Note: We are no longer releasing regular excerpts of Mike's Market Forecasting to the general public. We may release some excerpts to the public in the future if we have time and if we so decide to do so.

Paying Members of the website will have access to some of the market forecasting videos (in full or part) on a delayed basis starting in 2015. From these videos, Members will be able to learn a great deal.

The following article will be amended as needed over the next several days as we add charts and more content. We are releasing it now in rough draft format with the understanding that the final publishing date may not be for a few days.

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

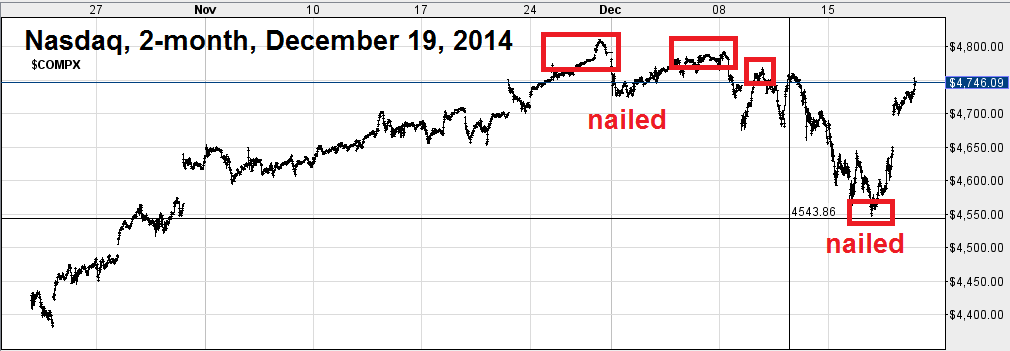

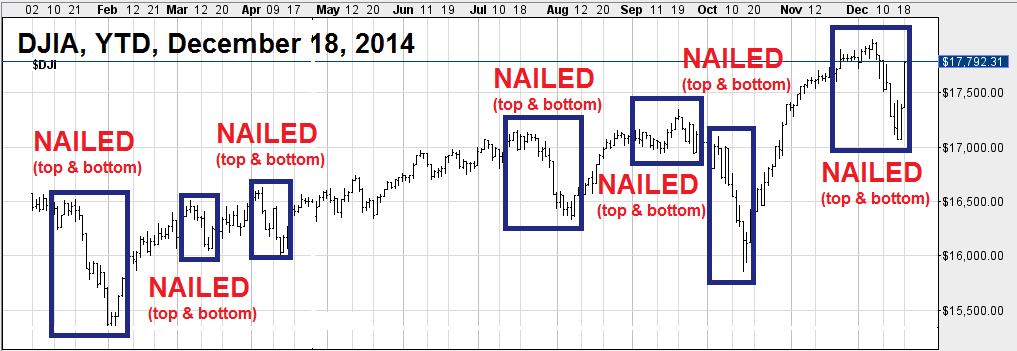

