Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Mike Stathis Has Been Recommending Nvidia (NVDA) Since May 2009

I began my mission helping investors steer clear of Wall Street because I learned firsthand how the game was played after having worked in the industry.

Thereafter, I learned how the media helps Wall Street after I was black balled by all media in 2006 and thereafter for trying to warn main street about what would become an unprecedented financial crisis in 2008.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content.

I think I've done quite well in that regard.

As a part of this mission, I have also spent a great deal of time and effort exposing the criminal activities of the financial media, as it works with Wall Street to deceive and defraud main street.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments, fake reviews, and hearsay from people they have no idea about.

Those who are unfamiliar with Mike Stathis can find out more about his credentials, background, and his investment research track record here, here, and here.

We urge you to examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

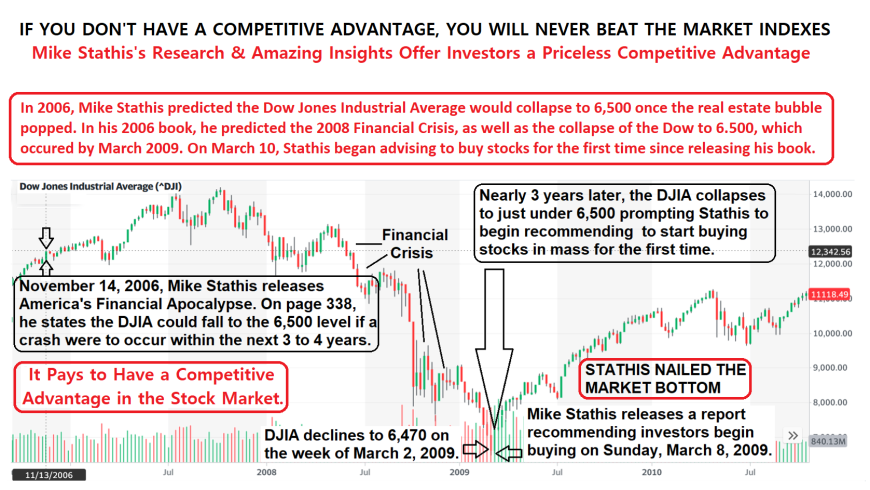

INVESTORS MUST HAVE A COMPETITIVE ADVANTAGE IF THEY WANT TO OUTPERFORM

Do you have a competitive advantage to help you beat the market indexes?

If not, you stand no chance of beating the indexes in the long run.

Without a reliable and sustainable competitive advantage, most investors are better off investing in index funds.

Furthermore, investors lacking a competitive advantage stand no chance to beat Wall Street.

For example, consider the following facts about Wall Street professionals and fund managers.

- You're competing against millions of financial professionals.

- Most of them are very experienced, well-trained, and very knowledgeable.

- Investing is their job. It's what they do for a living, so they're driven and committed.

- They know a lot more about the capital markets than you.

- They also have access to virtually unlimited human, intellectual, and capital resources.

- They utilize these resources to spot risk and identify opportunities on a daily basis.

Finally, most of the biggest investors and investment firms have access to insider information. Perhaps you need a reminder of this fact (see the video below).

How can you compete with investors who have insider information?

You stand no chance without a competitive advantage.

When it comes to both investing and trading, there's only two sides.

There's the winning side and the losing side.

For each stock that goes up in price, there are investors who owned the stock before the price surge.

These are the winners.

- There are also investors who sold the stock before it went up.

- There are other investors who never owned stock at all.

Each of these investors are the losers.

Remember, for every dollar of profit made by investors in the stock market, a dollar is lost by other investors who made the wrong decisions.

That's what you call a zero-sum game.

And it describes how the stock market works.

So if you want to beat "the street," you MUST HAVE a Competitive Advantage.

And if you want to beat the indexes, you MUST HAVE a Competitive Advantage.

SO, WHAT'S YOUR COMPETITIVE ADVANTAGE??

Are you getting a competitive advantage by watching CNBC, Bloomberg, or Fox Business?

