Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Mike Stathis Predicted Another Bankruptcy: Bed, Bath & Beyond (BBBY)

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

Examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, here, and here.

-------------------------------------------------------------------------------------------------------------------------------------

On Sunday, April 23, 2022, management for Bed, Bath & Beyond (BBBY) announced it had filed for chapter 11 bankruptcy protection.

It should come as no surprise to learn that Mike Stathis warned his research subscribers about the high risk of bankruptcy facing Bed, Bath & Beyond (BBBY) long before anyone else spotted the company's fundamental blunders.

But along the way, he also guided traders to huge gains.

Mike's long history of predicting bankruptcies dates back to his days working on Wall Street more than twenty years ago during the dotcom bust.

Among his first bankruptcy predictions were Enron, Worldcom, and Eastman Kodak to name a few.

- Mike even advised Alliance Capital against doubling down on it's 100 million share position in Worldcom. Unfortunately, the fund managers did not take his advice.

Not long after leaving Wall Street, Mike set his eyes on America's real estate industry and financial system.

He would go on to predict bankruptcies of several sub-prime mortgage companies due to an overleveraged MBS market filled with junk debt. Once the MBS market collapsed, Mike believed it would lead to a financial apocalypse unlike anything ever seen.

In his 2006 book, America's Financial Apocalypse (2006 extended version) he even wrote that America's safest mortgage powerhouses, Fannie Mae (FNM) and Freddie Mac (FRE) would go bankrupt and be bailed out by the government if the mortgage-backed securities (MBS) market collapsed as he expected.

To be clear, Fannie Mae and Freddie Mac were prime mortgage giants that only held mortgages with the highest credit ratings. So not even the most pessimistic investor would have thought to have shorted these stocks.

This might explain why the small handful of fund managers who profited from taking short positions in sub-prime stocks did not bother to short Fannie and Freddie. Quite simply, despite all of the false claims made by Hollywood, these fund managers had no idea things were as bad as they were.

These same fund managers were celebrated by establishment hacks like Michael Lewis and others as the "legends" of the 2008 financial crisis despite the fact their sub-prime bets were not so impressive considering that the lowest-rated debt always experience soaring defaults during a recession. Thus, these fund managers were really only betting on a recession, NOT an unprecedented financial crisis.

It might also explain why the performance of these fund managers has been pretty bad since the financial crisis.

Because Fannie Mae and Freddie Mac were established Government Sponsored Enterprises (GSEs) they were backed by the U.S. government (taxpayers).

That meant that if Fannie Mae and Freddie Mac failed, they would need to be bailed out by taxpayers. This is precisely what Mike wrote in America's Financial Apocalypse.

"Thus, it should be clear that America could face a devastating financial crisis from a misstep in the MBS market alone."

"What would happen if one or more GSE got into financial trouble? Not only would investors get crushed, but taxpayers would have to bail them out since the GSEs are backed by the government...failure of just one GSE or related entity could create a huge disaster that would easily eclipse the Savings & Loan Crisis of the late 1980s."

Reference: America's Financial Apocalypse (2006 extended version)

No one in the world made these predictions because you'd have to be both bold and brilliant to have done so.

You might want to ask yourself why Stathis wasn't at least included in Lewis' book or any of the movies hyping these fund managers.

Mike Stathis is the real star when it comes to having predicted the 2008 financial crisis. This is a fact which he has backed by a $100,000 guarantee for over a decade.

See more predictions from America's Financial Apocalypse here and here.

In order to take advantage of these forecasts, Mike recommended readers to short these mortgage stocks, along with the home builders in his 2007 book, Cashing in on the Real Estate Bubble.

He even mentioned that the banks would get hit hard but probably would survive.

Both books are legendary for their unprecendented accuracy and stunning insights.

But of course, the bankruptcies resulting from the 2008 financial crisis would be just a few of the many amazing calls Mike made prior to and during the financial crisis period that were published in his books and in his investment research.

During one of his rare interviews, Mike warned about the risks in Washington Mutual and Lehman Brothers, implying they would go bust. See here.

The following excerpts were taken from America's Financial Apocalypse (2006 extended version).

