Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Fannie and Freddie

Now we come to the Fannie/Freddie bailout. This is certainly a true bailout; not because taxpayers are on the hook for potentially $5.3 trillion, but because there was a moral hazard established once these formerly government agencies were transformed into publicly traded companies, knowing that if they screwed up they would be bailed out.

I’m sick and tired of hearing these excuses by Washington that this company and that is “too big to fail.”

Listen you crooks, if they’re too damn big to fail, they need to be government run to begin with.

Now, the auto industry is looking for their bailout, with 50 billion dollars in low-interest “loans” from Washington. They are using the excuse that they need the money to produce more fuel efficient autos.

In other words, they are saying “our business model stinks and our leadership has been horrendous for years, but if you want to help the economy, loan us $50 billion so we can make cars running on less oil.”

What will be the excuse the airlines industry uses for its bailout? In the past 12 months alone, GM has posted $54 billion in losses or nearly $70 per share!

People need to realize that all companies that are “too big to fail,” all companies that provide necessities – must be government run. That includes the Fannie and Freddie, the airlines, energy, and healthcare. Otherwise, in the best of scenarios, these industries will gouge prices.

In the worst of cases, they will act irresponsibly and take excessive risks, knowing that they are “too big to fail” and the government will bail them out. This is just plain common sense.

Why do you think these industries are in such dire shape?

Think about it. And as far as the financial system, it needs real regulation. Washington already learned its lesson with the agricultural industry back in the depression. As a result, this industry is government controlled via subsidies.

Don’t even try to throw in a political stance saying it’s socialist. It’ just makes sense. Push aside your political views and focus on what’s best for the economy.

Just because your chosen political party creates a menu list of issues, that doesn’t mean you should agree with them all. Ultimately, if you are a patriotic American you should focus on doing what’s right for the country, not accepting the agendas of a party at face value. If you do this you will have been brain-washed like so many are today.

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse.

The Jewish Mafia REFUSED to publish this landmark book because it exposed the widespread fraud committed by the Jewish Mafia.

Instead, the Jewish Mafia published useless marketing books written by their broken clock tribemens (like Peter Schiff's useless book which was wrong about most things and was written a year AFTER Stathis' book).

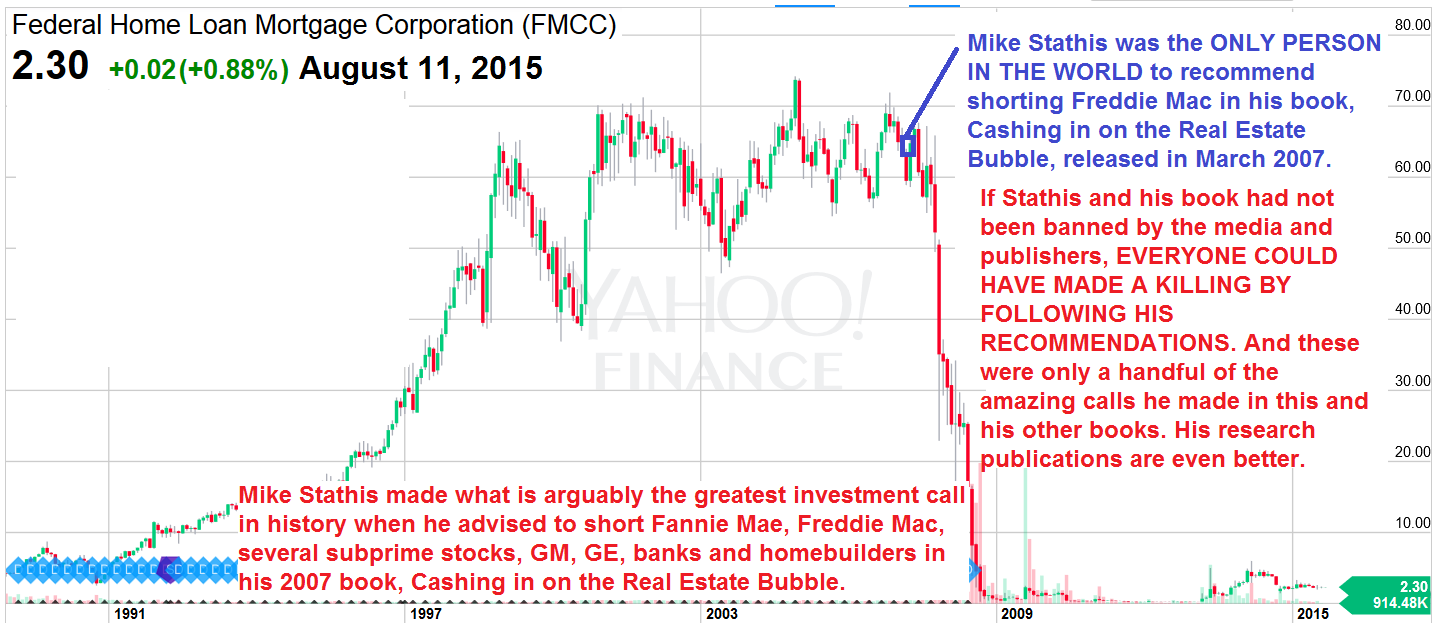

Stathis also released a book focusing on strategies to profit from the real estate collapse in early 2007.

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

So why does the media continue to BAN Stathis?

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

__________________________________________________________________________________________________________________

.jpg)

.png)

.png)

.png)

.png)