- CNBC - Watch TV, Lose Money: Theranos, Another Scam Promoted by Jim Cramer and CNBC

- CNBC Trading "Expert" Jon Najarian Promotes "Crypto King" Ponzi Scheme Crook John Caruso

- Jewish-Run Scam Network CNBC Promotes Jewish Con Tony Robbins as 401k Expert

- Jewish Moron Dennis Gartman Positioned as an Expert by Jewish Scam Network CNBC

- Another Jewish "Expert" from CNBC and FOX Involved in Fraud

- Jim Cramer's Boiler Room TheStreet Receives Millions of Dollars in Taxpayer Funds

- Proof that Jim Cramer is a Contrarian Indicator and Investment Idiot: NVDA

- Watch TV, Lose Money: Stock Manipulator Jim Cramer Pumps CF Industries at the Top

- Jim Cramer Pumps Silicon Valley Bank Stock as "Cheap" Days Before It's Seized

- Jewish Scam Artist Jim Cramer Pumped Cryptocurrencies at the Peak

- CNBC Liar & Con Man Jim Cramer Steers Sheep into Slaughterhouse with StitchFix (SFIX)

- Jim Cramer, CNBC and the GoPro Pump and Dump Scam

- How Jim Cramer, CNBC and Other Jewish Con Men Screw the Sheep

- CNBC's Josh Brown and Other CNBC Idiots Show You How to Lose Money

- More CNBC Scams - Jewish Media Promotes Jewish Cons, Liars & Clueless Kids to Deceive & Scam the Public

- CNBC Promotes Morningstar as a Credible Source But Mike Stathis Sets the Record Straight

Maybe you think you're getting a competitive advantage by reading Barron's or the Wall Street Journal.

- Jewish Mafia-run Barron's and Wall Street Pumped Luckin Coffee Before Shares Collapsed

- Barron's Promotes Jewish Charlatans & Clowns as Experts

If you actually think you're going to obtain a competitive advantage or even an edge by following the financial media, I have ocean front property in Wyoming that I'd like to sell you.

Most investors are oblivious to the fact that financial media is useless.

In fact, the financial media is detrimental to your investment performance.

That's the way the financial media has been designed.

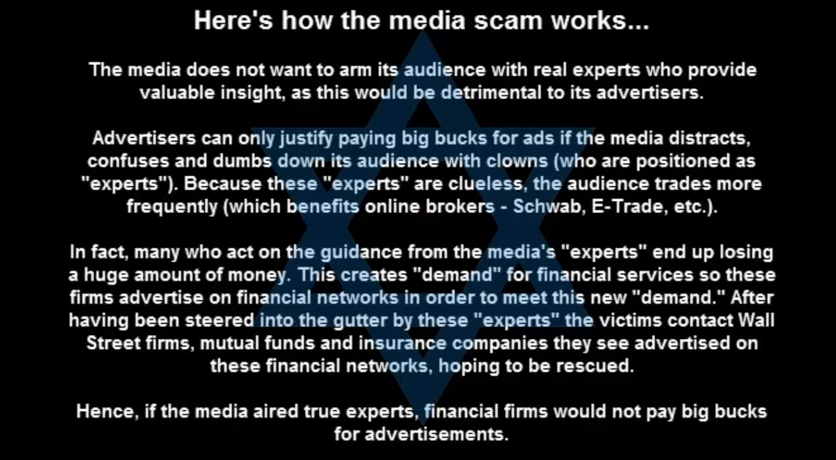

Mike Stathis has been exposing the media scam for well over a decade.

And he's published hundreds of articles and videos showing how it operates.

And then there are really naive investors who think they'll find value by reading the lowest level financial content plastered on hundreds of websites, such as Yahoo Finance, Zach's, MarketWatch, Motley Fool, The Street, Morningstar, Benzinga, Seeking Alpha, Zach's, Tipranks, Insider Monkey, Guru Focus, etc.

Let's get real. These websites are boiler rooms that publish clickbait trash.

