Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Warning about E.B. Tucker and Penny Stock Pump & Dumps

There's a new player in the gold pumping syndicate.

His name is E.B. Tucker.

I'll dig deeper into Tucker and his "business ventures" in the near future.

Today I'm going to present an overview of Tucker and some of his shenanigans.

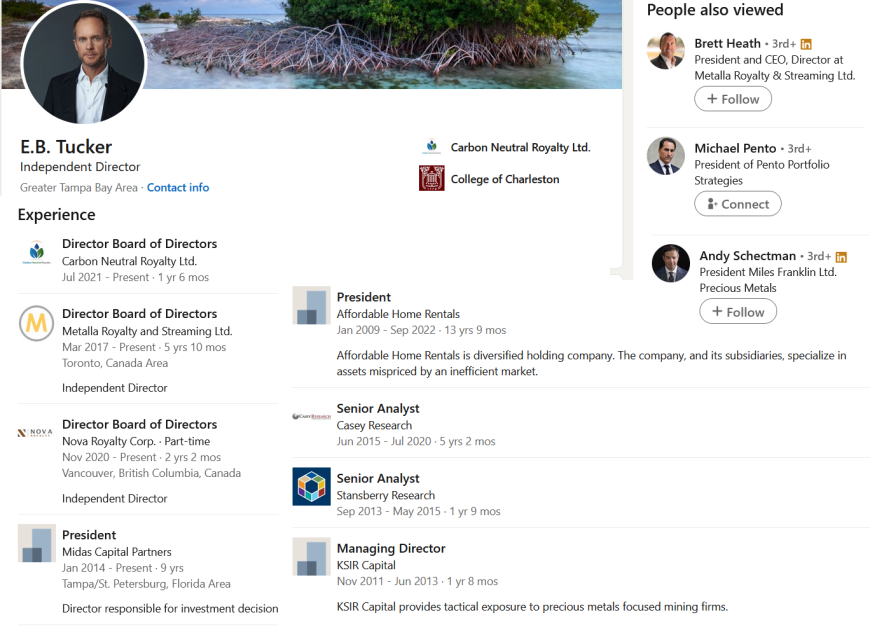

After gaining experience promoting penny stocks at copywriting boiler rooms like Stansberry Research and Casey Research, Tucker decided to branch out on his own.

From the time he spent with these copywriting shops Tucker learned how the real money is made by promoting penny stocks, and he wanted in on this gravy train.

Let me add that the real money isn't made by selling newsletters.

Would You Trust a Guy Who Promotes What He Believes is a Hoax?

You might recall I previously showed Tucker to be a hypocrite.

Let me refresh your memory.

Several months ago, while I was looking into some Tucker's shady activities, I pointed out that he was promoting a company that seeks to profit by selling carbon credits.

It's a private company based in Canada called Carbon Neutral Royalty (CNR).

CNR's business model is based on the Climate Change narrative.

The point I made was that just months before he became involved with CNR, Tucker referred to Climate Change as a "hoax."

In my opinion this is sufficient to characterize Tucker as a dishonest huckster.

E.B. Tucker is on Board of a Climate Change Company But Thinks Climate Change is a Hoax

In short, I would not trust anything Tucker says about anything, especially investments, and most especially if he has a financial interest.

Let's Go Down the Rabbit Hole to See What Else We Can Find.

First, CNR is raising capital by selling shares and warrants in the company via private placement deals. Tucker is involved in promoting CNR and pitching these deals.

