Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Dividend Gems Outperforms Again

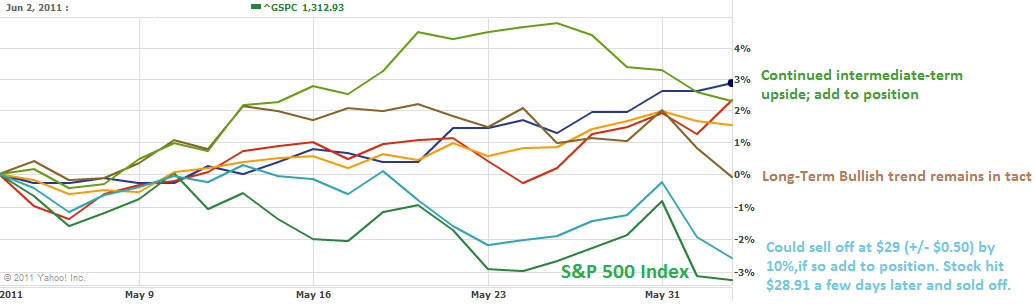

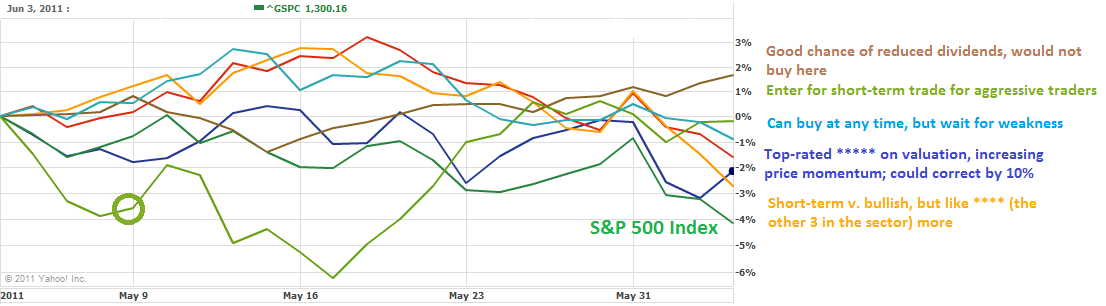

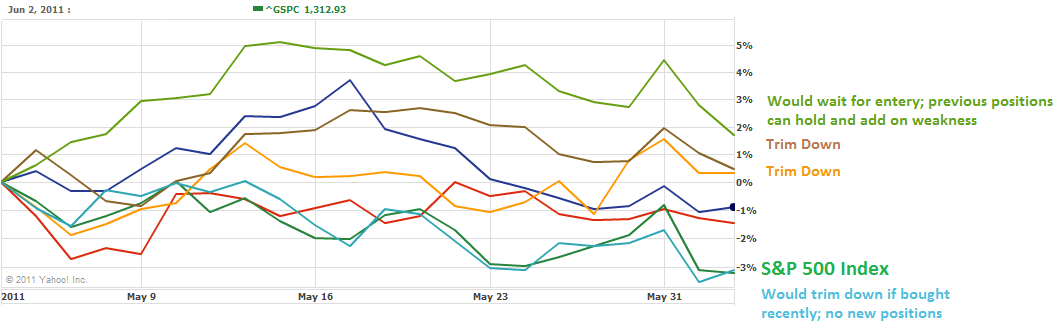

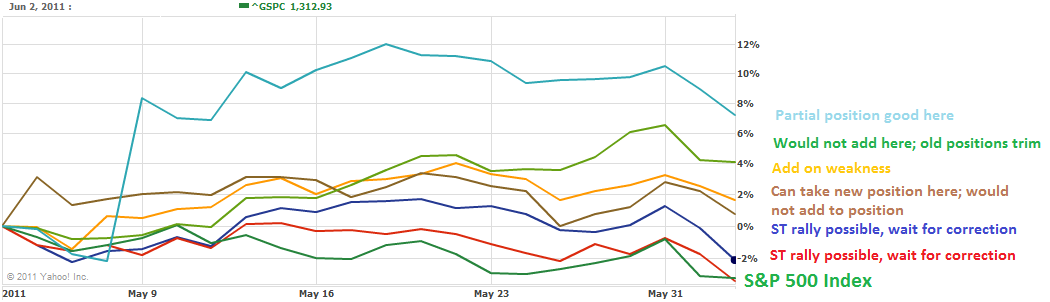

As the market has sold off over the past month, the Dividend Gems Recommended List has once again outperformed.

