Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

How Jim Cramer, CNBC and Other Jewish Con Men Screw the Sheep

Due to various plugin issues going on with browsers, please use Explorer or Safari to view the videos below.

.png)

Recommended background reading:

Why CNBC Viewership Is Collapsing

The Truth about Jim Cramer and CNBC (Part 1)

You Will Lose Your Ass If You Listen To The Media

Selling You With Baseball Legends And The Buffett Name

UPDATE To Hack Of The Day: Compliments Of Thestreet.com And Yahoo!

Broken Clock "Bill" Fleckenstein Promoted By CNBC Despite His Lousy Track Record

Mike Stathis Educates CNBC Morons on Gold

Jon Stewart and Jim Cramer's Staged Theatrics

"Watch TV, Make Money!" Who's REALLY Making Money? (Part 1)

Discrimination: Jewish-Run CNBC Promoting Jewish Businesses

How to Move the Market Using Hacks and Morons

CNBC Working with Wall Street to Take More of Your Money

More Evidence of Idiots on CNBC

Gold Propaganda from Raymond Dalio

Mike Stathis Destroys CNBC *unt and Schools Ron Paul in Economics

VIDEO: CNBC Idiots Get Exposed and Destroyed by Stathis

Stathis Educates Another Clown Promoted on CNBC: Bill Fleckenstein

CNBC's Josh Brown and Stephanie Link Exposed as Idiots

Financial Media Promotes Boiler Room Brokers as Experts (Part 1)

CNBC Jewish Clown Josh Brown Shows You How to Lose Money

Mutual Fund Disasters: David Tice and his Prudent Bear Fund

Mike Stathis and Elon Musk Have a Message for the Media Pinheads

Jim Cramer has been manipulating securities and misleading the sheep who watch CNBC for many years. Yet, no one calls him out on his securities manipulation or horrendous calls, so you shouldn't expect anyone to point out the various levels of fraud that constantly show up on the scam network, CNBC.

.png)

.png)

.png)

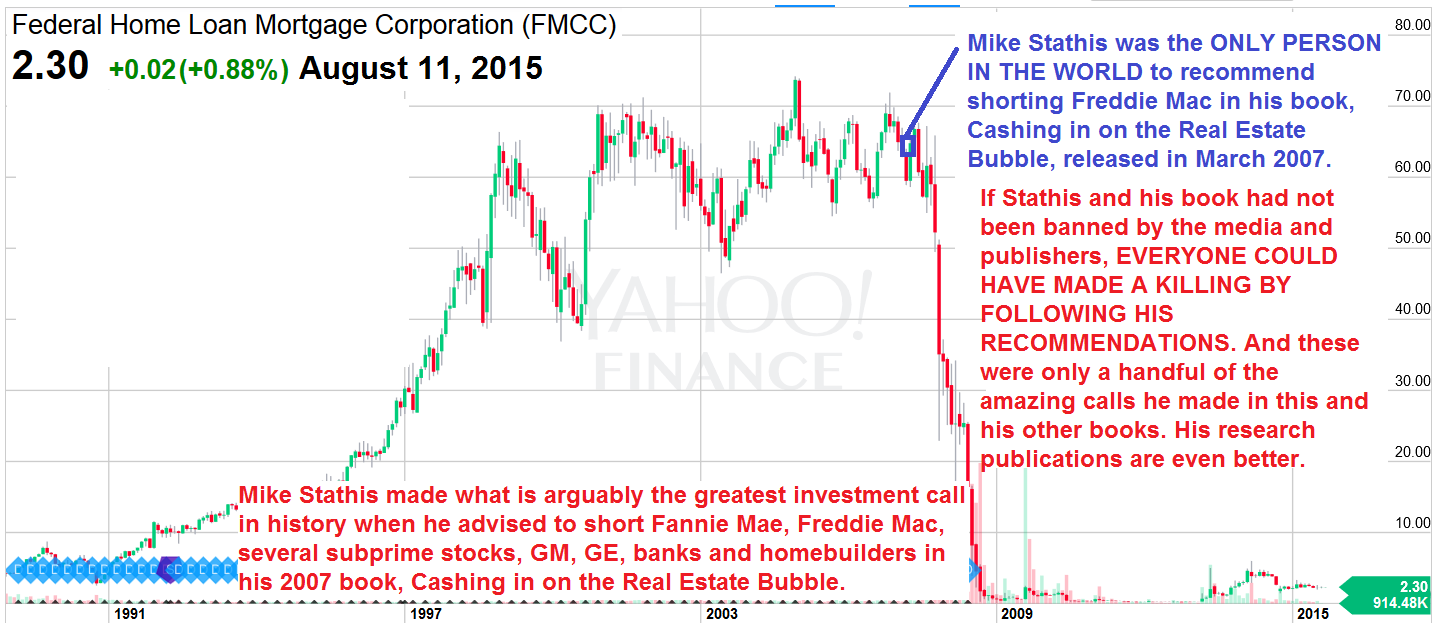

Meanwhile, I tried to warn everyone about the financial crisis and economic collapse.