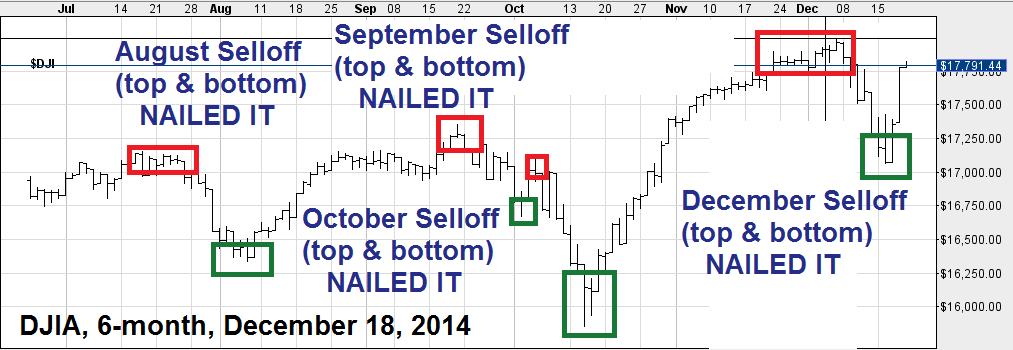

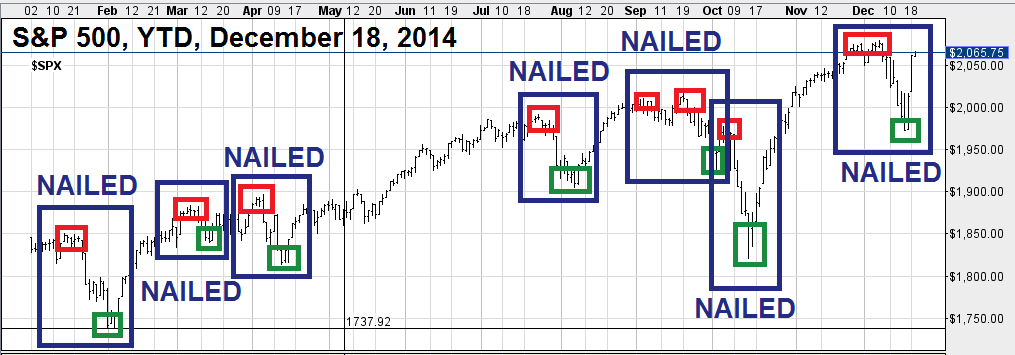

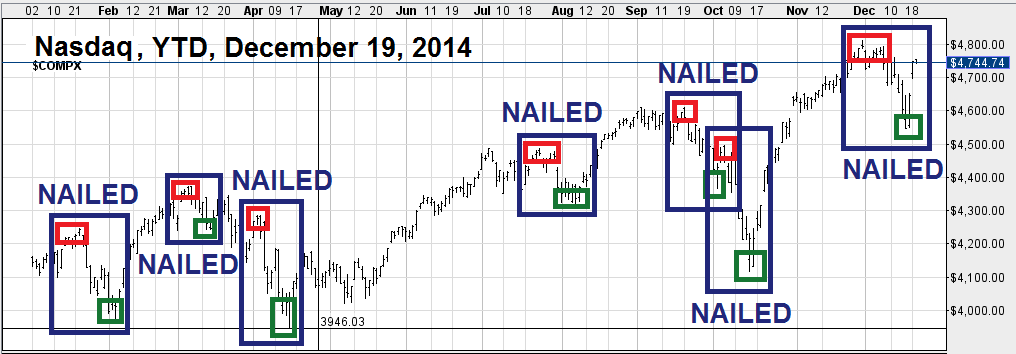

That's right. As unbelievable as it may seem, the fact is that Mike Stathis has once again nailed the US stock market (Dow Jones, S&P 500 and Nasdaq) correction, from top to bottom in December 2014.

That is, he did not just discuss a selloff. He predicted the top (he discussed the 17,800 and 18,000 as probably and possible highs for the year, respectively) AND he predicted the botttom (he gave the Dow 17,200-17,000 the highest probability of a bottom).

He was equally accurate with the S&P 500.

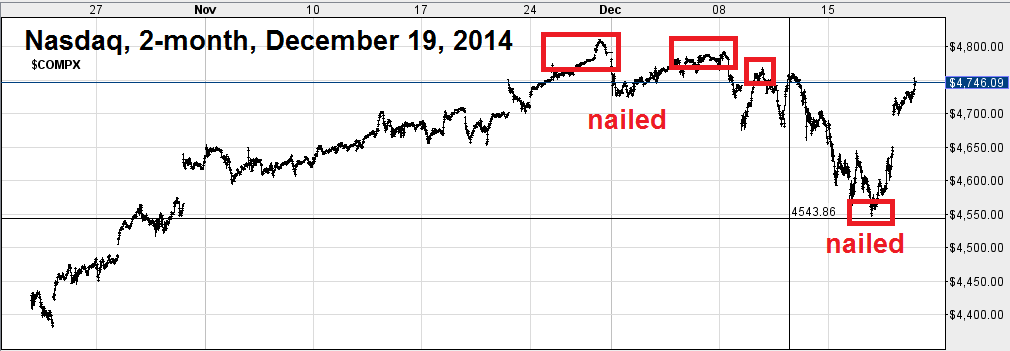

Note: he did not discuss specific levels for the Nasdaq but the bottom is assumed to occur on the same day or 1 day apart from the Dow and S&P.