- Yahoo Finance Scammers Defend Broken Clock Jeremy Grantham Who Missed Longest Bull Market in History

- Yahoo Finance is a Complete Jewish-Run Scam Which Only Promotes Jewish Frauds

- Yahoo Finance Promotes Jewish Tranny Clown Lyn Alden as Investment Expert Proving its a Boiler Room Scam

- Yahoo Finance Teams Up With Zero Hedge Scam Artist and Liar Bob English/Jared Blikre

- Benzinga: Another Jew-Run Fake Financial News Boiler Room Operation Promoting Jewish Clowns as Experts

- Yahoo Finance Promotes Airhead Millennials in Order to Pump Crypto Scams

- Disgraced Economist Ken Rogoff Promoted by Liar and Promoter of Scam Artists, Jared Blickre

- Yahoo Finance's Jared Blikre Promoted Con Man Mike Maloney

- Jewish-Run Boiler Room Yahoo Finance Promotes Jewish Clown Kid Promoting Stupid and Dangerous Stock App

- Yahoo Finance Jewish Cons Whore More for Jewish Con Porter Stansberry

- Yahoo Finance Deceives its Audience by Partnering Up With Con Artist Jason Bond (April 2, 2019)

- Con Artist Deepak Chopra Promoted as Investment Guru by Yahoo Finance

- Yahoo Finance Hypocrites Criticize Doomsday Clowns

- Marketing Fraud: TheStreet Promotes Reporter as Retirement Expert

They publish ad-based content which has been proven to be disinformation.

They also sell paid subscription services using false claims in order to lure the sheep into their scam.

But the fact is they have no investment experts publishing their content.

They employ copywriters, cons, and scam artists.

- CNBC Stock Manipulator Jim Cramer and TipRanks Lead Sheep to Slaughterhouse. CANO

- Proof that TipRanks is a Disinfo, Garbage Scam Service

- YouTube Fake Investment Guru Larry Jones Shows You How to P1ss Your Money Away Using Google and TipRanks

- YouTube Fraudster and Fake Analyst Tom Nash (Tomer Nesher) is a Paid Pumper for Israeli Scam TipRanks

- Mike Shows You How Useless Financial Media is Using Motley Fool As an Example

- MarketWatch Clown Brett Arrends Claims Stock Market Overvalued in 2014 More than Dot-Com Bubble

- MarketWatch, Bloomberg and Goldman Sachs Are Spin Doctors of Confusion and Disinformation

- MarketWatch Fake News Peddler Mark DeCambre Keeps Creating Fake Track Records to Sell Ads

- Mark DeCambre is a Fake News Click Bait Scam Artist Working for Boiler Room Marketwatch

- Jewish-run Scam MarketWatch Promotes Jewish Charlatan Tony Robbins as an Investment Authority

- MarketWatch Jewish Crooks Promote Jewish Robert Prechter as an Expert AGAIN!

It's quantity over quality.

That's the business model of ad-based content.

And it's the result of the Internet.

The content from these types of websites is pumped out like a machine for the purpose of triggering search engine results intended to lure more sheep into the slaughterhouse of scams and deceit.

Similar to financial TV networks and newspapers, these copywriting boiler room websites hide behind the shield of being classified as media companies in order to get away with deceiving and defrauding the public with fake news, stock manipulation, and false claims.

And they pay websites like Yahoo Finance and many others to have their content published so that everywhere you look you see their content.

Mike Stathis has previously described this as the media's "flooding approach."

Others actually think they can invest well by listening to fake investment gurus on social media.

The problem is that such individuals aren't even aware they are listening to frauds and idiots.

If you actually think you're going to gain a competitive advantage by listening to fake investment gurus on YouTube, Facebook, and other social media platforms, even God won't be able to help you.

- CNBC Make It. A Scam that Promotes FIRE Movement Frauds & YouTube Cons Graham Stephan and Kevin Paffrath

- Tom Nash is a Fake Investment Guru, Idiot, Liar and Fraud

- Meet Kevin and Tom Nash Are Frauds

- Fake Investment Guru Tom Nash Claims No One on Wall Street Pays Attention to P/E Ratios

- Exposing YouTube Fake Investment Gurus Series: Introduction to Tom Nash

- Cathie Wood Pumper, Tom Nash Exposed as a Fraud by Leading Investment Expert

- FTX Paid Whore Tom Nash Claims FTX is Fine One Day Before Collapse (Nov 12 2022)

- Scam Artist, Liar and Fake Investment Guru Meet Kevin is YouTube's Sham-Wow Guy

- Meet YouTube Liar and Con Man Kevin Paffrath (re-released)

- Meet Kevin (Kevin Paffrath) Goes from Real Estate Con to Fake Investment Guru Scam Artist

- YouTube Fraudster of the Year: Kevin Paffrath (Meet Kevin) Parts 1-3

It's important to remind you that ALL of the sources I have mentioned are partners with the copywriting industry because they sell advertisements promoting sensational videos from con artists like Jim Rickards, Porter Stansberry, Whitney Tilson, Nomi Prins, Jim Rogers, Harry Dent, Robert Kiyosaki, David Stockman, and hundreds of other copywriting clowns.