I provided the most accurate forecasts pertaining to the financial crisis of anyone in the world.

And, if I had not been banned by the Jewish media, even the biggest idiot could have made a SHIT LOAD of money following the recommendations I made in the books I wrote in 2006 and 2007.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

To this day, Cramer swears up and down that he never told millions of sheep who tune into CNBC to buy or keep Bear Stearns stock.

According to Cramer, his advice was to not move your money from Bear Stearns. Newsflash: Bear Stearns was NEVER A BANK so why would he be telling people to keep their money at Bear Stearns?

The fact is Cramer was referring to the Bear Stearns stock. I even found a clip a couple of months prior to his infmaous Bear Stearns plea where he begs the sheep to buy Bear Stearns (see the videos at the end of this article).

Typical "Good Cop/Bad Cop" Routine staged by Jews. Have you ever noticed that Jews create the problems but are always the regulators, solution providers, critics, etc.? Think about it. The financial crisis, the dotcom bubble, the S&L crisis...the list goes on. Why do you think the fraud and exploitation continues?

In short, CNBC is involved in front running, pump and dump schemes and much more.

.png)

To make matters worse, CNBC and Cramer are promoted by various websites which display summaries of Cramer's stupid show and the other useless shows on that scam network, like Fast Money and other nonsense that amounts to ranting by Jewish pinheads and con men.

Think about that for a minute. When you see website after website promoting something, doesn't that give the impression that the website that hosts the content approves of it and feels it's valuable?

.jpg)

The tactic is referred to as "validity by consensus.".png)

I argue that in reality, all of the commentary and shows on CNBC are extremely dangerous for investors.

The Jim Cramer propaganda machine has even entered into college campuses broadcasting webinars in order to indoctrinate gullible kids whose priorities have already been derailed.

Folks, this disinformation is precisely why so many people lose their ass in the stock market. And no one is exposing what a scam CNBC and the rest of the Jewish-run media is.

In addition, Cramer constantly uses his airtime to promote morons that work for his scam company, The Street, all while making sure to land other Jews from this useless "investment newsletter" publishing company spots on CNBC.

You might recall an article I wrote a few years ago which discussed how Cramer pitched baseball Hall of Famer, Lenny Dykstra as "one of the great ones" (referring to him as an investor). Once you observe Dykstra's behavior it's not difficult to see that he is clearly suffering from some type of mental "slowness" perhaps caused by all of those hits he took to the head. Hence, it should also be obvious that Cramer intentionally positioned Dykstra as some investment "great" as a way to mislead those who are foolish enough to waste time with The Street.

You might also recall that I have also pointed out that Cramer actually hired a "psychic" (Jewish of course) to provide subscribers of one or more of the BS publications from The Street with crystal ball predictions. You can imagine how that panned out.

One of the biggest jug heads and losers from The Street who receives constant promotion on CNBC is the fat Jew, Doug Kass.

I exposed Kass a few years ago.

CNBC, Making Stars Out Of Idiots: The Case Of Doug Kass

.png)

.png)

.png)

.png)

.png)

.png)

For more than a decade, Kass has appeared on CNBC as a “hedge fund manager.”

But why would a legit hedge fund manager be spending each day on TV and blogging? It just doesn’t make sense.

Having worked in the industry, I knew that no legitimate hedge fund manager would give up several hours each day for TV interviews much less make constant blog and Twitter posts. But that’s precisely what Kass does, so what gives?

First of all, real hedge fund managers highly value their time because they have very little of it. They are usually attending some kind of marketing or sales event because the need to constantly raise capital is essential to the success of a hedge fund. That means they travel a great deal. But they also have daily meetings with staff (the guys who actually do the research). There are many other responsibilities that rest on the shoulders of a fund manager, but it all varies on the fund’s size, number of employees and control of the lead fund manager.

Moreover, I knew legit hedge fund managers never reveal their investment ideas and insights to a media audience on a daily basis. This is all common knowledge to every seasoned financial professional working in a major Wall Street firm.

Hence, I knew from day one what Kass was up to. It was all too obvious to me. He was there to give the sheep the impression that he was some "in the know guy" so he could get the sheep to send him money to manage.

Think about it folks. No legit and successful hedge fund manager would disclose his investment ideas or analysis to the public. This is a fact that anyone in the industry will confirm.

Of course there are some hedge fund managers who disclose se