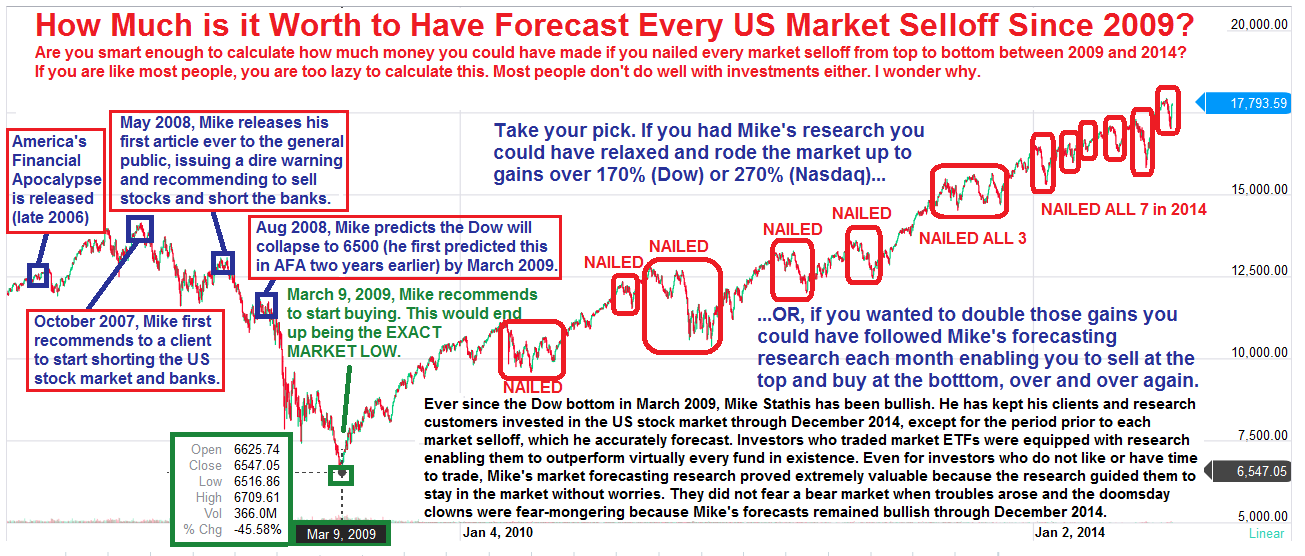

That means he nailed every single market selloff in 2014 - all seven (7) of them. He nailed the smaller three (3) in the first half of the year. And he nailed the larger four (4) selloffs which took place beginning in July.

And he nailed the top AND bottom of each selloff.

That means Mike didn't only tell investors when to sell, he also told them when to buy.

His accuracy is nothing short of amazing.