Mike Stathis has previously exposed these and countless other cons, so check the website.

Check the end of this article for some examples of sources of disinformation, scammers and frauds.

There aren't many sources that can help you gain a competitive advantage because there aren't many real experts who are willing to help main street.

The fact is that, with rare exception all of the real investment experts are focused on making money for themselves by managing large funds.

They aren't going to waste time with media interviews unless they want some face time just to market their fund.

But if their fund is truly doing well, they won't need to market themselves.

Everyone else promoted by the media as an "expert" has no clue what's going on.

Instead of an investment expert, these people are really a marketing experts.

But if you aren't sufficiently knowledgeable about the markets, you're likely to be fooled by their fast talking BS lines.

These characters pose as experts in order to market themselves so they can land big speaking fees at investment events and conferences, pitch their useless books, and so on.

That's how they really make their money, not from investments.

Even on the rare occassion when a legit fund manager or other true expert appears in the media, you won't hear anything from them that will help you perform well in the markets.

That's a guarantee from Mike Stathis.

He knows this because he has been observing the financial media for many years, so he knows all of the games and tricks they play.

Yet investors are always searching for this "holy grail."

That explains why they watch financial media shows and read articles on websites.

They think they will be able to spot when there's some value.

The reality is that you won't know when you've come across valuable insight in financial media unless you're a very knowledgeable investor.

Some of you might be thinking that you're a very knowledgeable investor.

If that's the case, why would you waste your time searching for valuable insight in one of the worst places - in the financial media?

If you think the financial media provides a good source of investment insight, you aren't a knowledgeable investor.

You're what's commonly referred to as the "dumb money."

HOW CAN YOU GET A COMPETITIVE ADVANTAGE?

You need access to a top investment expert.

And you need access his excellent research.

You also need to either have or else develop good judgment.

In this case I will define "excellent research" as an unbiased source of unique insight with a proven track record of excellent forecasts and recommendations.

Note that the insight needs to be somewhat unique or else it won't be so valuable.

Part of having a competitive advantage means your insights are unique.

That's how you find yourself on the winning side of the trade or investment.

If the insights are not at least somewhat unique, there is no competitive advantage.

Ideally, you should aim for access to a top expert with extensive industry experience, as well as a long history of consistently proven results as seen by their track record.

Ideally, you should seek out a top expert with a long history of great results, as well as the ability to think independently. This individual will know when to counter investment recommendations of "top experts" and analysts. Such an individual will be capable of providing unique insights.

We know of no better person that fits the description above than Mike Stathis.

Mike is that exception I spoke of earlier as a true expert who isn't focused on making money for himself. That's why he's declined numerous offers to run investment funds and work as the head of research of funds.

Take a look at a few of his remarkable investment calls in the charts below.

Note: If you are unable or unwilling to go through and examine each of these well-annotated charts and carry out the sufficient leg work required to understand and appreciate the significance of Stathis' insights and recommendations as shown in the charts below, you will never be able to utilize world-class research such as that published by Mike Stathis.

The first two charts below show the results of those who followed Mike Stathis' analysis and recommendations to short Fannie Mae and Freddie Mac in his 2007 book, Cashing in on the Real Estate Bubble.

Not shown are similar results for additional stocks he recommended to short such as the sub-prime mortgage stocks, homebuilders, and banks.

He even warned that General Electric and General Motors would get hit hard because he realized these companies had grown to become essentially consumer finance companies.

We urge you to examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

The following video summarizes Mike Stathis' 2008 Financial Crisis Track record.