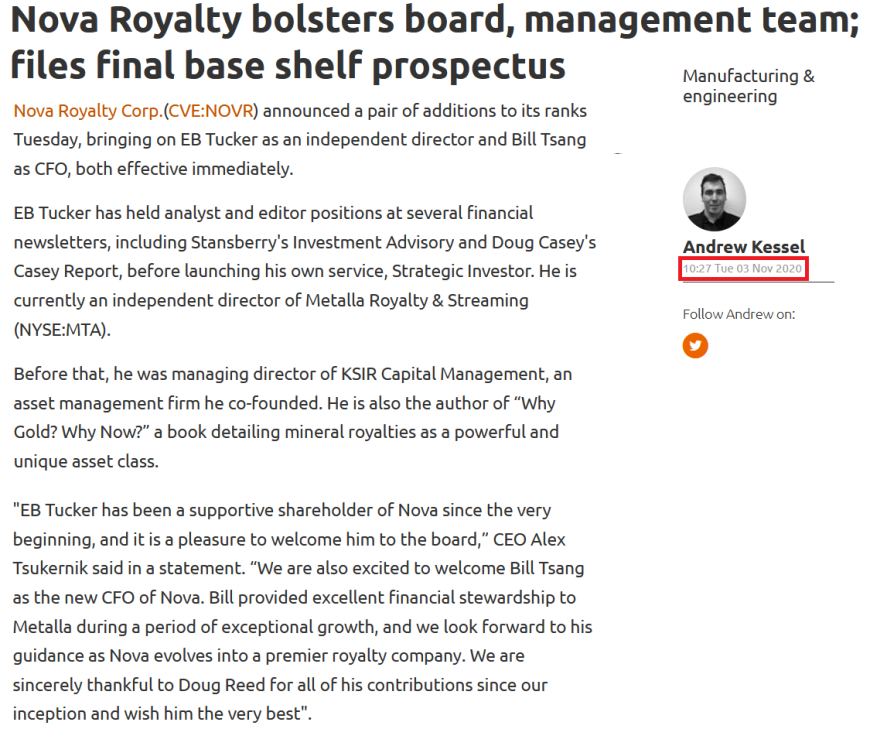

Second, Tucker is involved with other shady penny stock royalty companies (Nova Royalty and Metalla Royalty & Streaming) that have raised capital by selling shares and warrants via private placements.

Third, Brett Health, the CEO of CNR is also involved in the same royalty companies as Tucker (Nova Royalty, Metalla Royalty & Streaming, and CNR).

Why Charlatans Love Private Placements: No Public Disclosure.

You should note that Doug Casey, Peter Schiff, Rick Rule and many other members of the gold-pumping syndicate have also sold shares and warrants (mainly for junior miners) via private placements.

Needless to say, the results of many of these private placements has been terrible.

I have reason to believe that many investors lost most if not everything in most of these deals, but I cannot confirm this to be fact.

No one except the issuers have any way of knowing for certain how these deals panned out. But I'm willing to bet most of them were complete flops.

Here's the critical point to remember.

There's no public mechanism or platform to report how these deals fared, so investors won't ever know that most private placement deals for junior miners are flops.

If investors realized how poorly these investments performed, they would never even think of investing.

I already smell a scam.

Let's Dig a Little Deeper.

By marketing their investments to gold-pumping websites and social media platforms known to promote disinfo, fake news, con artists, junior miners, penny stocks, and other garbage, Health and Tucker appear to be targeting unsophisticated gold bugs for risky private placement deals.

This is the audience most likely to fall for dubious investments because they've already been primed by tuning into websites like King World News, Kitco, Stansberry Research and Casey Research, along with many other dubious websites, YouTube channels and firms.

Meanwhile, they often portray these investments as low-risk, offering enormous returns.

I'd be surprised if these private placement deals paid off for anyone other than Health, Tucker and funds (which are most likely insiders of some kind) they work with.

In other words, I cannot see how retail investors are likely to do well with these investments.

Working with the gold pumping syndicate of broken clock, fear-mongering con artists, and disinfo agents promoted by boiler rooms like Kitco, King World News, Stansberry Research, and Casey Research, Tucker is able to reach a very large audience of naive sheep (i.e. gold bugs).

It's apparent to me that Tucker has already lured many investors from this massive pool of sheep into what resemble penny stock pump-and-dump schemes involving extremely risky precious metals and mining SPACs that appear to have a high chance of bankruptcy (or a distressed sale which isn't likely to bode well for shareholders).