Let's take a closer look at a few of Mike's forecasts in the first part of 2014

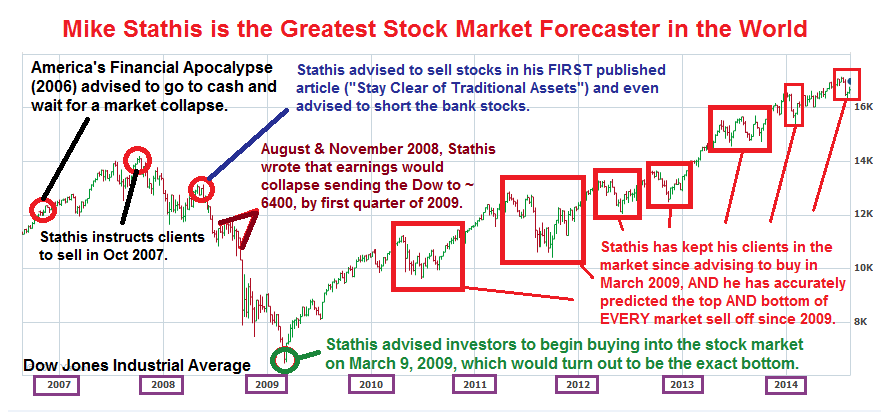

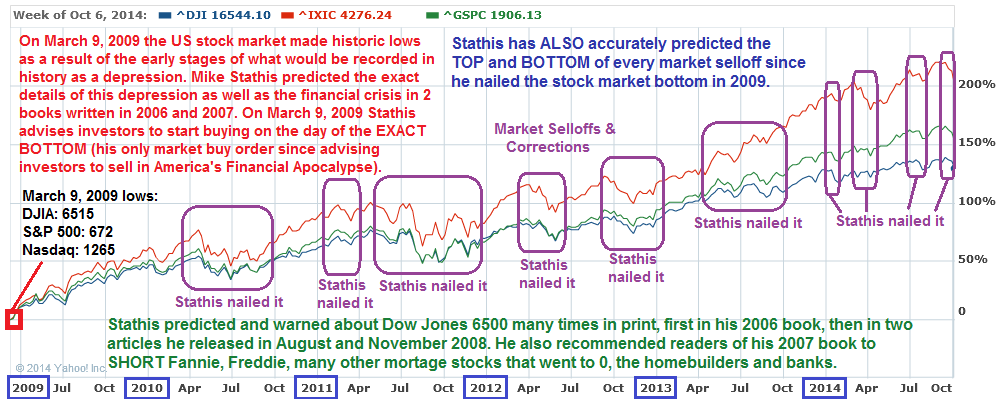

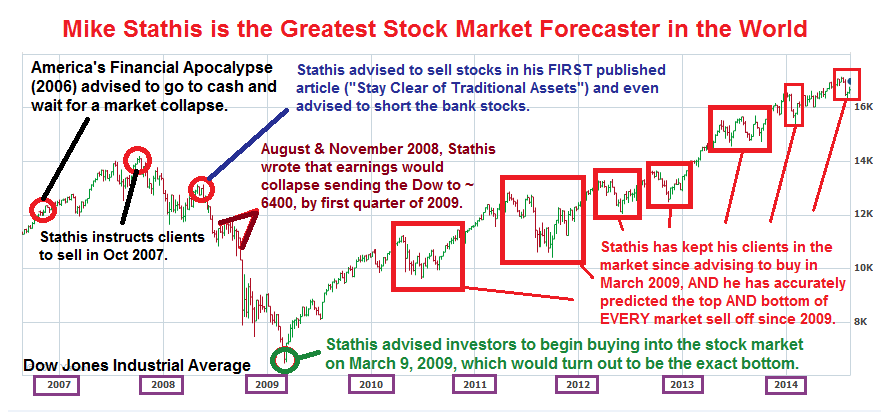

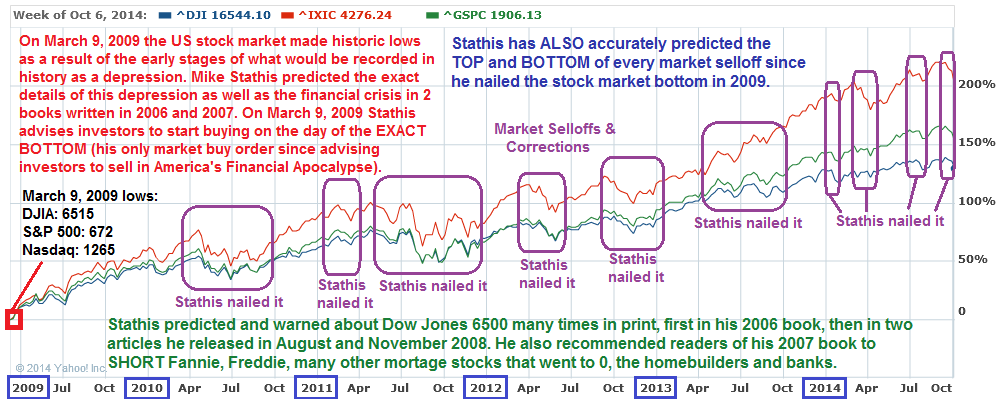

As of December 19, 2014, Mike Stathis, chief investment and trading strategist of AVA Investment Analytics has now nailed every single US stock market selloff ever since he first predicted the Dow Jones to collapse to 6500. He nailed all of the stock market selloffs in 2010, 2011, 2012, 2013 and now 2014.*

Note: the above chart is through early 2014 so it does not show forecasts after spring 2014

.png)

Note: the above chart is through the first few days of 2014 so it does not show forecasts made in 2014

Note: the above chart is through October 2014 so it does not show the two forecasts from November 2014

* Mike first discussed the possibility of the Dow collasping to 6500 in his 2006 landmark book (which was completely banned by all publishers and the media) America's Financial Apocalypse in 2006. Because this 2006 forecast was made two years before