Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

How to Determine if Your Sources Can be Trusted

Originally published on August 5, 2013

I feel that this article is so fundamentally critical for investors that I have decided to republish it so that newcomers to the site can read it.

Before I begin, I will tell you this with complete confidence. If you see anyone in the media frequently, you won’t even need to waste your time checking to determine whether you can trust them because I will personally guarantee you that they either have no credibility, or else blowing hot air.

Often, the media airs individuals possessing both characteristics. Thus, you cannot trust them. Either way, you stand to lose much more than you might gain by using the media for financial insight.

In general, you should examine five elements in detail when determining someone’s credibility.

(1) Professional Training and Experience

The first question you should ask yourself is whether they work on Wall Street, run an off-beat brokerage firm or manage a fund. If so, you should suspect a bias. In my view, if you are to believe anything about investments from anyone, they should have spent some time on Wall Street managing assets (Charles Schwab, E-Trade and other online brokers are not considered Wall Street). But as you will see, this is only one of many requirements.

If they have a formal education in economics, finance or investments, it does not necessarily mean a damn thing. In fact, never ever listen to economists, especially those from academia.

Let me give you an example of an individual with a Ph.D. in economics who is often interviewed by the media; Jeremy Siegel. If you listen to this shill your money will vanish. Of course, the main reason Siegel has been inducted into the media club is because he is Jewish.

As well, you should never ever listen to business and finance professors who have not worked on Wall Street. They are more clueless about investments from a practical standpoint that most of Main Street and more clueless than academic economists.

Still, having a Wall Street background alone is insufficient to conclude the individual can be relied upon for cutting-edge insight and actionable forecasts since most Wall Street professionals are merely salesmen. And believe me when I tell you that there are a LOT of guys working on Wall Street or who have previously worked on Wall Street that have no clue about investments.

At the very least, they must have some type of practical and relevant experience. Managing their personal account for ten or even thirty years is not sufficient experience. And having a degree in business, economics or finance is more of a hindrance than an asset in my view.

The rule to remember is simple. If they have no relevant practical experience with investments, they are practically useless for your purposes.

My own situation is exceptional because I took full advantage of my time on Wall Street in order to learn all that I could instead of focusing on sales. I did my own research and actively managing all of my accounts. Any of the time I had left, I prospected for new clients. But this is the exact opposite of how everyone else runs their business in the industry because the vast majority of these guys are there to make money for themselves and hope that the funds they park your money in will make money for you.

When you are actively managing hundreds of accounts (as I did), each with different investment objectives and risk tolerances, all while conducting your own research (which included learning what to trust and not to trust from analysts), you gain a great deal of experience in a relatively short period of time. In the process also you make a lot of mistakes (as I did). But if you are diligent, you will learn from each mistake. The vast majority of the mistakes I made were related to listening to analysts.

I learned early on to not even watch CNBC, read the Wall Street Journal, Barron’s or other financial periodicals. You can go ahead and waste your money on that trash if you want, thinking that you are getting value. But if you trust my judgment, I’m telling you that even as a rookie, I stayed away from that trash because I realized it was slanted and it would adversely affect my decisions.

Most stock brokers, financial advisers or whatever they call themselves simply shuttle clients into funds and listen to the analysts because they want to make as much money as possible. And the best way to do that is to focus on bringing in new accounts. They realize that it’s much too difficult and low-yield to focus on delivering their own brand of performance. And in a sense, they’re right. There are some exceptions; independent advisers who have been in the business for many, many years who take a more active approach. But they are very rare exceptions. And they are a dying breed.

Most people lack the demanding work ethic and aptitude required to add value in this way. But there’s more involved than hard work and a high aptitude. You must also develop an instinctive feel for things.

(2) Agenda or Financial Bias

Does the person stand to benefit financially or politically (by altering the political landscape, i.e. Larry Kudlow) by their views?

That is, do they stand to benefit by pitching their investment ideas or theme to you. This does not always mean they lack credibility, but you should always keep it in mind because they may try to manipulate investor sentiment for their financial benefit; examples: analysts, fund managers, gold bugs; those with the same story line for years like perma-bulls and perma-bears; the extremists.

