Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Moron of the Month: Martin Armstrong

In the audio below, Mike tells it like it is in his typical animated, unrehearsed way (warning: if you do not like cursing, please do not listen to this audio).

The full version of this article (including the audio commentary) is available only to active Members and Clients.

For some strange reason, over the past couple of years we have received quite a few emails by individuals asking us Mike’s opinion on Martin Armstrong.

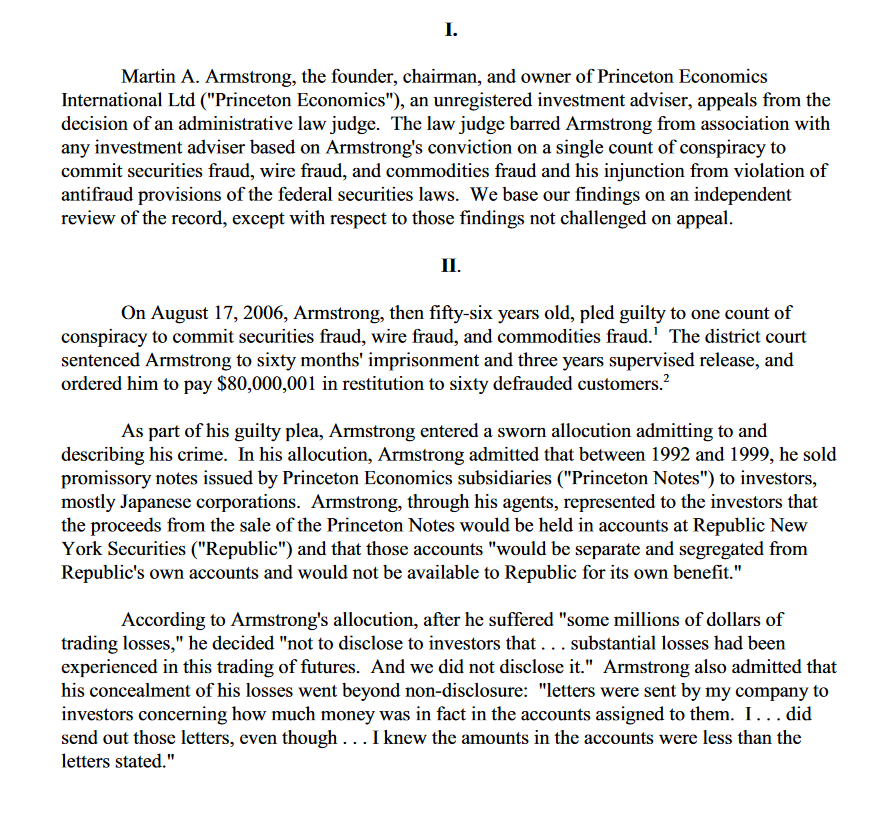

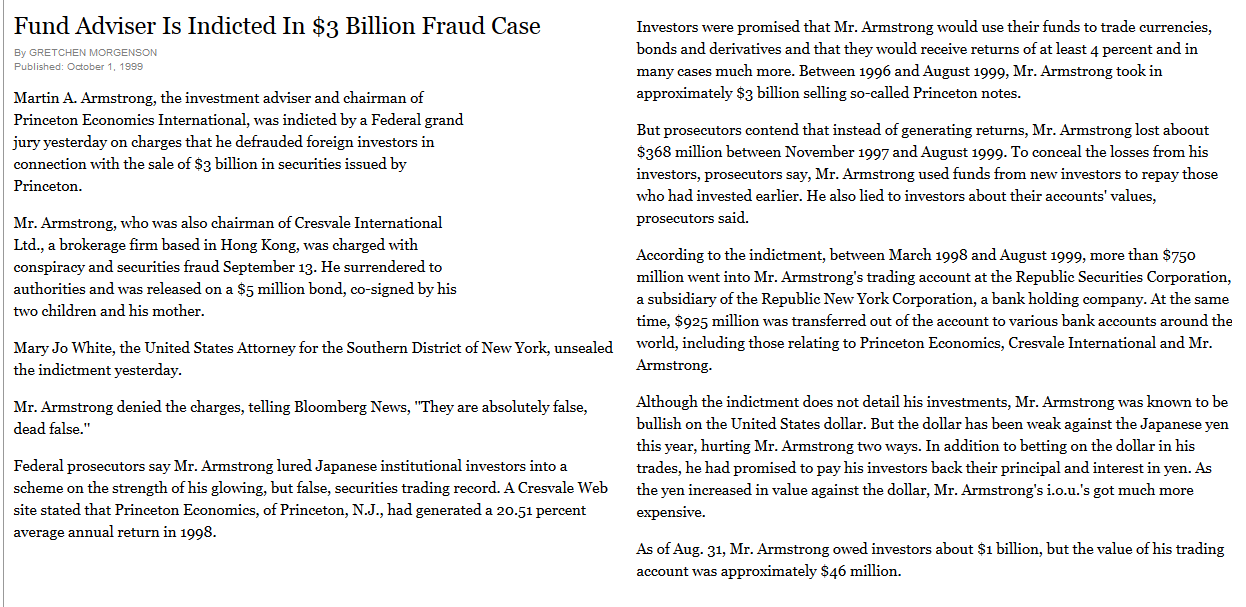

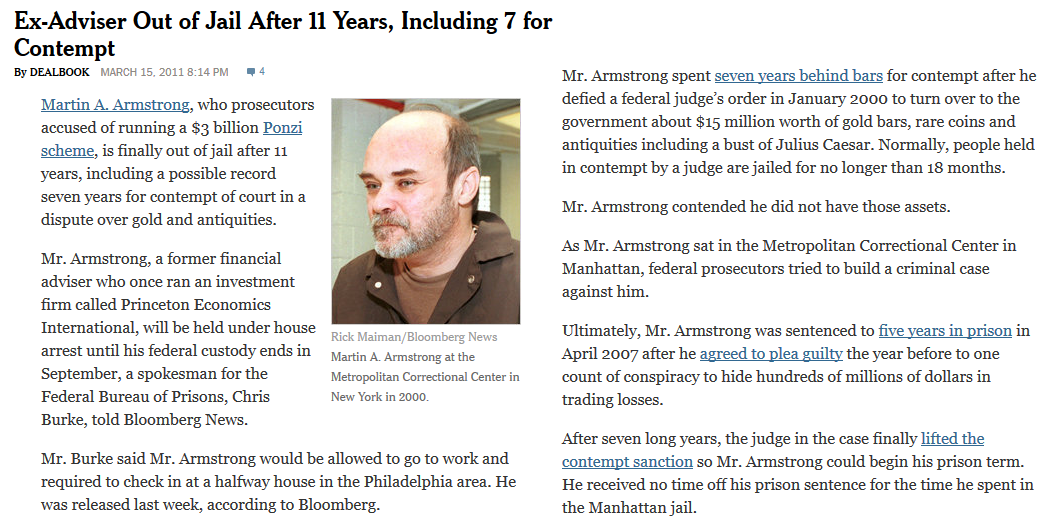

Before we begin, you might want to check on the case by the SEC against Mr Armstrong.

Anyone who even has to ask us about Armstrong has NO idea about Mike’s track record, much less Armstrong's. We highly doubt they've even read a single one of Mike's highly informative and very educational books, which most likely accounts for the reason why they continue to remain lost in the woods.