the financial crisis, he did not list this 6500 collapse forecast the scenario with the greatest probability. However, by August 2008 Mike released an updated forecast for the Dow which was associated with a collapse to 6500 with very high probability, which Mike expected to materialize by the first quarter of 2009.

I can guarantee you there has NEVER been an individual that has built such an impressive period of consistently accurate forecasts.

And Mike's forecasts in the emerging markets, commodities, currencies and securites are either just as good or damn close.

Those of you who are subscribers to our research are truly experiencing one of the greatest feats in investment history.

Because this most recent market selloff in December began in the early part of the month and botttomed in the middle of the month, it feel in the middle of two monthly market forecasts.

November 2014 Market Forecast Summary

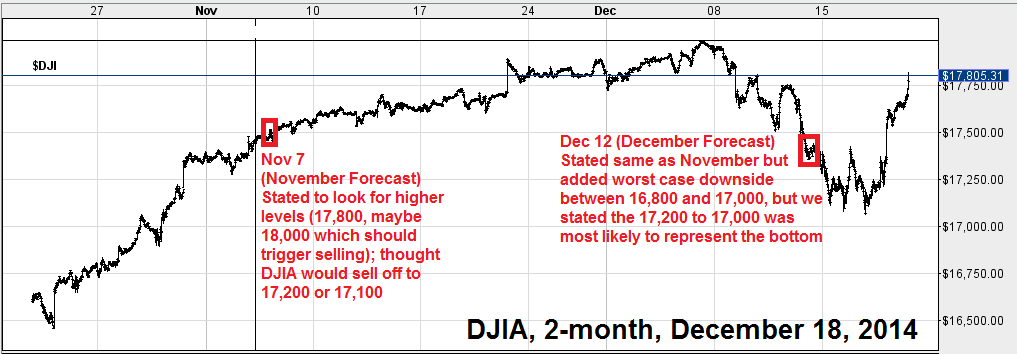

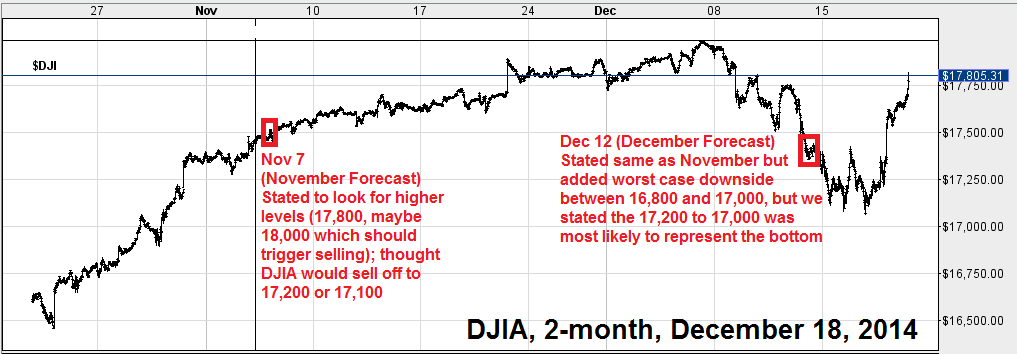

When the November 2014 Market Forecast was made (November 7, 2014) the market had not yet begun to correct.