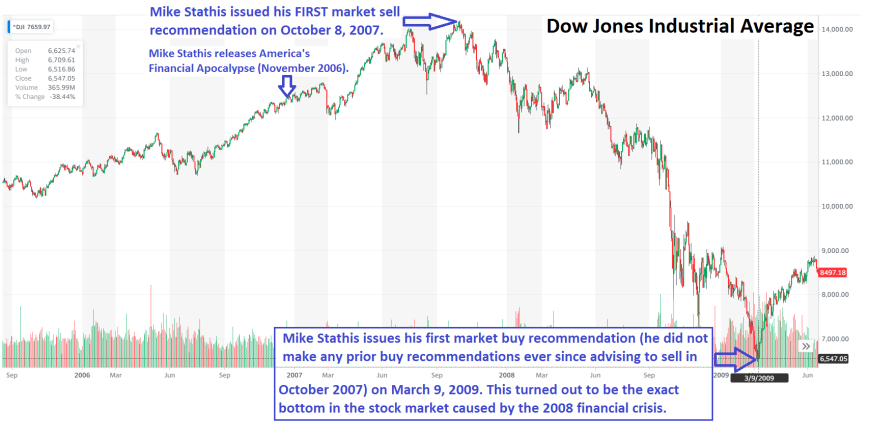

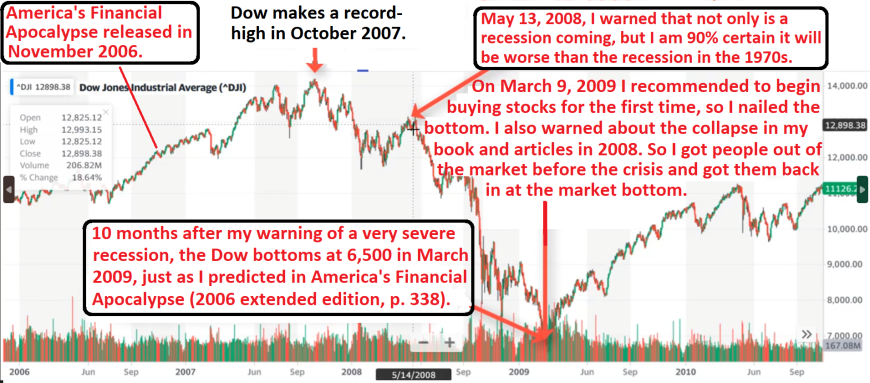

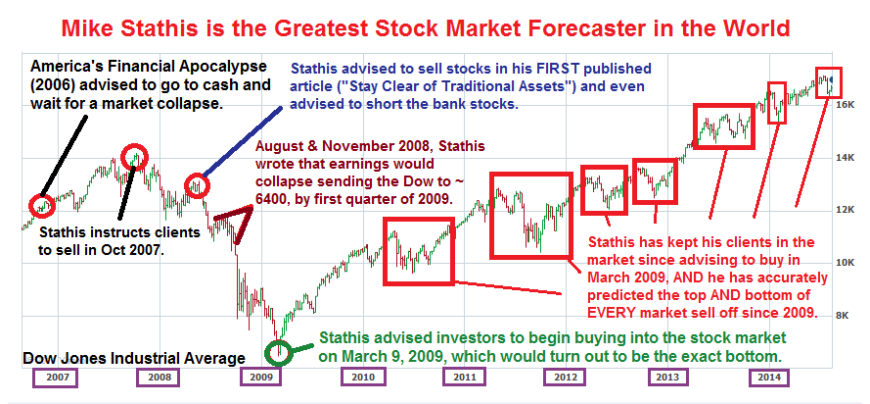

Next, take a look at Mike's financial crisis stock market forecasts and recommendations, published in his 2006 book, America's Financial Apocalypse as well as in several articles in the public domain in 2008 and 2009.

- Stay Clear of Traditional Asset Classes (May 4, 2008)

- More Smoke from Wall Street (May 12, 2008)

- Getting Ready to Short the Financials (July 17, 2008)

- Get Ready for the Earnings Meltdown (August 7, 2008)

- Payback is a BITCH (September 11, 2008)

- Market Guidance: Past, Present and Future (November 23, 2008)

- Fair Value is Here, But Watch Out Below (March 9, 2009)

The next chart is a summary of the results of stock market forecasting recommendations made by Mike Stathis since late 2006 (from America's Financial Apocalpyse) through the end of 2014.