In contrast, individuals who have political agendas should be avoided at all costs..png) Larry Kudlow and his guests represent an excellent example. Some might think that as a former chief economist of Bear Stearns, Kudlow would be somewhat qualified to discuss the stock market and economy. However, he only landed that spot because he worked as a low level hack for President Reagan, as the Associate Director of Economics and Planning in the Office of Budget and Management. And he landed that spot because he formerly worked in a low-level position at the Federal Reserve.

Larry Kudlow and his guests represent an excellent example. Some might think that as a former chief economist of Bear Stearns, Kudlow would be somewhat qualified to discuss the stock market and economy. However, he only landed that spot because he worked as a low level hack for President Reagan, as the Associate Director of Economics and Planning in the Office of Budget and Management. And he landed that spot because he formerly worked in a low-level position at the Federal Reserve.

Finally, Wall Street chief economists are salesmen. I do not know of a single one that is even qualified to teach economics. Thus, being a chief economist of a brokerage firm does not really mean much as far as credibility is concerned.

.png) As a final note, I’m going to tell you something you have never heard (and never will hear elsewhere). When Kudlow was working at Bear Stearns, he was a known coke head. When I was working at Bear Stearns I was told that Kudlow was found huddled under the desk of his hotel room all coked out after he failed to show up for an important presentation. After that incident, he was fired.

As a final note, I’m going to tell you something you have never heard (and never will hear elsewhere). When Kudlow was working at Bear Stearns, he was a known coke head. When I was working at Bear Stearns I was told that Kudlow was found huddled under the desk of his hotel room all coked out after he failed to show up for an important presentation. After that incident, he was fired.

I’ve seen many credible fund managers who were so biased due to their fund’s investment approach or positions, they stuck with their views despite the obvious because it would not do them any good to get with the program.

For instance, if you are a mutual fund manager and you think the market will collapse, you sure as hell aren’t going to tell your clients because you have to remain majority invested in the market. But you better believe they will be liquidating their personal accounts.

Likewise, if you are a gold dealer and you feel that gold has peaked and is headed way down for many years, you sure as hell aren’t going to tell anyone because you would go out of business.

(3) Timing

No prediction, no matter how accurate is worth a damn if you have been crying wolf for many years.

Timing is extremely difficult to predict in advance. But if an individual knows what he is doing, he will be able to recognize things just before they happen or during the early stages; not in all cases, but in the majority of cases.

Perma-bears have been preaching the same doom and gloom lines since the early-1990s; some for much longer. Were you aware of this? If you weren’t that means you have been accepting what these guys say with blind faith.

It also means these charlatans take a buy-and-hold approach.

Folks, if you’re going to side with a buy-and-hold strategy, you’re much better off with Wall Street perma-bulls because the U.S. stock market eventually goes up over time. But you must know when to shift gears because extremes are always dangerous, as are extremists.

When trouble arises, most unsophisticated investors assume that perma-bears are ahead of the curve when they pitch their doom and gloom because they are not even aware that these guys are perma-bears. As such, they have been saying the same thing since the Dow Jones was 1000 twenty years ago. Investors would not be fooled if they bothered to research their track record.

In addition, unsophisticated investors seem to think that if a person warned about the economic collapse 15 or 20 years ago, they are a better source of insight than someone who warned about it a couple of years before it happened. But the exact opposite is true.

As the following video illustrates, Peter Schiff has not only been preaching the same doom and gloom story line for well over a decade, he has been wrong much more often than right. That means you are better off flipping a coin when determining your investment decisions rather than listening to what Schiff and the other salesmen have to say.

Always remember that stock broker means one who sells stocks. Peter Schiff is a stock broker. Therefore, he is a salesman and all good salesmen have a sales itch which they stick to through thick and thin. Schiff may be good at sales, but the product he is selling (his dog-and-pony economic ideas and disasterous investment ideas) is complete garbage.

You see, if you have been preaching that the Dow Jones is headed to 1000 since 1995, you missed out on some tremendous gains in the U.S. stock market. As since these guys recommend to get out of the market many many years before it collapses, this causes those who follow their advice to miss out on tremendous gains.

