Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

NAR's Yun Continues to Mislead on Housing

NAR Chief Economist Lawrence Yun continues to prove he's lost in the woods. I'm sure most of you who have followed the real estate market recall his long list of ridiculous predictions.

Do you remember when he claimed house prices would rebound in 2007? His quotes continue to supply stand-up comedians with new material.

One could reasonably argue that Yun is committing consumer fraud by trying to entice people to buy into a market that is poised to fall further. I suppose he thinks his ridiculous predictions will restore confidence in the real estate market.

If in fact his role is to spread optimism, the NAR should be legally required to post an appropriate disclaimer stating their real purpose.

Despite what Yun states, more affordable mortgages won't solve this mess. It's a bubble that must deflate. If it does not deflate fully now, it will down the road with much bigger consequences.

Mr. Yun, if you're going to try to remain optimistic throughout the crisis, at least do it within reason.

A National Association of Realtors study shows house sales remained soft in March, but the organization is forecasting sales will begin to improve over the summer.

I wouldn't bet on it.

The median new-home price is estimated to fall 3.7 percent to $238,000 in 2008, then rise 5.4 percent in 2009 to $250,900.

Wrong

NAR said the 30-year fixed-rate mortgage is likely to increase gradually to 6.2 percent by the end of the year, and then average 6.3 percent in 2009.

What he is not telling you is that the period after 2009-2010 is critical since most ARMs will have reset by then and inflation will be sky-high. Stating that mortgage rates will be contained through 2009 is trivial. Why won't he tell us what will happen after 2010? Does he not realize that rates are set to soar or is he afraid to tell the truth?

Below are just a few of my forecasts for the real estate bubble made in 2006. Thus far, I have had no reason to change these estimates. Like all of my forecasts, these were made with the hope that no revisions would be needed, unlike the "experts" who continue to revise their estimates each day, dragging Americans further into the abyss with their reckless guidance.

- Home Prices: from the peak in 2006, home prices will decline to pre-1999 levels.

- Commercial real estate market will also suffer

- Prime Mortgage foreclosures: the next trend in the housing correction will be a crisis in prime mortgages due to the weakness in the economy

- Rental Market: set to heat up, good investment opportunities

- Mortgage rates: will head north of 8% after 2010, and soar into double digits thereafter. This will cause home prices to sink further.

- Most likely, the housing correction will last many years. While it may show signs of improvement by 2009 or 2010, this will be temporary. When millions of baby boomers scale down to condos and retirement communities over the next several years, the market will be flooded with existing home inventory.

I'm not claiming my forecasts will always be right. But I make them with the intent to position investors ahead of the curve rather than behind it. And when adjustments are needed I’ll make them. But so far, I haven’t needed to.

Finally, in my opinion, the banking crisis is far from over despite what you hear from the "experts."

In order for America to mount a real recovery, consumers need real wage growth; something they have not had since 1999. They need affordable gasoline, healthcare and food prices - something they have not had for several years. Consumers also need job stability - something that continues to fade.

Only after these things have been provided will Americans be fit to purchase a home responsibly. Financial irresponsibility is something all too familiar to Washington. And most consumers have learned well from them. I suppose Washington thinks they'll be able to borrow from foreign nations indefinitely. Well guess what? Those days are fading fast. See my May 4 article ("Stay Clear of Traditional Asset Classes") for more on the real estate and banking crisis.

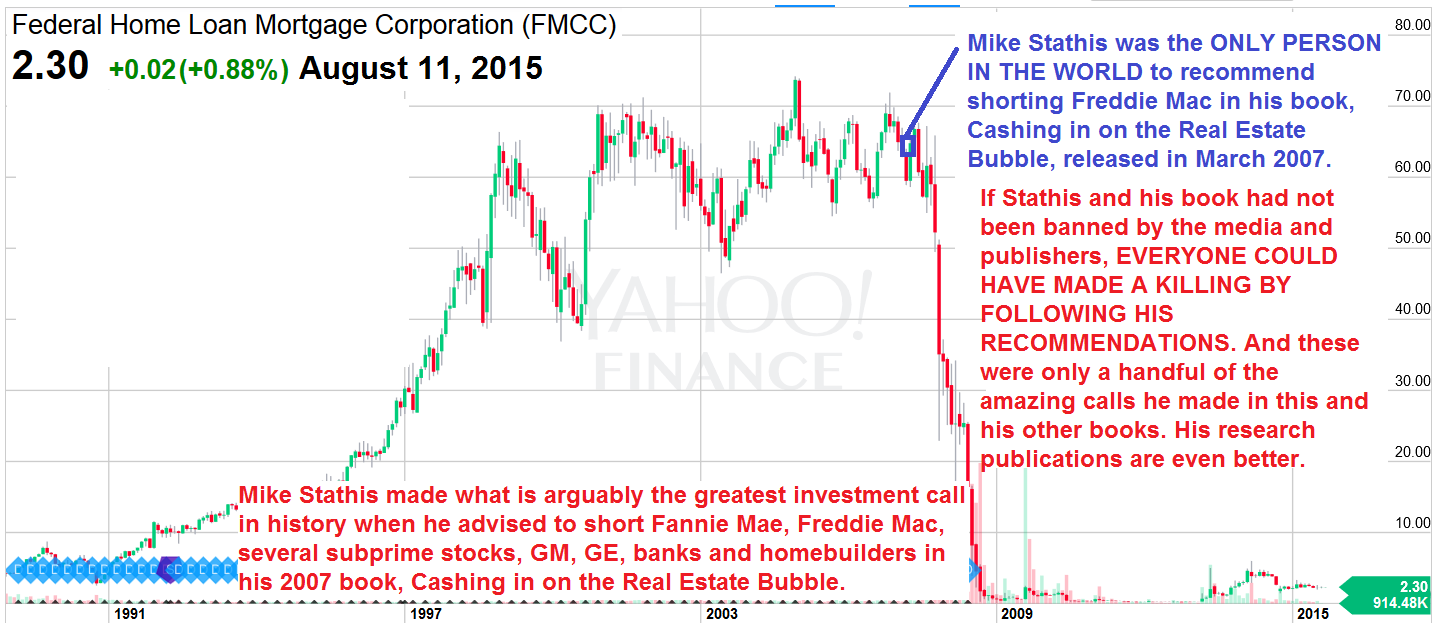

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse.

The Jewish Mafia REFUSED to publish this landmark book because it exposed the widespread fraud committed by the Jewish Mafia.

Instead, the Jewish Mafia published useless marketing books written by their broken clock tribemens (like Peter Schiff's useless book which was wrong about most things and was written a year AFTER Stathis' book).

Stathis also released a book focusing on strategies to profit from the real estate collapse in early 2007.

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

So why does the media continue to BAN Stathis?

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

__________________________________________________________________________________________________________________

.jpg)

.png)

.png)

.png)

.png)