We have not updated this chart because there is not enough space on the chart to show his accurate forecasts since 2014. However, Mike's results have similar accuracy which is extremely high.

If you want to examine his market forecasting track record in more detail, check the Newsletter Track Record section.

Mr. Stathis' Forecasting Track Record Since 2015

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

The next chart shows Mike's recommendations to short JC Penny long-term because he believed it would file for bankruptcy, which is exactly what happened. In contrast, you can see that the investment "experts" got it completely wrong.

The next chart illustrates how Mike Stathis was warning about Alibaba (BABA). He specifically told investors to avoid the stock. Mike had been warning about the dangers and risks of U.S.-listed Chinese stocks years before it was discussed in the media.

Meanwhile, the "legendary investor" Charles Munger was buying Alibaba (BABA) while praising the company and the Chinese government.

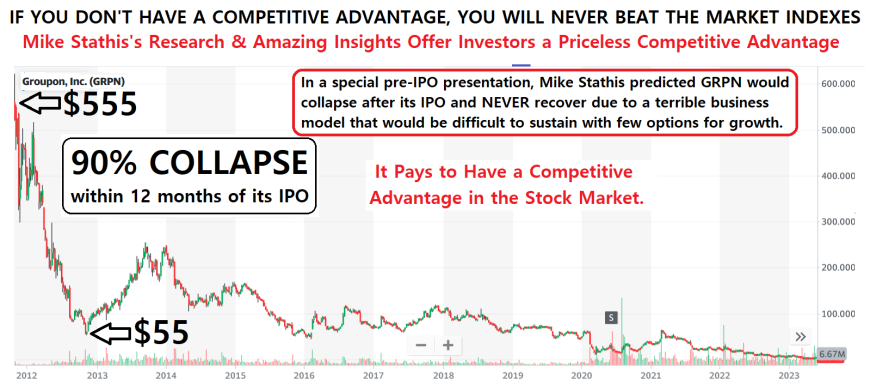

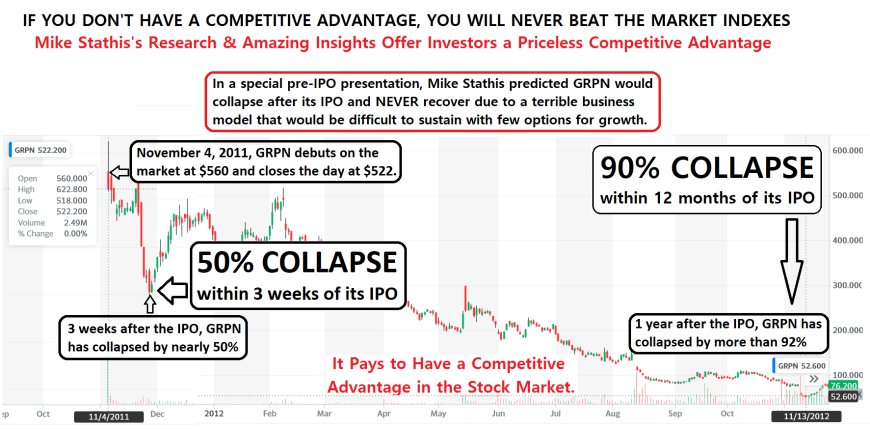

The next two charts illustrate the results of Mike's pre-IPO research presentation of Groupon. In this presentation Mike discussed why the business model was flawed and why the stock would collapse after its IPO, never to recover due to limited growth options. He recommended to short the stock.