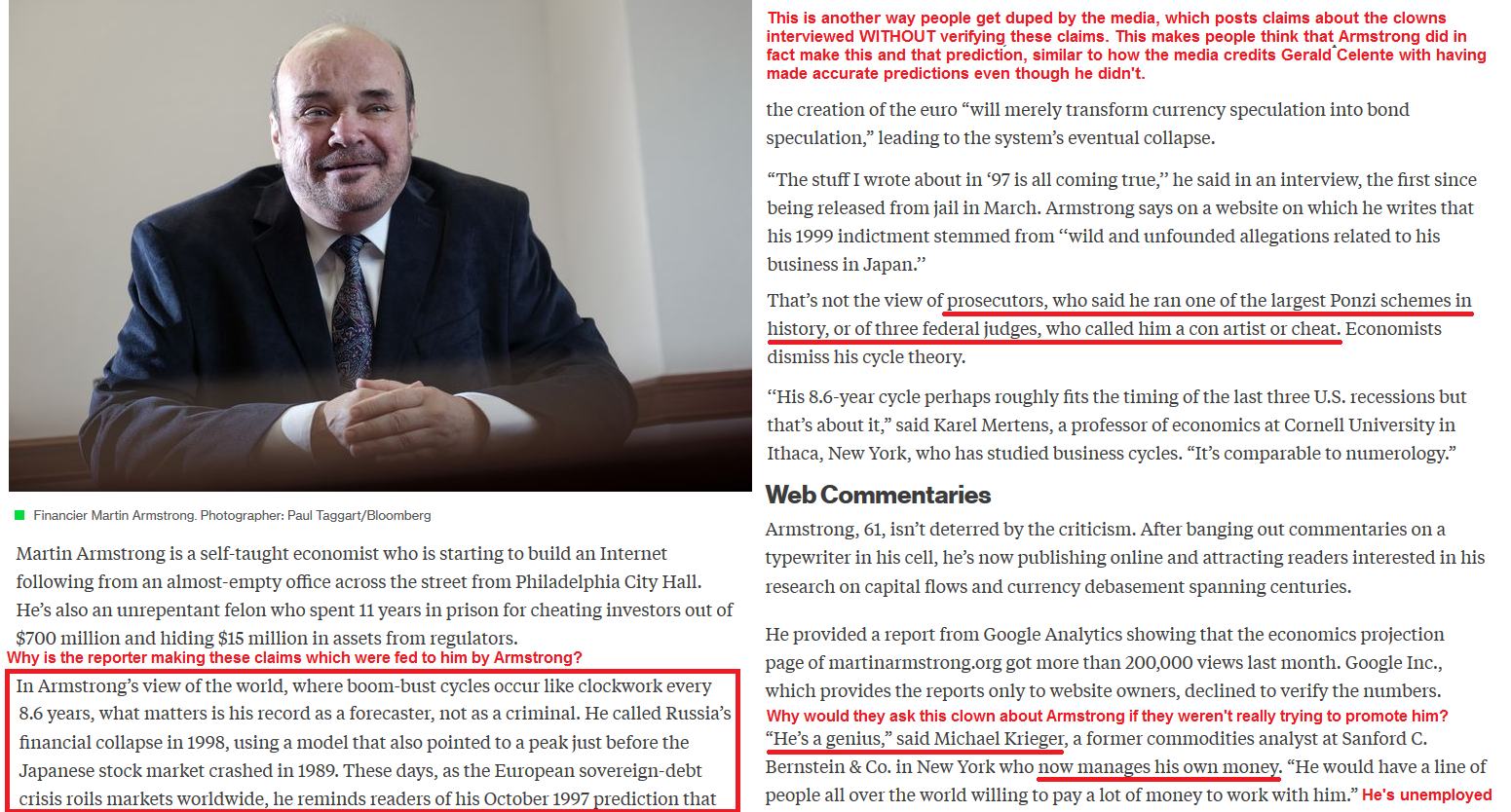

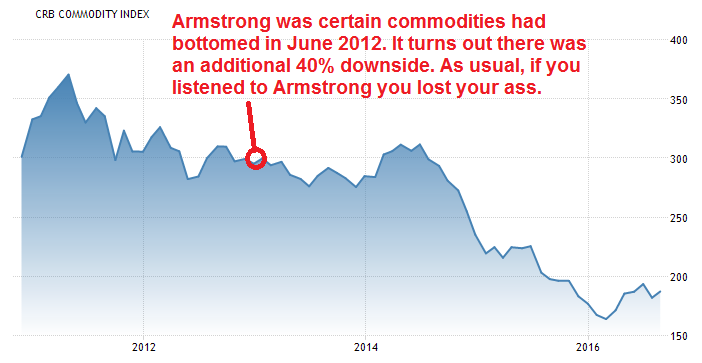

If such individuals were familiar with Armstrong's ridiculous track record (if one can even consider it a track record) securities fraud, terrible commodities trading performance and apparent lack of understanding of the capital markets, much less valuation, equities or much else having to do with investments, they would realize that Armstrong is a complete joke.

So why do these individuals waste our time?

These are the same people who are likely to never get far with their investments because they have the wrong mindset. They are looking for quick answers from others rather than taking the time and spending the effort to do the hard research for themselves. Quite simply, they are lazy and naive. And they are typically the kinds of people targeted by con men and cult leaders.

There are however, some who actually attempt to research these things but have no idea how to conduct basic research because their minds were never developed adequately. Unfortunately, these individuals also often fall prey to con men and cult leaders.