So let's take a glimpse at what Mike said.

In the November 2014 Market Forecast (November 7, 2014) Mike stated that he felt the markets would encounter what he referred to as a “volatility retracement.” The bottom line is that he thought the Dow would decline to 17,200 to 17,100 before mounting a rally.

He also stated that he thought the S&P 500 would decline to 1950-1970 (probably 1960-1970) prior to mounting a rally.

The bottom in the Nasdaq was assumed to occur when the Dow and S&P reached their bottoms which was assumed to be on the same day or within 1 day.

Mike also stated that he felt the Dow stood a 75% chance of reaching 17,800 before the end of the year and 18,000 was also possible.

He also advised trimming down on positions and the portfolio in general by means of selling into strength. He emphasized that you should be especially selling in the 17,800 was reached and more strongly at the 18,000.

At the time this forecast was made (November 7) the Dow was 17,573 and the S&P 500 was 2031. After the forecast was released, the US market stalled for a few days then rallied nicely, the Dow crossed 17,800 then made an intraday high just shy of 18,000 on December 5, 2014. Then it began to sell off hard.

December 2014 Market Forecast Summary

In the December 2014 Market Forecast (December 12, 2014), Mike confirmed his previous forecast with some minor additions. At the time the forecast was made (December 12) the Dow was 17,280 and the S&P 500 was 2002.

Mike reiterated his November forecast results with a couple of minor adjustments. He now stated that the 16,800 was possible. In general, he said you should view the bottom in terms of the two highest probability regions. The first region was the 17,200 to 17,000. The second region was the 16,800 to 17,000.

Mike concluded that he felt the Dow would bottom at the 17,200 to 17,000 range.

On December 16. The Dow made an intraday low of 17,067 after Russia’s shocking and unprecedented interest rate increase of 800 basis points or an increase in rates by 80%. By December 18, the Dow closed at its high for the day at 17,778.

The S&P 500 bottomed almost exactly where Mike predicted, at 1973, then soared.

In addition to providing some of the world's most accurate and insightful investment research and forecasts, one of the really spectacular things about Mike's forecasting is that he actually focuses on teaching his subscribers how to forecast and other skills that are essential to becoming a great investor.

Mike's market forecasting track record could easily command an annual subscription fee north of $100,000/year for institutional investors and funds.* And full access to our research could easily command north of $200,000 for each institutional investor.

Remember, Mike has not only led the world with his market forecasting track record, he has also established what would have to be the top commodities, currencies and precious metals forecasting track records.

Remember, Mike is the ONLY person in the world who made an irefutable case for the financial crisis, as well as stock market collapse and depression in his 2006 book, America's Financial Apocalypse. He is also the only person who nailed the exact bottom in the US stock market on March 9, 2009.

He was also the first analyst in the world to warn of Europe's long deflationary period in 2010.

He also predicted the collapse in commodties in early 2011, precisely when the collapse began.

He also telegraphed the collapse of Brazil in his research beginning in 2010 and pinpinted the economic issues. He also accurately guided investors to trade the Brazilian market ETF, EWZ all the wway down.

The accuracy of his stock picks, trading guidance and distressed securities analysis is much too lengthy to even begin to present here, but you can gain an idea from previous publications found on the website.

Here is a small start.

Mike Stathis Is THE TOP Investment Mind In The World

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Who Do You Think Nailed the Latest Market Selloff AGAIN?

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Stathis Nails the Gold & Silver Trade Again

We Predicted The Market Selloff Yet Again

We Nailed The Gold Breakout

More Proof Wall Street Research Is Useless

ANOTHER Security From Our Recommended List Gets Bought Out

We Predicted The Market Correction AGAIN

Does AVA Investment Analytics Have Insider Information?