See Shorting & Short Squeeze Case Studies

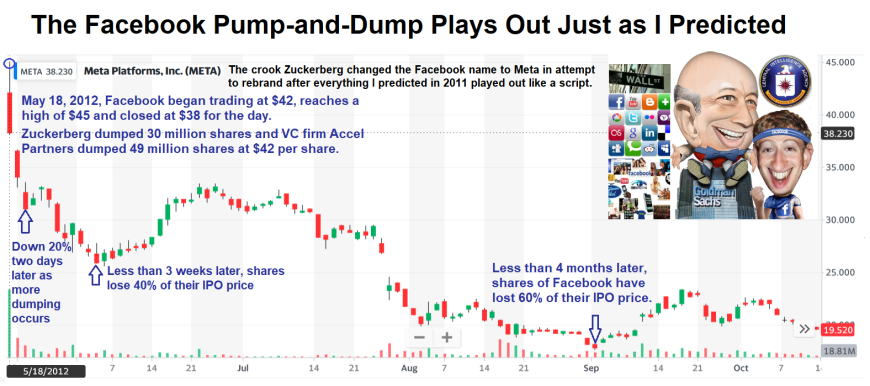

The next grand slam was provided to the public for free. Just over one year before Facebook's IPO, Mike wrote an article which was made available to the public explaining why he was confident Wall Street was orchestrating a pump-and-dump for Facebook's IPO.

Take a look at the results.

As usual, Mike was right. Shares of Facebook collapsed immediately upon entering the public markets.

After four months, Facebook shares had collapsed by nearly 60% before staging a comeback.

Facebook's comeback after its collapse is a story Mike is open to discuss upon request by research subscribers.

See Goldman Sachs and the Facebook Pump and Dump

See Shorting & Short Squeeze Case Studies

Take a look at the results of Facebook within a couple of months of its IPO.

If you had read the Wall Street Investment Bible, you would have been convinced to buy Netflix (NFLX) at $3.

Mike Stathis' Credentials and Track Record

- Mike is an Ivy League graduate with degrees in the physical sciences.

- He has worked at major Wall Street firms

- He has worked in the venture capital industry.

- He has advised multi-billion dollar mutual funds, hedge funds, and pension plans.

- He has advised Fortune 100 corporate treasury departments.

- He has advised ultra high-net worth individuals and high-level executives of Fortune 100 firms.

- He has written business plans for numerous startups and advised countless companies.

- He predicted the 2008 financial crisis with more accuracy and detail than anyone in the world.

You can learn more about Mike and his investment research track record here, here, and here.

You should examine his track record of having predicted the 2008 financial crisis. See here, here, here, here, here, here, here, here, here, here, and here.

Along with the most detailed analysis in the world at the time, Mike's research prior to the financial crisis enabled investors to capture life-changing profits.

You should confirm these claims by checking his 2008 financial crisis track record here, here, here, here, here, here, here, here, here, here, and here.

No one can match the accuracy, detail, and comprehensiveness of his 2008 financial crisis predictions.

Mike Stathis holds the leading investment forecasting track record since he began publishing research in 2006. And we have backed this claim with up to a $1,000,000 guarantee. See here.

- We could list all of the bankruptcies Mike predicted over the years such as Eastman Kodak, Bombay Company, Enron, Circuit City, Sears, Radio Shack, JC Penny, BonTon, and Bed, Bath and Beyond, along with several others. But we aren't going to do that today.

- We could make a great case showing evidence why we believe Mike to be the world's best distressed securities analyst. But we aren't going to do that today.

- We could discuss Mike's remarkably accurate stock market forecasting track record which we believe to be the world's best. But we aren't going to do that today.

- We could discuss Mike's brilliant insights debunking precious metals propaganda as well as the accuracy of his precious metals and oil forecasts and trading guidance, which we believe to be the world's best. But we aren't going to do that today.

- We could discuss Mike's accurate trading guidance for stocks as well as his ability to pick long-term blockbusters. And we could also discuss why we believe Mike is one of the world's best equities analysts. But we aren't going to do that today.

- Finally, we could discuss Mike's amazing macro calls, such as his detailed research predicting the rise of China two decades ago, followed by it's downfall several years ago, the deflationary decade in Europe and many other accurate calls. But we aren't going to do that today.

The reader should check the following links here, here, and here to see much of this material.

Today, we are going to examine what we believe to be as one of the greatest investment forecasts made in at least the past two decades.

This call might even rival that made by Mike when his 2006 book, America's Financial Apocalypse predicted the 2008 financial crisis along with his accurate forecast of an average 35% collapse in residential real estate prices (real estate bottomed in 2011, 35% down from highs), as well as his prediction that the Dow Jones Industrial Average would bottom at 6,500, which it did in March 2009.

Notably, he recommended investors begin buying into the stock market on March 9, 2009, as the Dow reached 6,500.