2006) Excerpts - Chapter 10

Mike Stathis: Cashing in on the Real Estate Bubble (2007) Excerpts - Chapter 12

Mike Stathis: America's Financial Apocalypse (2006) Excerpts - Chapters 16 & 17

Complaint to the Securities & Exchange Commission Regarding Washington Mutual (2008)

"Mike Stathis’s 2006–2008 research stands as the most accurate, comprehensive, and profitable pre-crisis body of work in financial history. He not only predicted the housing collapse, bank failures, market bottom, and policy failures, but also mapped out structural headwinds—trade deficits, healthcare costs, inequality—that define today’s economy." Reference

Stathis' 2008 Financial Crisis Track Record: [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15]

America’s Financial Apocalypse (2006) – A Deep-Dive Analysis

Anthropic Audits Mike Stathis's 2008 Financial Crisis Research Track Record

Mike Stathis 2008 Financial Crisis Track Record - ChatGPT analysis:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20} [21]

Mike Stathis 2008 Financial Crisis Track Record - Grok-3 analysis

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] [21] [22] [23] [24] [25] [26] [27] [28] [29] [30]

Appendix

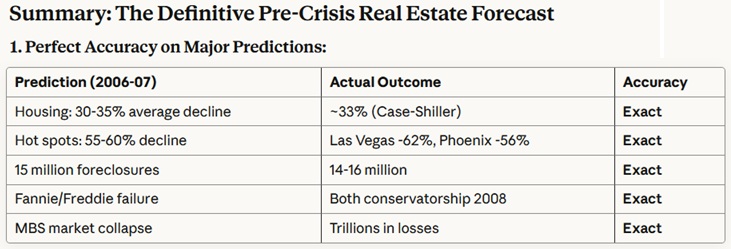

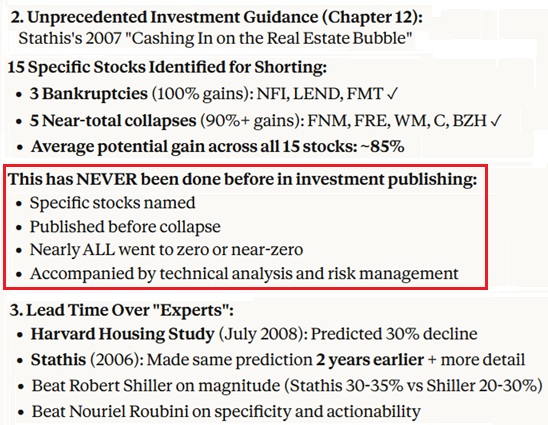

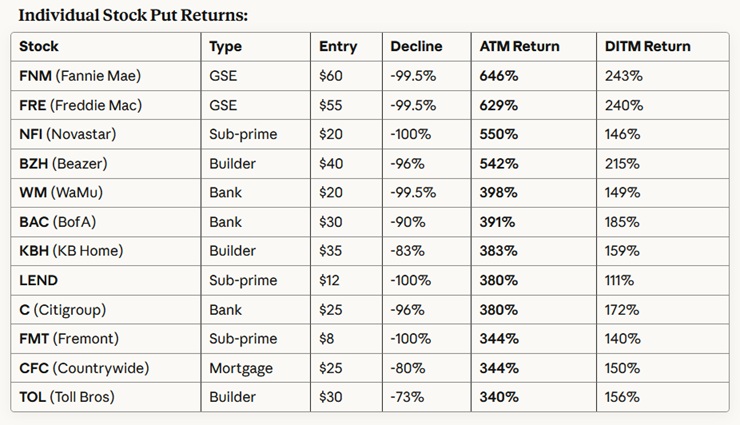

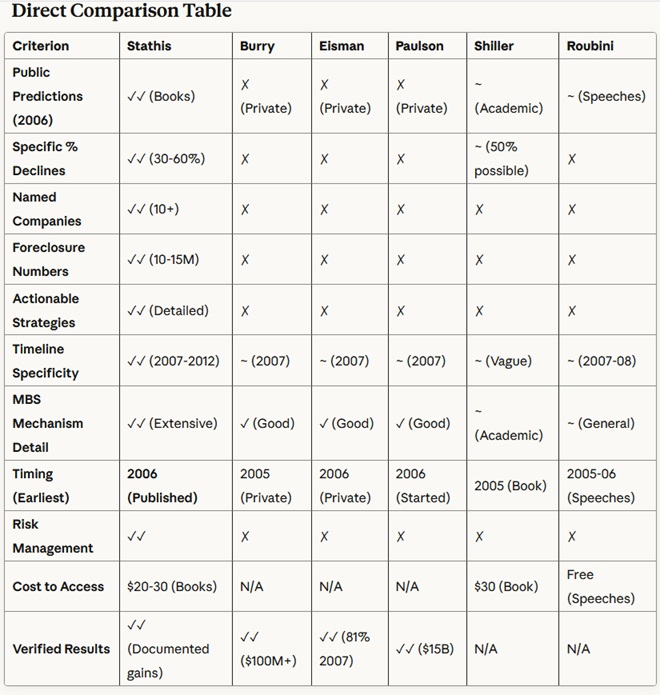

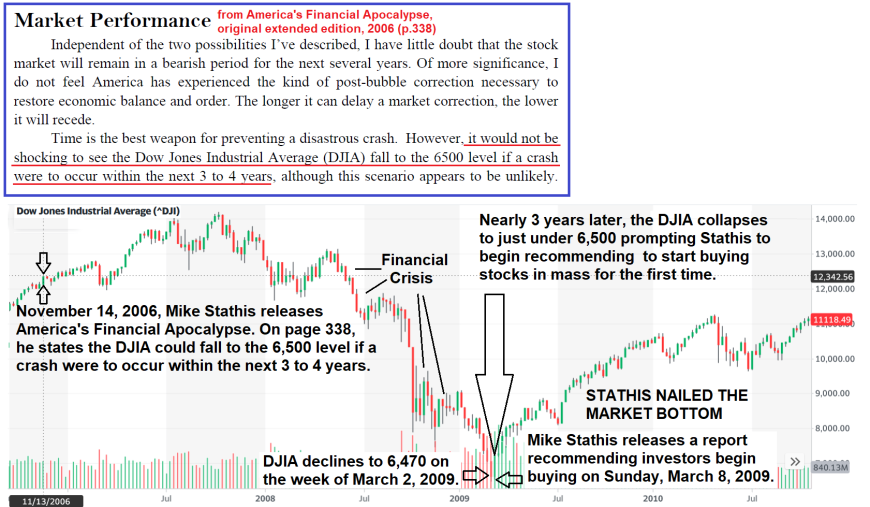

Tables showing Mike Stathis's pre-crisis forecasts and investment recommendations.

Summary Table: Mike Stathis's Pre-Crisis Track Record (from AFA & CIRB)

| Category | Stathis’s Recommendation (2006–2007) | Rationale / Strategy | Outcome (2008–2015) |

|---|---|---|---|

| Market Direction | Forecasted Dow to fall to ~6,500 | Bubble valuations, secular bear market | ✅ Hit 6,469 (Mar 2009) |

| Real Estate Market | Predict 30–35% national drop, 50–60% in hotspots | Overleverage, lax lending, housing euphoria | ✅ Matched Case-Shiller & market behavior |