We Pin-Pointed the Past Two Market Tops And Bottoms

Does AVA Investment Analytics Have Insider Information?

4-Day Gains of 30% for 2011 and 2010 Performance

Another Huge Winner in a Few Weeks

Newsletter Stock Recommendation Soars More Than 25% in Just 3 Days

Can a Book Serve as a Crystal Ball?

Since The Market Lows, Only One Man Continues To Shine

Mike Stathis' Near-Perfect Market Forecasting Record

Another Security from the Intelligent Investor Soars

The Case for Market Timing

Mike's Top 3 Stocks for Long-term Growth

Where Is The Stock Market Headed?

Dividend Gems Scores Another Huge Winner

Dividend Gems Scores ANOTHER Huge Payday

We Sold CenturyLink BEFORE It Collapsed

Warren Buffett Follows Our Lead On Heinz

Did You Own The BEST PERFORMING Stock In 2011? WE DID

Dividend Gems Destroys The S&P 500 Index AGAIN

Dividend Gems Holds Up As The Stock Market Collapses

Dividend Gems Continues To Smash The S&P 500 Index

Dividend Gems Outperforms Again

Dividend Gems Shines As The Market Corrects

The Impressive Performance Of Dividend Gems

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19]

Video Presentation Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13]

The links discussing the results of the video presentations above pertain to two video series published in April 2012 – “20 Stocks Over $100” and “60 Stocks Poised for HUGE Moves”

Note: several additional winners from these presentations that have not been included here for lack of time.

In the past, we also gave away some nice freebies as well:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19]

The list of accurate forecasts made by Stathis is virtually endless.

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

September 7 & 12 Forecast (excerpts only)

July 11, 2014 Forecast (excerpts only)

April 2014 Forecast (excerpts only)

January & February 2014 (excerpts only)

June 12, 2013

June 24, 2013 Update

September 12, 2013

December 2013/January 2014 (Excerpts Only)

January through February 2014 (Excerpts Only)

July through August 2014 (Excerpts Only)

For those of you who might think this is a gross exageration, you simply do not know what real research costs. In fact, consider that Merideth Whitnney was charging $100,000 annually for access to her ridiculously useless and innacurate ratings.

Quite simply, this level of market forecasting is absolutely priceless. Professional investors know this, as do investors with real money.

Retail investors would normally never get access to this type of world-leading expertise, but an annual subscription rate of $15,000 would be considered a bargain.

By the way, subscription rates going way up for 2015, so we suggest you grab the current low rates while they last.

We have been giving retail investors all kinds of chances to gain access to one of the world's top investment minds for years now.

Each year prices will go up, making our research out of reach for some. All we can say is subscribe now because rates will only keep increasing.

Of course, if Stathis were not banned by the media, you'd get to hear his forecasts for free. Instead the media continues to provide broken clock losers with daily airtime.

NOTE: We ONLY Want to sell subscriptions to our research to truly DEDICATED investors who intend to be subscribers for several years, as opposed to impulsive investors looking to make a quick buck. Our research is extremelyy educational in addition to having a very accurate historical performance. The only way you are going to get ahead and stay ahead of the curve is by becoming a very advanced investor and you cannot achieve that in one, two or even three years, not even with Mike's assistance.

Can afford our research? Are you sure about that? Read this.

Maybe you prefer to spend your money on things like cable TV and other useless things. It's all about priorities folks.

Don't ya think it's about time ya started asking the media clowns why they keep airing guys who serve as great contrarian indicators while banning the man who holds the leading investment forecasting track record in the world since 2006?

Mike Stathis' Track Record

Newsletter Track Record

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Mike Also predicted the collapse of several stocks.

Here are just a few you may remember.

.png)

.png)

.png)

Below Mike has released Chapter 12 of his own 2007 book showing that he was the only one to not only have predicted the financial crisis, but also showed specific ways to land huge profits.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

View Mike Stathis' Track Record here, here, here and here.

Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)