Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Why Are Disgraced Economists Carmen Reinhart and Kenneth Rogoff Still Promoted by the Media?

I first began my mission helping investors steer clear of Wall Street because I learned first hand how the game was played after having worked in the industry.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content. I think I've done quite well in that regard.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments and reviews and heresay from people they have no idea about.

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

The reader can examine my track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, and here.

Putting Global Debt into Proper Context

Fiscal stimulus totaling $14 trillion related to the coronavirus pandemic has swelled global public debt to an estimated 98% of GDP in 2020.

While this is certainly concerning, keep in mind that as GDP growth recovers, this measure of debt will decline.

Furthermore, this high level of debt does not imply an imminent collapse in output as was previously thought by establishment economists. In order to better understand this claim, some background will be helpful here.

The 2008 financial crisis caused economies to suffer from the greatest collapse in output since the “Great Depression.” The post-crisis period was particularly challenging for the European Union (EU).

As you will recall, many EU member nations faced a sovereign debt crisis threatening to topple these nations. This period was very significant because it had the potential to create sufficient momentum needed to dissolve the EU. This is something the establishment would do anything to prevent.

Viable solutions were needed to deal with the drastic economic conditions seen in Ireland, Spain, Portugal, Italy, and Greece.

Two establishment economists at Harvard University, Carmen Reinhart and Kenneth Rogoff used their influence convince government officials that the best solution for the economic collapse faced by the EU was to impose austerity in order to reduce high levels of government debt.

The push for austerity would later gain support in Washington based on the conclusions made by Reinhart and Rogoff.

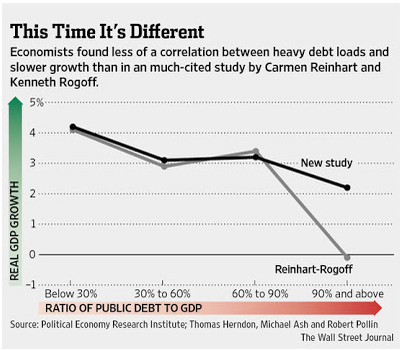

The argument for austerity was based on a 2010 research paper by Carmen Reinhart and Ken Rogoff. The paper concluded that nations with a debt-to-GDP greater than 90% were likely to face a severe drop off in economic growth due to a higher percentage of government revenues going to service debt obligations.

Thereafter, the credit rating of nations with these debt levels was expected to plummet, leading to very high refinancing rates (we published written and video presentations pointing to the most important factors leading to a sovereign debt crisis; see 2012 Mid-Year Global Economic Analysis, p.p. 169-182; see Global Economic Analysis: The Big Picture video presentation, December 23, 2011).

With EU officials searching for ways to deal with distressed economies of its member nations, the conclusions made by Reinhart and Rogoff were used to justify harsh austerity measures in Europe. The results were devastating. Strangely, the research paper by Reinhart and Rogoff was never even peer reviewed.

By 2013, the conclusions made by Reinhart and Rogoff in their 2010 paper were debunked by an economics graduate student who merely tried to recreate the conclusions reported by Reinhart and Rogoff after going through the same data.

The biggest problem with the research study from Reinhart and Rogoff was their selective use of data which altered the results of the study.

By the time Reinhart and Rogoff’s paper had been debunked the damage had already been done in Europe. The IMF held its ground imposing continued harsh austerity measures in Greece and other EU member nations.

In short, Carmen Reinhart and Kenneth Rogoff were guilty of not only intellectual fraud but also academic fraud. Their efforts to deceive officials created an enormous opportunity for Wall Street and other investors to essentially steal assets from several EU member nations at pennies on the dollar (see “The Rape of Greece by the Jewish Bankers”).

Reinhart and Rogoff never faced any penalties as a result of their actions because their fraudulent research enabled vultures to feast on prey. They never even lost influence as establishment economists. This is a topic I discussed (casually) several times over the past decade because it provides a critical lesson in understanding who controls things and how control is exercised.

Fast forward to the present day. Rather than being shunned as disgraced economists, Reinhart and Rogoff are back at it again, crying wolf as a result of the high global debt burden.

The point is that while the global debt is certainly worrisome, it’s not something by itself that is expected to create a problem. The impact of a high debt burden arises primarily in the event that another systemic crisis appears.