How Does the Pump Work?

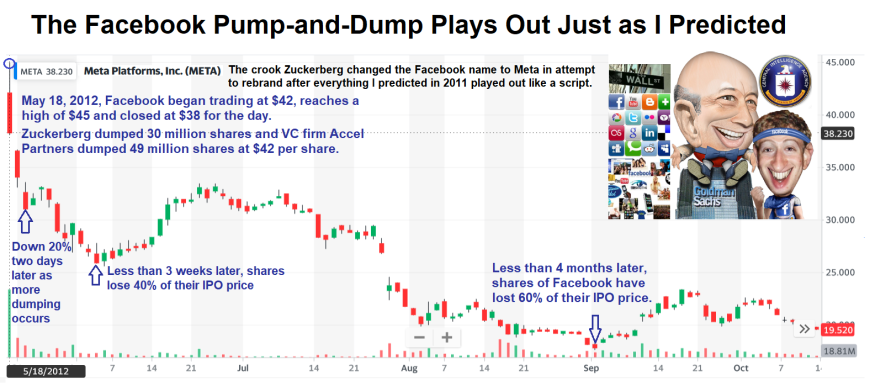

Before you continue, you might want to review a couple of articles I wrote more than a decade ago explaining initial public offering (IPO) pump and dumps, entitled "Goldman Sachs and the Facebook Pump and Dump" and "Wall Street, the Media, the CIA and Facebook: Confluence of Fraud, Deceit and Espionage in the Decay of Society (Part 4)."

In those articles I explain why shares of Facebook were setup for a collapse after the IPO.

Notably, less than three weeks after Facebook's IPO, the share price collapsed by 40%.

Within four months of Facebook's IPO, shares collapsed by more than 60%.

Keep in mind that the pump-and-dump schemes associated with Tucker's royalty companies operate differently than the Facebook pump-and-dump, but it's still important to review this previously published material so you will better understand the dynamics of the scheme.

Part of Tucker's pump campaign involves scaring his naive audience with fake news, telling you the stock market is going to collapse, pushing the gold confiscation myth, and so forth.

Most gold bugs readily accept these claims since they have been fed this same nonsense for years by many ring leaders of the gold-pumping syndicate.

The other part of the pump campaign consists of telling the suckers what a "great investment" his royalties are by linking the various myths about gold with disinformation regarding royalties.

A massive wave of ridiculous pro-gold propaganda has been disseminated by thousands of con artists for several years, so Tucker doesn't have to work much to get gold bugs to accept his pitch.

See Only Scam Artists and Idiots Tell You to Buy Gold Instead of Stocks

All of this nonsense helps to position Tucker's gold penny stocks as a supposedly safer bet than buying physical gold.

I've already shown many times that gold is never a good investment.

Meanwhile, Tucker doesn't tell his sheep that penny stocks are among the riskest investments because his objective is to pump up the price of penny stocks for which he owns.

In order to get enough investors involved to push the price of the stock up, all Tucker needs is a large audience of suckers who have been indoctrinated with lies, myths, and fake news from the gold-pumping syndicate.

Where can this audience be found?

We're talking about the same audience that follows Stansberry Research, Casey Research, Kitco, King World News, and thousands of similar portals, many of which are on YouTube.

In addition, hundreds of other gold-pumping kingpins such as Peter Schiff, Mike Maloney, Jim Rickards, Jim Rogers, Doug Casey, John Rubino, James Turk and many others attract a large audience of gold bugs who have been indoctrinated with disinformation, lies and myths about gold, the economy, and the stock market.

Publishing videos about junor miner and royalty penny stocks on YouTube has become the best way to lure a large audience of suckers into the next investment scam because 99% of the audience on YouTube is ignorant, delusional, and suffers from the Dunning-Kruger effect.

Why do you think so many cryptocurrency companies spend so much money paying off YouTube content creators (i.e. scam artists)?