If you aren’t able to pinpoint exactly WHEN your predictions will occur (which you shouldn’t expect from anyone) you MUST discuss warning signs in sufficient detail so that others will know what to look for so they will know WHEN to respond. Otherwise, the predictions are useless. In fact, they are very dangerous. The best way to do that is to discuss very specific forecasts and economic relationships. None of the media’s “experts” do this because they really don’t know what is going on. They are marketers who pitch their sales line to their audience.

The few who do discuss specific forecasts either fail to appreciate the fact that bubbles can last a long time before popping (perma-bears) or they fail to realize that there is a bubble or a bubble is likely (perma-bulls). They also don’t give a damn. All they care about is selling you a story line that will lead to more money in their pockets.

This is why they have looked at the brutal economic conditions and scared their sheep into staying out of the largest stock market rally since the Great Depression. Virtually all of the gold bug, perma-bear crowd keeps insisting that the dollar is headed to 0 and the Dow Jones is headed to 1000. The perma-bulls play the same game by insisting the stock market will soar. Hopefully, you are beginning to see how the game of deceit is played.

It doesn’t take a genius to understand macroeconomic conditions; they’re bad. But that doesn’t necessarily mean the stock market is going to reverse its bullish trend.

The single variable that distinguishes someone who really understands what is going on versus others who can only see what the herd sees is the ability to decipher the economic risks and realities with stock and bond market performance. This enables such an individual to navigate the cyclical periods of up and downs.

If you are unable to bridge this gap or else you are not aligned with someone who can, I would advise you stay out of the capital markets forever, or else just buy index funds.

Some naïve investors buy into the extremist views of perma-bears causing them to miss out on tremendous gains. Other naïve investors buy into the extremist views of perma-bulls causing them to suffer huge losses. In each case, they fall for this ploy because they cannot understand the difference between risk and reality.

The gold bugs and perma-bears pitched the same lines while the stock market went up by 500% in a decade because doom was their sales pitch. The perma-bulls and shills for America’s fascist regime pitched the same lines while the stock market collapsed because they always pump up the market.

(4) Specificity

Simply predicting “major problems” for the U.S. economy or real estate market is insufficient to make money.

In order to be considered a credible analyst, forecaster or investment strategist, one must publish specific forecasts that are actionable; ones that investors can utilize successfully for their own benefit.

Open-ended statements and generalities are useless. They are also frequently used by marketers posing as “experts.” These are the guys plastered throughout the TV, radio and print media.

And when you make ridiculous claims such as the dollar is going to 0 due to hyperinflation you have lost all credibility. You should start a list and write down every person who has made this ridiculous claim.

I’m willing to bet Peter Schiff any amount of money he wants that hyperinflation isn’t coming to the U.S; let’s give it a target of say five years from now (because I don’t want Schiff to keep stalling for time as he lures more suckers into his ridiculous investment approach). I’m willing to bet you that he won’t take me up on the bet.

And if you think the euro is safer than the dollar as Schiff does, then I say invest in mental hospitals to help cover some of your future costs.

(5) Hit-miss Ratio

You also need to look at the percentage of right versus wrong calls, or the hit-miss ratio.

As well, you need to weigh each call in order of importance. For instance, being right about predicting Dow Jones 6000 is a much more important call than predicting the collapse of a single stock.

What these charlatans typically do is cherry-pick their best calls while leaving out the disasters. In almost every case I have studied (over a period of many years), the number of losers far exceeds their winners. But you won’t know this unless you conduct a full investigation of their track record.

The guys guiltiest of avoiding or misrepresenting their hit-miss ratio are the newsletter clowns. You know who they are (Weiss, Stansberry, Casey, Schaeffer, etc.). These are the guys who spend millions of dollars for online ads because they know that this this where they can lure the biggest number of naïve, greedy fools. They have a staff of 2 or 3 dozen writers constantly pumping out “amazing investment opportunities” or selling you fear each day. In that way, they have all of the angles covered.

By covering a massive amount of securities and publishing ten or twenty different newsletters, they are able to cherry-pick the stocks that did well while not bothering to tell you about those that blew up. This is the oldest trick in the newsletter scam industry. And it is a rendition of the original scam from the early days before the Internet.