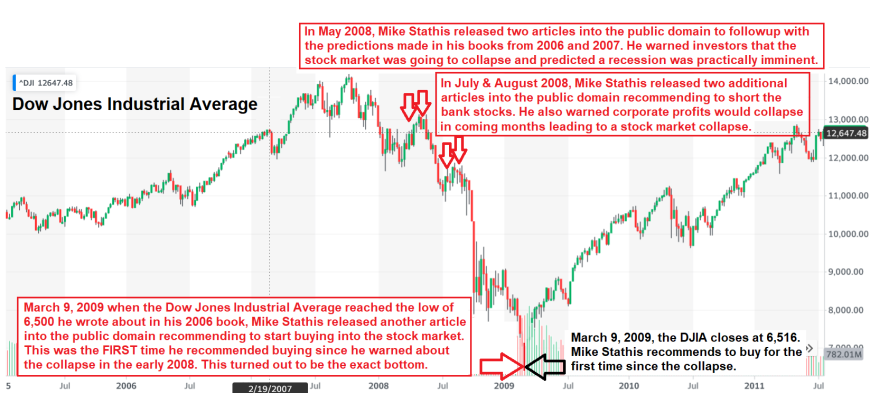

"...it would not be shocking to see the Dow Jones Industrial Average (DJIA) fall to the 6500 level if a crash were to occur within the next 3 to 4 years..."

Three years later in March of 2009, when the Dow Jones Industrial Average was around 6500, Mike recommended investors start buying stocks for the first time since he released America's Financial Apocalypse in 2006.

See here, here, here, here, here, here, here, here, here, and here for more on his 2008 financial crisis predictions and investment recommendations.

Not long after the 2008 financial crisis Mike wrote the Wall Street Investment Bible. In this book Mike predicted several more bankruptcies, such as Circuit City.

As he wrote in the book, several years before, he predicted the company would recover from a distressed state which it did. But he predicted this second time the company was not likely to recover. And it didn't.

He also predicted that Bombay Company would go bankrupt.

A few years later Mike laid out a convincing case for the eventual bankruptcy of Sears Holdings, followed by RadioShack, and JC Penny.

The remarkable thing about Mike's Sears bankruptcy prediction was that at the time he made the prediction, shares of Sears were trading at over $51.

The fact that Sears was selling for such a high price at the time implies that no one realized the company was in trouble, except Mike.

That's what you call confidence.

Mike's bankruptcy forecasts for Sears, RadioShack, and JC Penny were initially released as part of a special securities analysis video series called 60 Stocks Poised for HUGE Moves published on May 30, 2012.

The video below shows some excerpts from 60 Stocks Poised for HUGE Moves.

Mike later followed up with these bankruptcy predictions in the Boot Camp series (1 & 2), which began in 2016 and lasted through the end of 2017.

The Boot Camp series was created in order to teach investors the most essential skills of securities analysis and risk management. We believe the Boot Camp series to be the best source of investment education in the world.

Throughout the more than 70 hours of live presentation contained in the Boot Camp series, Mike used real-time examples from the stock market to teach subscribers critical lessons, all while providing forecasts and recommendations for a long list of stocks. And the results were wildly successful.

For example, in the distressed securities portions of the Boot Camp, Mike predicted several companies he felt stood a good chance of bankruptcy in coming years including BonTon (BONT), Steinmart (SMRT), Tuesday Morning (TUES), and Pier 1 (PIR), Windstream (WIN), and Frontier Communications (FRC).

In 2018 when the first Securities Analysis & Trading Webinar series was launched, he followed up with analysis of these securities along with many others.

Mike Details the Demise of BBBY in the Securities Analysis & Trading Webinar Series

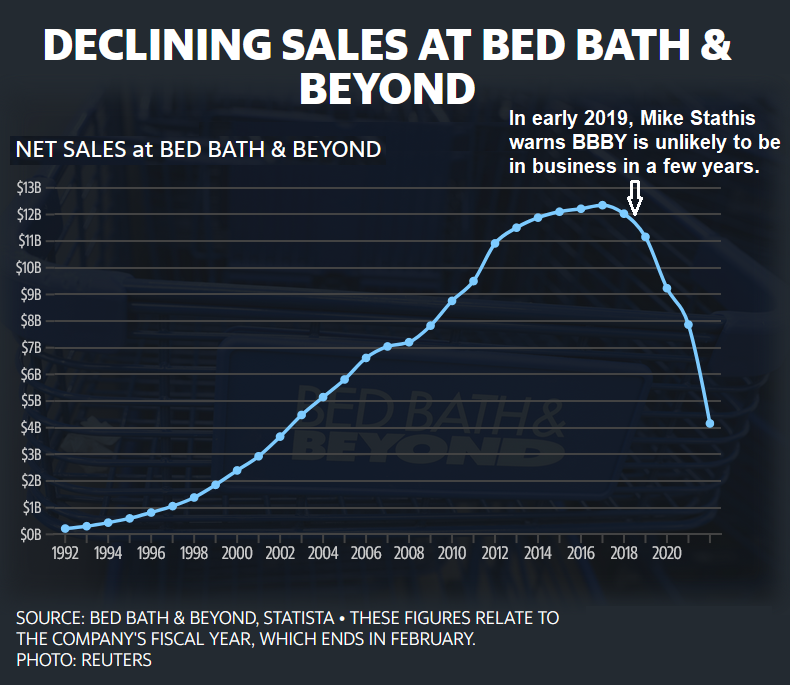

Over the course of a four-year period commencing in 2019, Mike warned that Bed, Bath & Beyond (BBBY) would not be around in years to come during several sessions of the Securities Analysis & Trading Webinar series.

His first warnings came in April 2019 when BBBY stock price was still quite high, indicating that no one believed the company was in trouble.

Mike explained why Bed, Bath & Beyond's long-term prospects were bleak long before anyone on Wall Street (or anywhere else) realized the possibility of bankruptcy down the road.

Even though Mike was confident BBBY would eventually file for bankruptcy, he led subscribers to huge gains by recommending long trading positions during critical periods, while providing exit strategies.

Once the meme stock craze took off in 2020 and 2021, Mike again guided subscribers of the Securities Analysis & Trading Webinar series to massive profits while reminding them that the bleak fundamental picture for BBBY had not changed and was actually much worse than in 2019.

Although Mike continued to provide an ongoing analysis of BBBY in 2022 (including highlight several lucrative trading opportunities) he emphasized the increasing need for those seeking to capture "meme gains" to become more cautious on the stock.

By late 2022, he was warning investors that even jumping in on a short squeeze was very risky at that point because he felt the end was near for BBBY.

Below are some excerpts from Mike's discussions on BBBY over a several year period during numerous sessions of the Securities Analysis & Trading Webinar series.

2018-2019 Securities Analysis & Trading Webinars

Session 9, April 25, 2019

“…We’ve clearly hit a new phase of e-commerce over the past few years, and they haven’t retooled.”

“When you see something like that, that should tell you it’s the beginning of the end. The store is failing.”

“Whenever you see a store depart from its core business, that tells you they’re failing. And I saw that with BBBY several years ago and I just wasn’t interested.”

“They’ve replaced management and started a shakeup, but I don’t think it’s enough.”

“This is one where probably if you get in at the right time and exit at the right time it’s gonna be sweet. In other words, I don’t think this is the end of BBBY (right now) because you’re gonna see catalysts that’s going to cause it to pop. But as a fundamental investment I wouldn’t touch it because basically you’re talking about a failure in management.”

Session 10, June 3, 2019

“BBBY is a speculative play; from April 25 I believe I mentioned that I might look to get into it at or below $13, so now that it’s $13 should you get into it? Well, let me just say this is not a stock I would invest in. It’s one of those plays that you look for some upside, so in other words I would look for an $18 to $22 exit. And the reason why I mention this is because, if you don’t exit at the right time, you can get stuck in a stock that fades into the darkness, the abyss. Sears is a good example.”

“Long term it’s not gonna be around.”

“I believe 85% we’re going to see $18-$22 over the next 18-24 months. So, the question is, is it worth it to get into it? For me I wouldn’t be interested unless there’s a lot more upside due to an extreme selloff.”

Session 11, July 30, 2019

“They could go quickly, not like JC Penny or Sears…they lingered for a long time. BBBY could be gone in a few short years...”

“There’s a good chance you’re going to see a turnaround in the stock, but I don’t think its going to last, so you need to think of it as a speculative situation and focus on the exit price.”

2022 Securities Analysis & Trading Webinars

Session 8, June 15, 2022

Mike revisits BBBY after not covering it during 2021 due to lack of requests.

“Given the perspective of having recommended BBBY in 2019 for upside to around $20 from $9, it’s not a good time now to be betting on BBBY due to weakening economy, insufficient store closings and continued weakness in the business.”

“This is one I just wouldn’t get into because it’s too risky.”

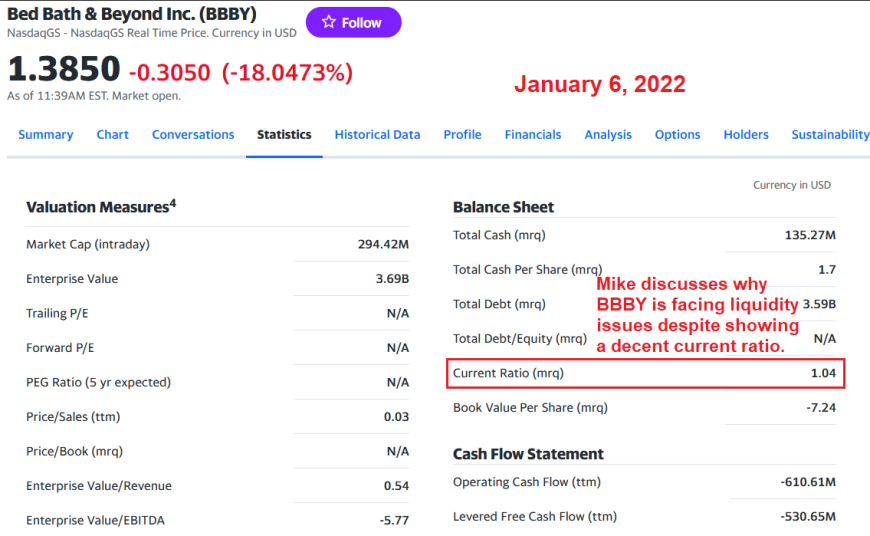

Mike then goes over BBBY's balance sheet and concludes “it’s not good. It’s a bad situation.”

“The bottom line is the risk-reward on BBBY at this point is a no-no. If you made money from it a couple of years ago you can follow it because some things could pop up...”

Session 10, July 7 2022

“There’s a possibility BBBY could reignite as a meme stock.”

“Unless they restructure significantly, or you don’t do something radical this company is finished because this company has been crap for many years.”

“If they don’t cut costs fast and secure adequate financing they will get into a liquidity crunch and it could quite quickly escalate into an officially distressed situation and bankruptcy. So don’t take the recent one-day (21%) pop in the stock as an indicator of some kind of turnaround.”

“And keep in mind this thing could continue to fly because of the nonsense going on (meme situation) plus the huge short interest, but it does nothing for the fundamentals.”

Session 11, July 24, 2022

“3 years ago when I recommended an entry at around $9 for an exit at around $20, BBBY was not looking so good, but it was in much better shape than today.”

Session 12, Aug 14, 2022

“It’s clearly distressed.”

When mentioning the recent pop, Mike explains that BBBY could rise higher.

“This thing could go a lot higher because hedge funds are getting involved now to suck in the retail sheep.”

“Nothing has changed…it’s a complete garbage company...”

Session 13, Aug 28, 2022

“I called the BBBY meme rally, did I not? This thing went to $30; it was $5.”

“The company is in deep trouble, and if they don’t do something serious, they may not last over the next couple of years.”

Session 17, Nov 13, 2022

“This company is on the verge of bankruptcy. It’s still possible to avoid bankruptcy but not likely.”

“I think it’s too little, too late.”

2023 Securities Analysis & Trading Webinars

Session 1, Jan 8, 2023

“The most desperate liquidation I’ve ever seen. As I’ve been saying, it’s too little, too late. Back in 2022 I stated they needed to shut down at least half their stores down fast, by a year. They waited too long and didn’t take enough action.”

“It’s not just one blunder. We’re talking about years of failures.”