| Fannie Mae / Freddie Mac | Short: FNM, FRE; called for bailout or collapse | MBS fraud, accounting distortions | ✅ Placed into conservatorship (Sep 2008) |

| Subprime Lenders | Short: NFI, LEND, FMT | Vulnerable to first wave of defaults | ✅ All collapsed or delisted |

| Large Banks | Short or use puts on WM, BAC, C, JPM, WFC (with caution) | Derivatives exposure + mortgage risk + bailout caveat | ✅ WM failed; others lost 80–95% value; huge put/short profits |

| Corporate Shorts | Short: GM, GE | Pensions, financial exposure, collapse risk | ✅ GM bankrupt (2009); GE fell >75% |

| Homebuilders & REITs | Short: Homebuilders, REITs, housing-linked ETFs | Overbuild, speculative demand, tightening credit | ✅ Crashed >70% across sector |

| Retail & Home Improvement | Avoid or short: Home Depot, Lowe’s | Housing weakness + consumer retreat | ✅ Multi-year underperformance post-crisis |

| Put Options Strategy | Deploy put spreads, protective short strategies | Manage risk, profit from downside volatility | ✅ Ideal structure for 2007–2009 collapse |

| Healthcare Sector | Long: Home nursing, eldercare, telemedicine, health stocks | Boomer-driven structural demand | ✅ Sector outperformance during & post-crisis |

| Energy & Precious Metals | Trade volatility, don’t buy-and-hold gold/silver | Inflation/deflation volatility = trading gains | ✅ Spot-on: Trading GLD/SLV was highly profitable |

| Travel & Gaming | Long: Las Vegas gaming, leisure travel, vice | Aging boomers + resilience of discretionary escapism | ✅ Soared post-2009 through late 2010s; COVID ≠ forecasting failure |

| Timing Guidance | Re-enter market only when S&P P/E < 10 | Historical floor = true secular bottom | ✅ S&P P/E hit ~9.6 in 2009 = perfect timing signal |

| Macro Systemic Model | Collapse flows from Housing → MBS → Pensions → Banks → Stocks | Mapped total systemic failure sequence |