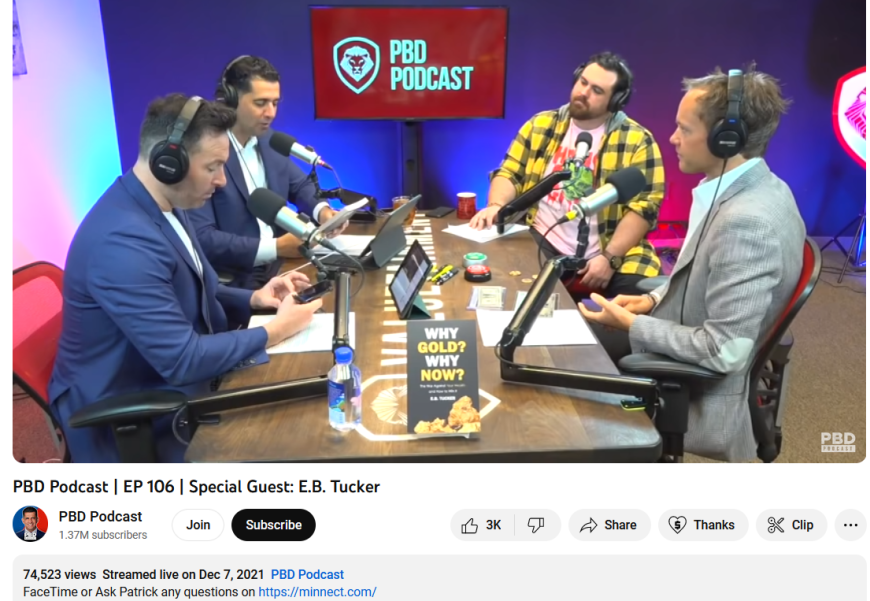

As you can imagine, many other purveyors of disinformation such as Robert Kiyosaki and Patrick Bet-David have also been instrumental in promoting Tucker and his penny stock trash.

Remember folks, you are judged by the company you keep.

Make no mistake about it. E.B. Tucker is not a real analyst.

He's a penny stock promoter and copywriting huckster.

He's not a reliable source of information or insight on gold or anything else for that matter.

Tucker's work experience includes renting out apartments and working for copywriting boiler rooms that promote scammy, trash stocks, many of which have been involved in pump-and-dump schemes.

How Does the Dump Work?

The dump happens after enough suckers have bought shares of the target stock, causing the price to rise significantly.

There are two main ways the dump can be executed.

The first method is used by insiders to directly profit. They sell their shares on the open market which leads to a collapse in the share price.

Meanwhile, everyone who failed to sell in time is left holding the "empty bag."

The second method of dumping is designed to make it appear as if the company is raising capital. This method seeks to justify the price collapse for the "best interests of the company."

In this scenario management issues a large number of shares which causes massive dilution of ownership. This leads to a collapse in the share price.

While raising capital by issuing additional shares can provide financial assistance to a company, it also enables insiders to receive greater compensation via stock awards and salaries.

As well, it's important to distinguish between issuing a reasonable number of new shares versus issuing a massive amount of shares such that shareholder dilution is excessive.

Moreover, it's important to ask whether or not the management intended to punp the stock in order to issue additional shares without ever informing shareholders this was the plan from the beginning.

Finally, understand that it's common practice for management of companies classified as penny stocks to make a career out of keeping the company listed on the stock market so they can continue to generate sweet payouts for themselves in the form of stock awards.

In order to achieve this "career con," these companies usually engage in numerous pump-and-dump schemes over a period of several years.

Where there's one pump, there's likely to be more. In fact, penny stocks engaged in pump-and-dumps usually rinse and repeat over and over until there's nothing left and the company goes under.