For those who continue to remain clueless, I’d like to offer you an easy method to determine whether a source is credible and can be trusted. All you have to do is follow Mike’s three golden rules:

1. 1. A man is judged by the company he keeps.

Check who the person is being interviewed by and hanging around if you want to see what this person is all about.

2. Con artists always hang in syndicates.

This is similar to the first rule except this rule emphasizes the "strength in numbers" approach used by con men whereby they pat each other on the back, attend the same conferences and create fake media in order to keep their cult members from deviating to other sources that might alert them to the fact that they're being scammed.

3. Everyone in the media has been bought off.

They are NOT concerned with your best interests. They are only concerned with lining their pockets. In order to extract the most money possible from their media exposure, these shills tell the media what they want to hear - drama, nonsense, lies and myths - all in order to create fear and greed with the audience, all of which raises the amount of money the media can demand from it's advertisers because it will lead to more business for them.

Consideration of these three rules alone should suffice when forming conclusions about Martin Armstrong.

But in case you have no problem with a man who only has experience trading commodities (which is considered gambling and has nothing with do with the skill sets required to understand equities and bonds), especially when he proved he was unable to even trade commodities without losing his ass...

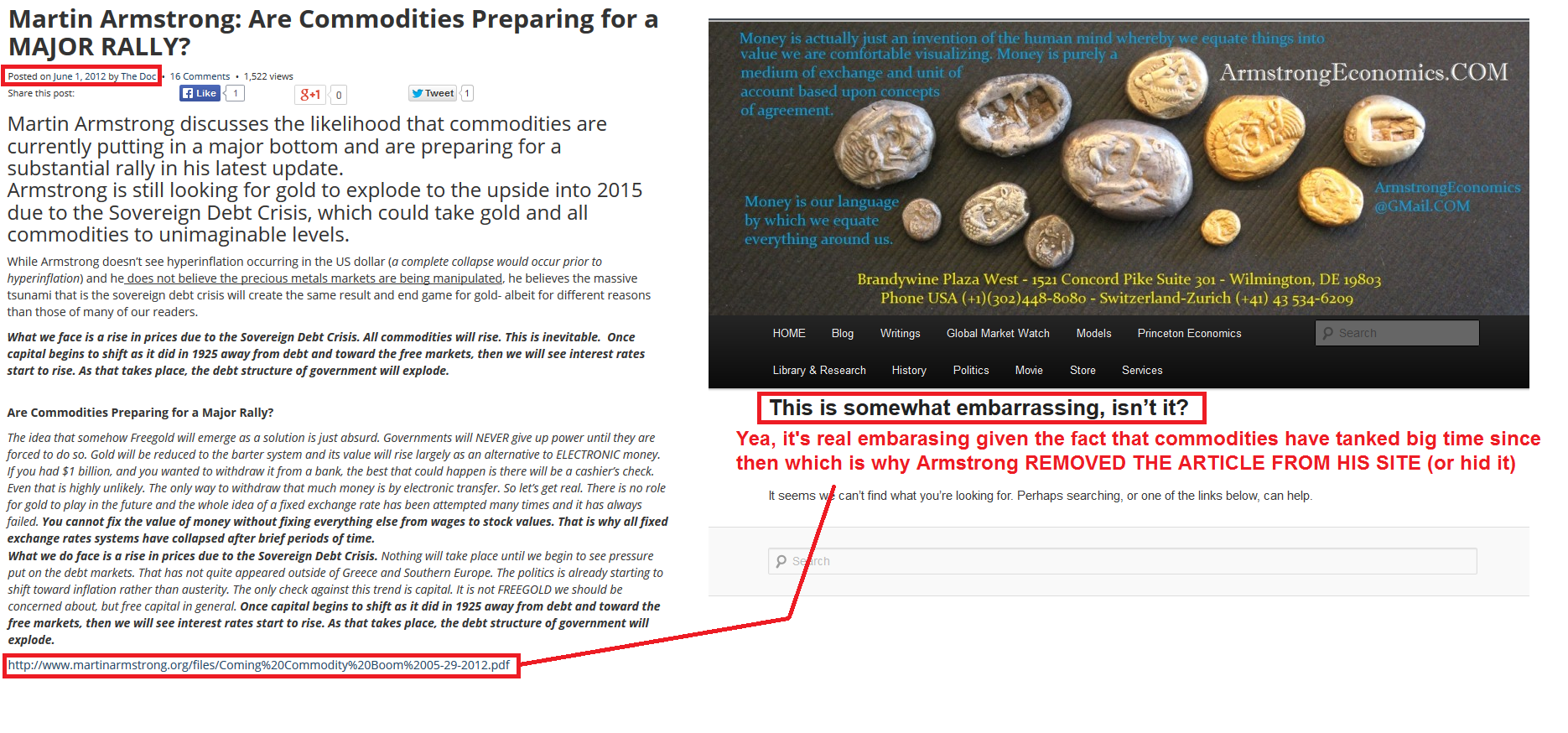

...And in case you have no problem with a man who defrauded investors, maybe you’ll take note that this man was previously very closely associated with the gold pumping crowd and was calling for hyperinflation before he decided that the Peter Schiff broken clock strategy would only make him look more foolish than even Schiff, understand that Martin Armstrong tried desperately to compensate for his cluelessness by flip flopping from doom to boom.