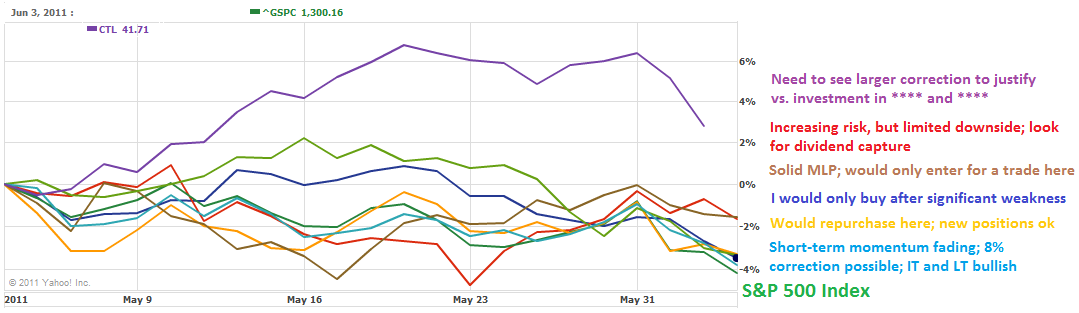

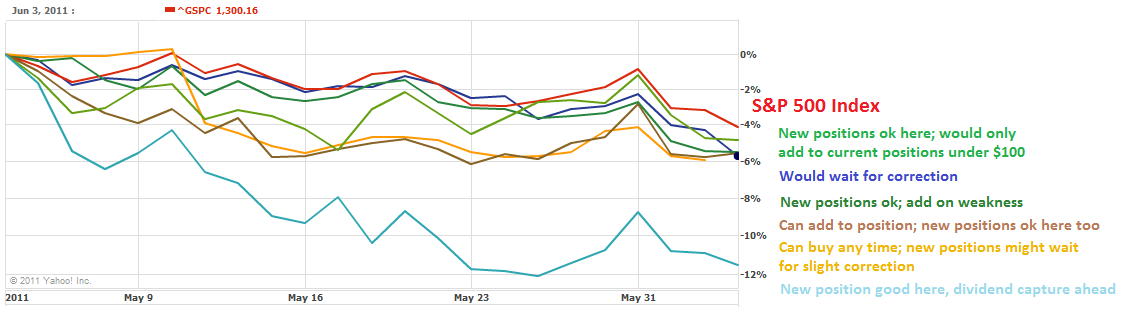

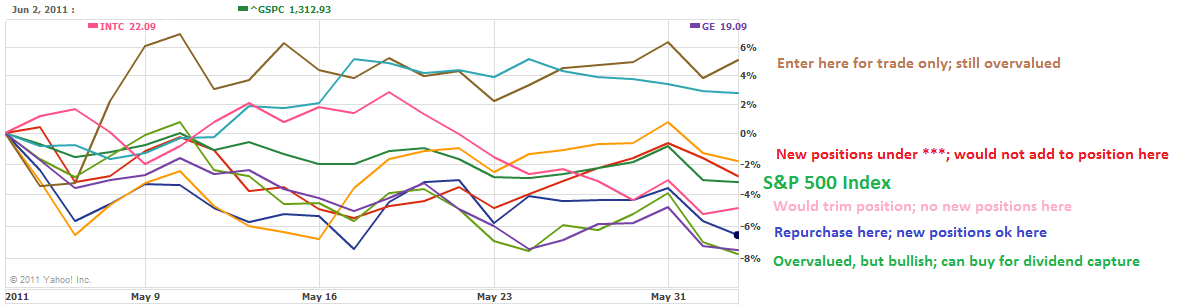

Below are charts representing EVERY security in the Dividend Gems Recommended List so you can see the entire performance, not cherry-picked data.

Dividend Gems maintains a list of 45 securities specifically selected based on optimizing risk-adjusted returms with a focus on cash dividends.

Although the securities in the Dividend Gems Recommended List are actively managed, we expect even a buy and hold strategy to outperform the S&P 500 Index.

To the right you will see color-coded text representing brief notes for each security.

Only notes that gave recommended actions are listed. Also note that these notes were written when the May DG issue was published on May 9th. The performance period was from May 9 to June 2.

- 29 securities in the DG recommended list outperformed the S&P 500 Index.

- 4 securities performed in line with the S&P 500 Index.

- 12 securities underperformed the S&P 500 Index.

Keep in mind that we do not view one or even two months of performance as relevant. However, because Dividend Gems is relatively new, we have published the performance since inception to give readers an idea just how excellent our research is.

Also keep in mind that the Dividend Gems Recommended List focuses on relatively low-risk dividend securities. Yet, the average dividend yield of the Dividend Gems list is about 5.9%, versus 1.75% for the S&P 500 Index.

Also keep in mind that the dividends have not been factor in the returns shown in the following charts.

In addition, you should pay attention to the notes to the right and compare how this more active approach enhanced returns and decreases losses.

Note that the May issue of Dividend Gems was published on May 9th, 2011. It was sent out on the morning of May 10th. Therefore, you should inspect each security from May 9th or 10th to determine ifthe performance is any different than that reported since the time period begins one week earlier.

(click on image for a larger view)

This follows previously reported superior outperformance of Dividend Gems, as shown here.