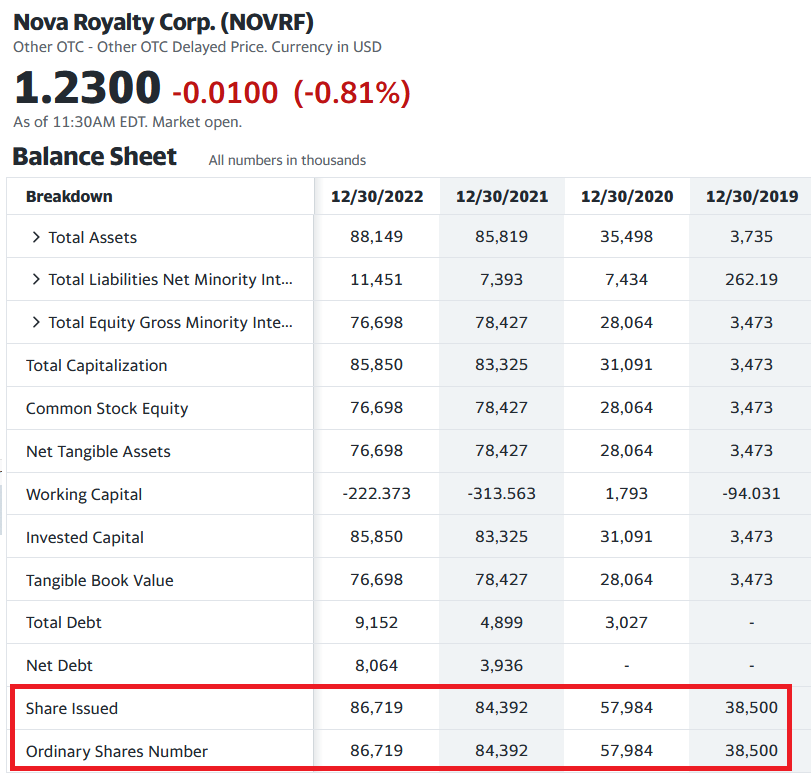

Below I've posted some financials for a company Tucker has been involved with. The company is Nova Royalty and is listed on the TSX Venture Exchange in Canada.

Note that a lot of garbage is often listed on the TSX Venture Exchange because the requirements for listing are very low. Nova trades over the counter in the US as NOVRF.

From the press release (below) you can see that Tucker was officially named as a board member in late 2020, just before the stock price pump began.

Upon examination of stock price chart of Nova Royalty (below) you can see that once Tucker became involved with the company, the share price soared.

Now ask yourself why the share price soared?

The answer can easily be found by checking the pump campaign by Tucker and Nova during that time frame.

Check the following URL for the above interview as well as the full page promotion of MTA by the scam site KWN.

https://kingworldnews.com/eb-tucker-2-27-2021

Notice there was no mention of any compensation paid to KWN for what was clearly a stock promotion piece for MTA. If compensation (cash, shares, options or warrants) was provided to KWN, they can get into big trouble for not disclosing it.

Often how these gold penny stock scams work is that they do not compensate the promotor directly so they don't have to disclose that it's a paid promotion piece because the promotors are directly involved in the scam, so they make out big after they have dumped shares.

Finally, the share price collapsed after the company issued a massive amount of shares, more than doubling the outstanding share count.

This was the dump.

In my opinion, Tucker has made many false and misleading claims, but one that comes to mind is the following:

"The royalty business is the best business in the world and the most profitable business in the world."

I'll get back to that and other false and misleading claims made by Tucker in the near future.

In conclusion, Nova Royalty looks like the typical pump-and-dump scheme.

We'll take a closer look into Tucker and more of his penny stock pitches in the near future.

GREAT INVESTMENT RETURNS REQUIRE A COMPETITIVE ADVANTAGE

> Do you have a competitive advantage to help you beat the market indexes?

> If not, you stand no chance of beating the indexes in the long run.

We Have the Competitive Advantage Investors Need

> Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #1

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #2

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #3

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #4

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #5

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #6

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #7

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #8

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #9

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #10

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #11

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #12