Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Fannie & Freddie: Truth or Consequences (Part 1)

Amidst speculation that Freddie and its big brother Fannie are facing insolvency, U.S. Treasury Secretary Paulson said the primary focus was supporting Fannie and Freddie "in their current form as they carry out their important mission."

Well, the fact of the matter is that “carrying out their mission” is what got them into this mess to begin with.

Paulson delivered the subtle message that has been interpreted by most that he won’t bail the GSEs out. But if the GSEs aren’t able to raise sufficient capital, it’s going to initiate a printing frenzy by Bernanke, with or without a conservatorship.

Before we consider exactly what Paulson’s statement means, have a look at the following excerpts I put into print in 2006.

"Because Fannie and Freddie lack sufficient government oversight, they haven’t maintained adequate capital reserves needed to safeguard the security of payments to investors. And due to exemption from the SEC Act of 1933, they aren’t required to reveal their financial position. In fact, they’re the only publicly traded companies in the Fortune 500 exempt from routine SEC disclosures required for adequate transparency and investor accountability. As a result, many feel the GSEs are exposing themselves to excessive risk."

"Recent investigations have forced Fannie to restate earnings to the tune of nearly $11 billion from 1998 to mid-2004. The SEC has fined them $400 million and the management is now being investigated by the Department of Justice. Thus far, Fannie Mae was found to have misrepresented its risk position, acted irresponsibly, and manipulated earnings so company executives would receive huge bonuses.”

“The original intended purpose of the GSEs was to focus on affordable housing for the private sector. Yet, dozens of studies have shown that Freddie and Fannie have not been dedicating their resources towards this mission, but have been supplying funds to the overall market. Therefore, the GSEs have been a significant stimulus for the rapid growth of sub-prime loan market that has contributed to the enormous risks we see within the real estate bubble."

Source: America’s Financial Apocalypse: How to Profit from the Next Great Depression

Is this the “important mission” of the GSEs Paulson was referring to - Fraud, mismanagement, excessive risk, and abuse by management of a quasi-government agency?

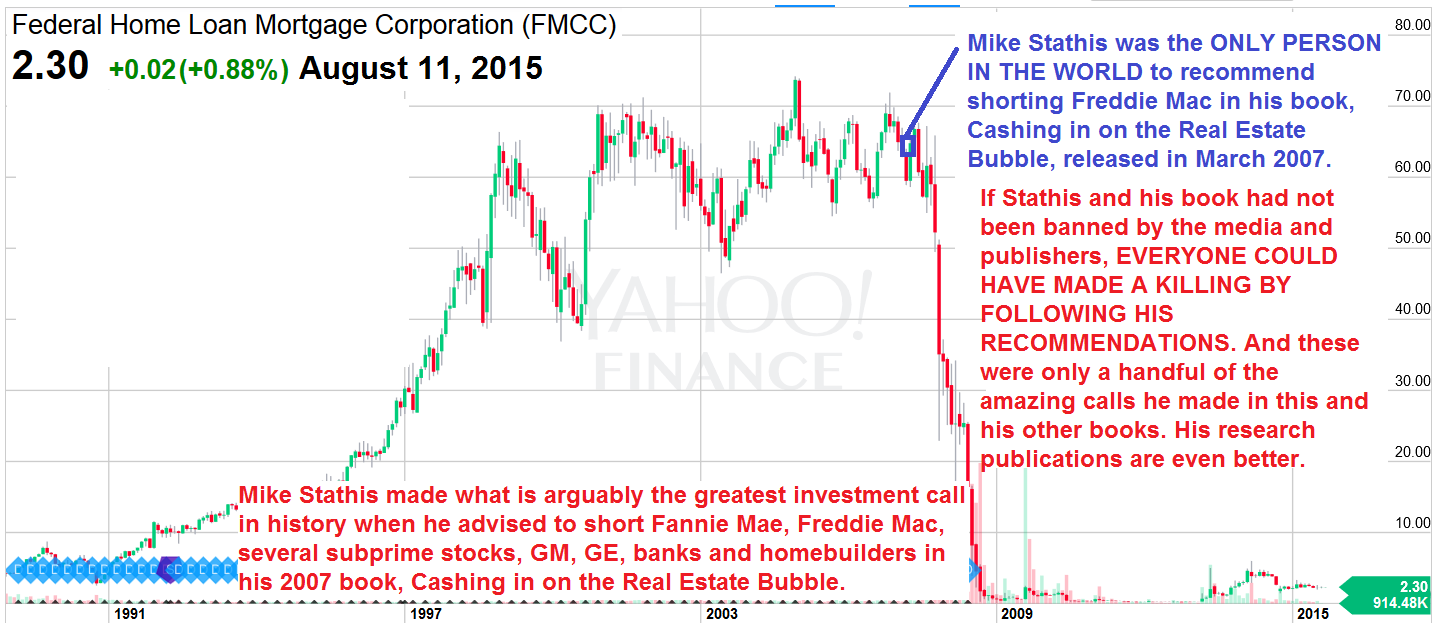

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse.

The Jewish Mafia REFUSED to publish this landmark book because it exposed the widespread fraud committed by the Jewish Mafia.

Instead, the Jewish Mafia published useless marketing books written by their broken clock tribemens (like Peter Schiff's useless book which was wrong about most things and was written a year AFTER Stathis' book).

Stathis also released a book focusing on strategies to profit from the real estate collapse in early 2007.

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

So why does the media continue to BAN Stathis?

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

__________________________________________________________________________________________________________________

.jpg)

.png)

.png)

.png)

.png)