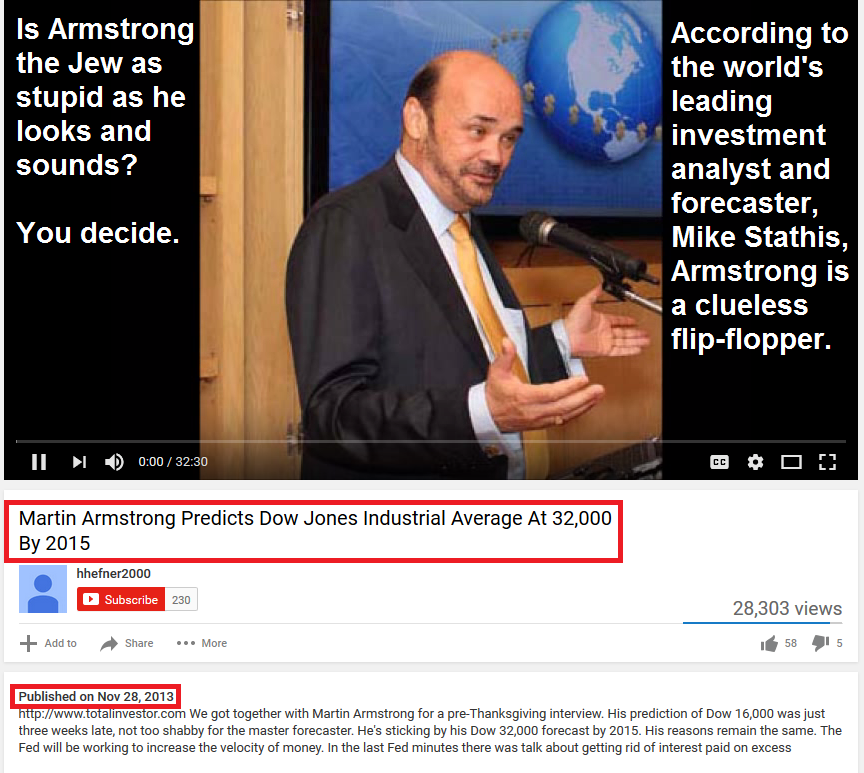

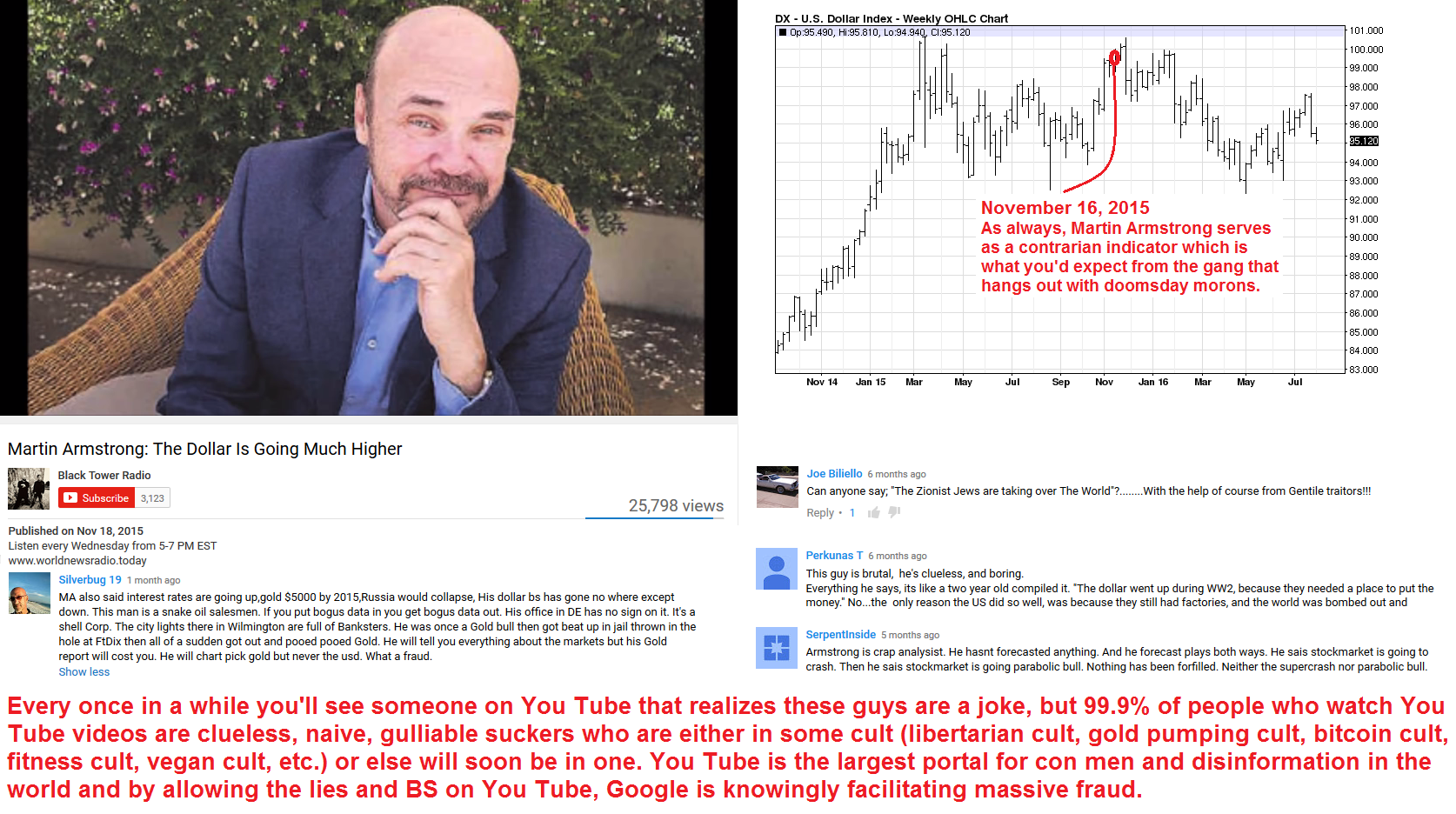

In fact, in late 2013 Martin Armstrong claimed the Dow Jones Industrial Average would top 32,000 by November 2015.

It is quite clear to me that Martin Armstrong has absolutely no idea about macroeconomics, asset valuation methodology, the capital markets, or much of anything else, other than perhaps creating a cult following from an audience of idiots.

I suppose when you didn’t get past high school, dropping complex terminology around and liking it to your “approach” will fool pinheads. As it turns out, the vast majority of gold bugs are in fact uneducated pinheads.

You see, what he’s trying to do here is to create some credibility by jumping on board of the bull market in stocks after finally realizing that the doomsday nonsense is done. And because Armstrong is so far off from having any credibility, he figures he needs to bet big if he expects to win big.

And winning big is exactly what he needs to get some credibility.

As a result, Armstrong came out with the most ridiculous bullish “forecast” I’ve ever seen; Dow Jones Industrial Average of 32,000 by late 2015. This “forecast” was announced in late 2013.

Let me be crystal clear about this...no competent investor pays any attention to Armstrong. If someone claims they do, I can assure you they are incompetent. The end.

.png)

Oh yea and I guess I missed that sovereign debt crisis which was supposed to send gold and commodities soaring. Notice how Armstrong tries to flip flop out of his previous hyperinflation nonsense.

The full version of this article (including the audio commentary) is available only to active Members and Clients.