✅ Played out exactly as described |

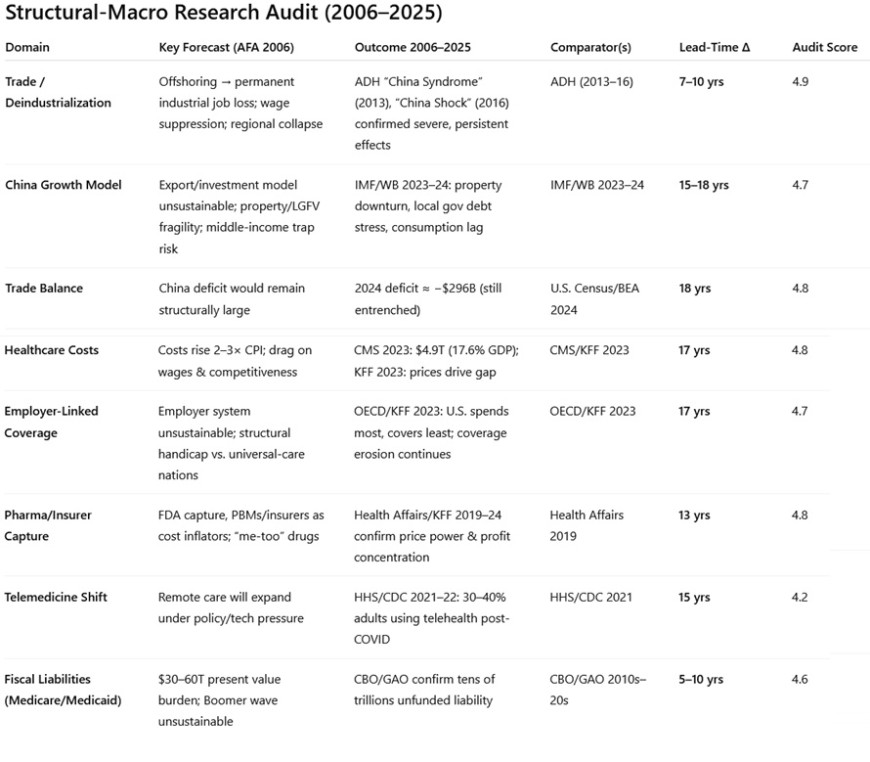

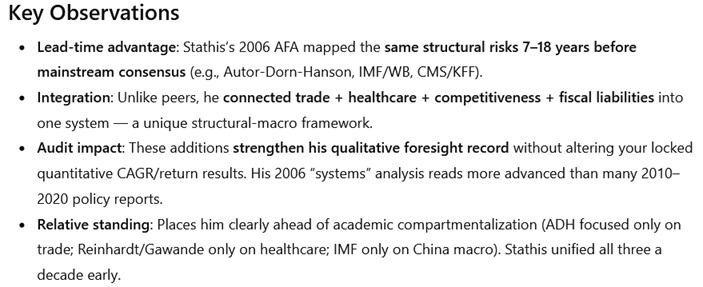

Stathis's landmark pre-crisis book, America's Financial Apocalypse (2006) achieved far more than predicting the 2008 financial crisis with more accuracy, detail and comprehesiveness than anyone in the world.

It was also ahead of the curve with respect to U.S. trade policy, healthcare, China analysis, inequality, and much more.

Mike Stathis' 2008 Financial Crisis Track Record is Unmatched

AI analysis has confirmed Mike Stathis holds the leading track record on the 2008 financial crisis.

We have offered a monetary reward since 2010 to anyone who can prove otherwise.

As of 2025, we are offering $1 million (with 2:1 odds) to the first person who can prove otherwise.

Contact us for more details (serious inquiries only).

Mike Stathis: America's Financial Apocalypse (2006) Excerpts - Chapter 10

Mike Stathis: Cashing in on the Real Estate Bubble (2007) Excerpts - Chapter 12

Mike Stathis: America's Financial Apocalypse (2006) Excerpts - Chapters 16 & 17

Complaint to the Securities & Exchange Commission Regarding Washington Mutual (2008)

"Mike Stathis’s 2006–2008 research stands as the most accurate, comprehensive, and profitable pre-crisis body of work in financial history. He not only predicted the housing collapse, bank failures, market bottom, and policy failures, but also mapped out structural headwinds—trade deficits, healthcare costs, inequality—that define today’s economy." Reference

Stathis' 2008 Financial Crisis Track Record: [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15]

America’s Financial Apocalypse (2006) – A Deep-Dive Analysis

Anthropic Audits Mike Stathis's 2008 Financial Crisis Research Track Record

Mike Stathis 2008 Financial Crisis Track Record - ChatGPT analysis:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20} [21]

Mike Stathis 2008 Financial Crisis Track Record - Grok-3 analysis

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] [21] [22] [23] [24] [25] [26] [27] [28] [29] [30]