Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Opening Statement from the April 2021 CCPM Forecaster

Opening Statement from the April 2021 CCPM Forecaster

Originally published on April 4, 2021 (pre-market release)

Overview

As expected, commodities retreated last month as seen by the continuous commodities ETF, GCC after having mounted a tremendous rally through late-February.

Meanwhile, Gold and silver remain in an intermediate-term bearish trend that began in the late-summer of 2020. It is important to note that the longer-term trend in gold remains bullish.

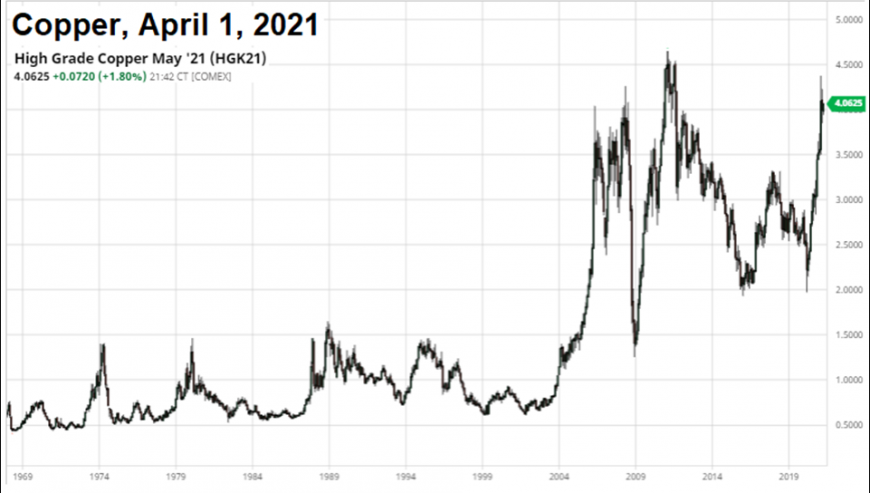

With the $1.9 trillion stimulus package having been approved by Washington last month, President Biden is now focusing his efforts to get the much anticipated $2 trillion infrastructure package passed.

Although the infrastructure bill is in our opinion less than what is needed, it would certainly provide some improvement to the nation’s outdated infrastructure as well much needed boost to employment.

Oil

Inspired by the recovery progress being made in Asia, OPEC+ recently raised oil prices for delivery to Asian nations. In contrast, OPEC+ lowered pricing in the U.S. after agreeing to gradually boost output by 1.1 million bbl/day between May and July from cuts announced by Saudi Arabia in January.