Here’s how it works. You write ten or twenty marketing pieces touting a stock and you send it to thousands of people in the mail. Each piece talks up a different stock. For the one or two that do well, the recipients will think that the scam artist really nailed the pick so they will subscribe to their newsletter. They won’t know that the guy also sent 20 different stocks to other people across the country. This is the oldest trick in the book and some of these guys are still probably using it today.

Of course none of these writers has ever worked on Wall Street. They don’t need to because they are marketers. Rather than offer you practical experience from having worked on Wall Street, they brainwash you with various tactics. Between all of the material that gets pumped out, they seem to cover every possibility so that when something happens, they cherry-pick previous predictions, knowing you won’t know better.

In fact, I have seen a modified form of this strategy used by a man who has worked on Wall Street; Peter Schiff of Europacific Capital (you might want to check Schiff’s Broker Check on FINRA to see why he no longer works on Wall Street).

In fact, I have seen a modified form of this strategy used by a man who has worked on Wall Street; Peter Schiff of Europacific Capital (you might want to check Schiff’s Broker Check on FINRA to see why he no longer works on Wall Street).

For instance, Europacific’s “chief economist” John Browne has been talking about the collapse of the euro. But Peter Schiff has been sidestepping the problems in Europe for obvious reasons.

In fact, with all of the problems in Europe, Euro pacific Capital may have to change its name to Pacific Capital because I already predicted at least 10 years of deflation in Europe in a detailed report in early 2011 (Intelligent Investor newsletter).

The only problem is that most of Asia has also been getting flushed down the toilet as well.

I guess there is always Euro Pacific Precious Metals, right?

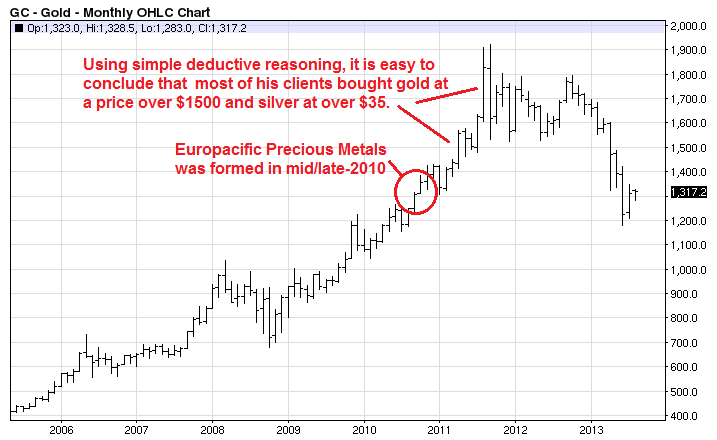

Well, unfortunately for Schiff's precious metals clients, because Euro Pacific Precious Metals was not formed until late-2010, that means most of his clients who have purchased precious metals through this company have lost money.

Rather than change his sales pitch, Schiff keeps insisting that the U.S. dollar is riskier than the euro!

Wow. If you have your money with Schiff, I advise you pull it ASAP because the man is clearly lost in the woods.

By claiming the euro will collapse (Browne) and the dollar will collapse (Schiff), Europacific Capital has both angles covered. Got it?

Others make ridiculous claims that say they predicted the fall of a bank based on a statement they wrote 60 days before that said “this bank has a terrible balance sheet” or “they risk insolvency.”

Almost all of these newsletter scam artists flat out lie about their track record. This is a fact. If you don’t know this then you have either not adequately researched their track record, or else you lack an adequate understanding of things.

Brokers are regulated by FINRA and the SEC, so they are usually somewhat more careful about putting out misleading claims. But some of these guys get around this by making media appearances where they are able to create the perception that they are always on the winning side of the trade.

Jim Cramer also plays this game, knowing that none of the sheep who watch him keep a written account of his track record.

Other members of the media club benefit from the same strategy because they are rarely held to their previous forecasts, unless they happened to be right, which is rare. They get away with this because most people have very short memories.

As a result of the pervasiveness of these extremists throughout the Internet, print and broadcast media, most of Main Street missed out on the biggest stock market rally since the Great Depression. If you didn’t miss out on this tremendous rally, chances are you didn’t sell in 2007 or 2008.

If either of these situations includes you, don’t ever forget it.

Don’t you think it’s about time you made some changes?