Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Dividend Gems Scores ANOTHER Huge Payday

How would you like to be on the receiving end of stocks that get bought out?

That's exactly what we have provided to subscribers of Dividend Gems every year since the first full year of publication (publication began in 2011 but the first full year was 2012).

Some of you might recall one of our previous home runs. In early 2013, Warren Buffett's Berkshire Hathaway announced a buyout of Heinz (HNZ).

Heinz had been on the Dividend Gems recommended list ever since we launched this publication in early 2011.

Warren Buffett Follows Our Lead On Heinz

Once again, subscribers to Dividend Gems were handed a big payout.

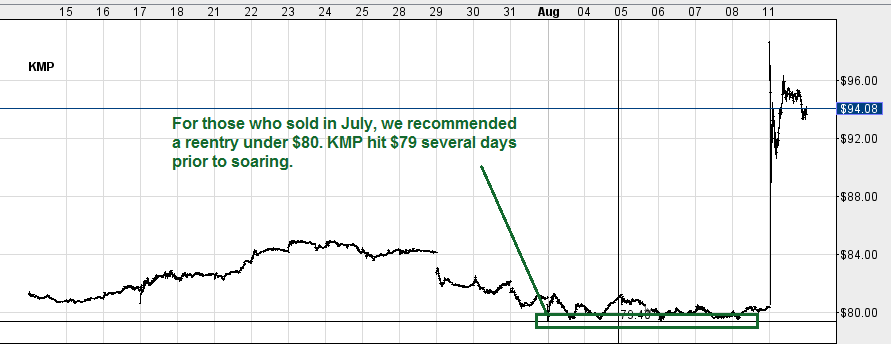

On August 11, 2014, Kinder Morgan announced a restructuring in which it would combine all of its publically traded assets (KMP, KMR, EPB and KMI) under one roof valued at $70 billion and trade under the symbol KMI (Kinder Morgan).

For shareholders this amounts to a buyout. As a result, shares of KMP (Kinder Morgan Energy), KMR (Kinder Morgan Management), KMI (Kinder Morgan) and EPB (El Paso Pipeline) soared.

KMP has been on Dividend Gems recommended Securities list ever since we released this publication in early 2011.

But similar to all securities on the list, we did not just tell investors to buy this stock; we provide monthly guidance, pointing to potential selloffs, rallies or collapses. We do this because investors must active manage their securities positions in order to minimize risk, maximize liquidity and maximize the total return.

Accordingly, we provided monthly management guidance for KMP ever since we added it to the Dividend Gems Recommended List, resulting in huge cumulative gains.

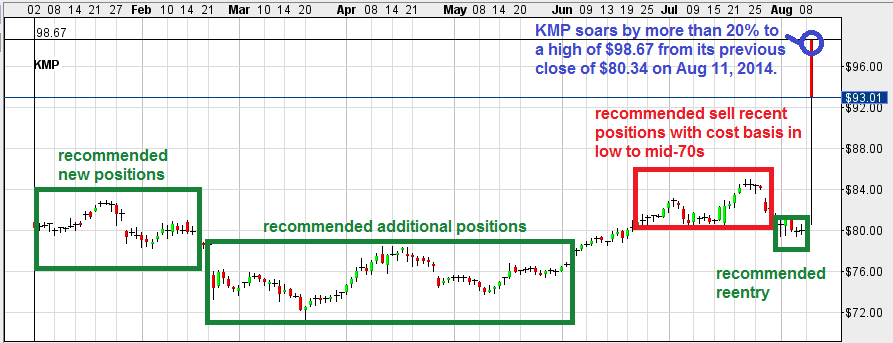

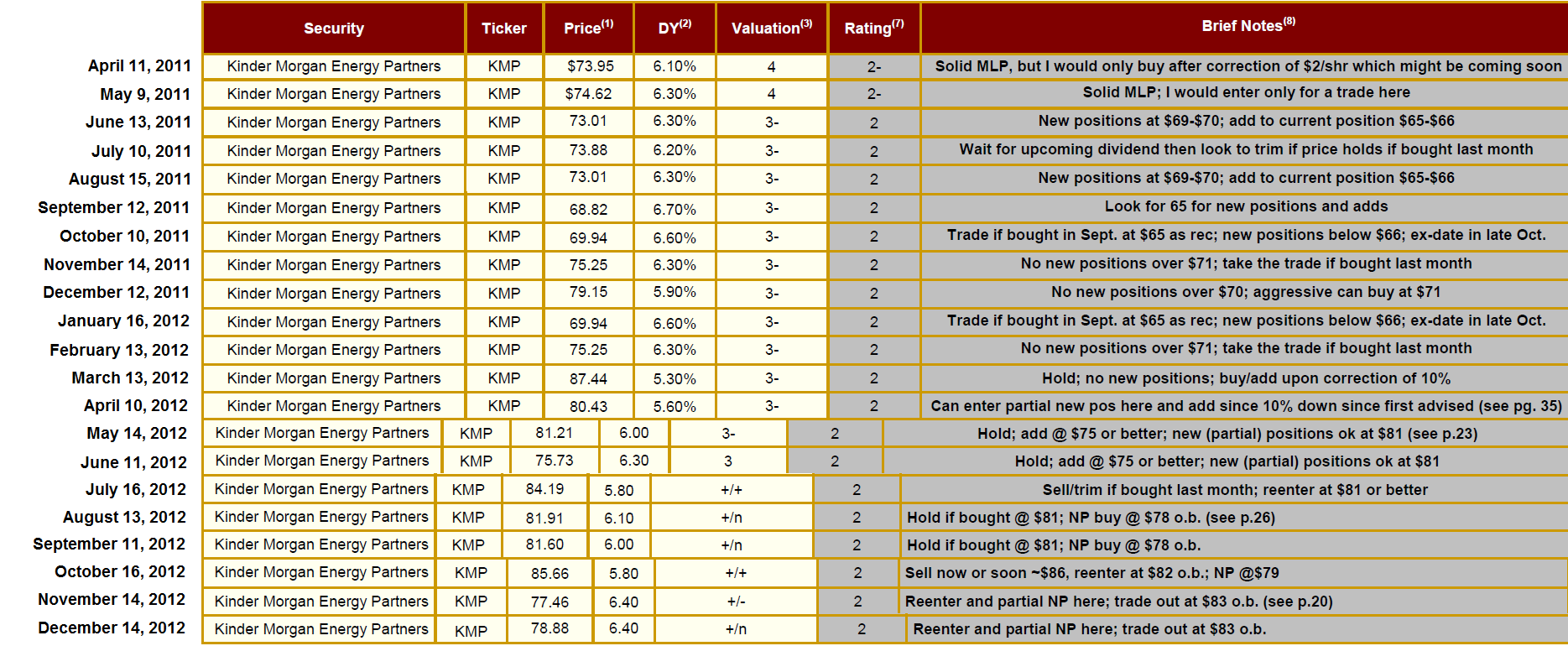

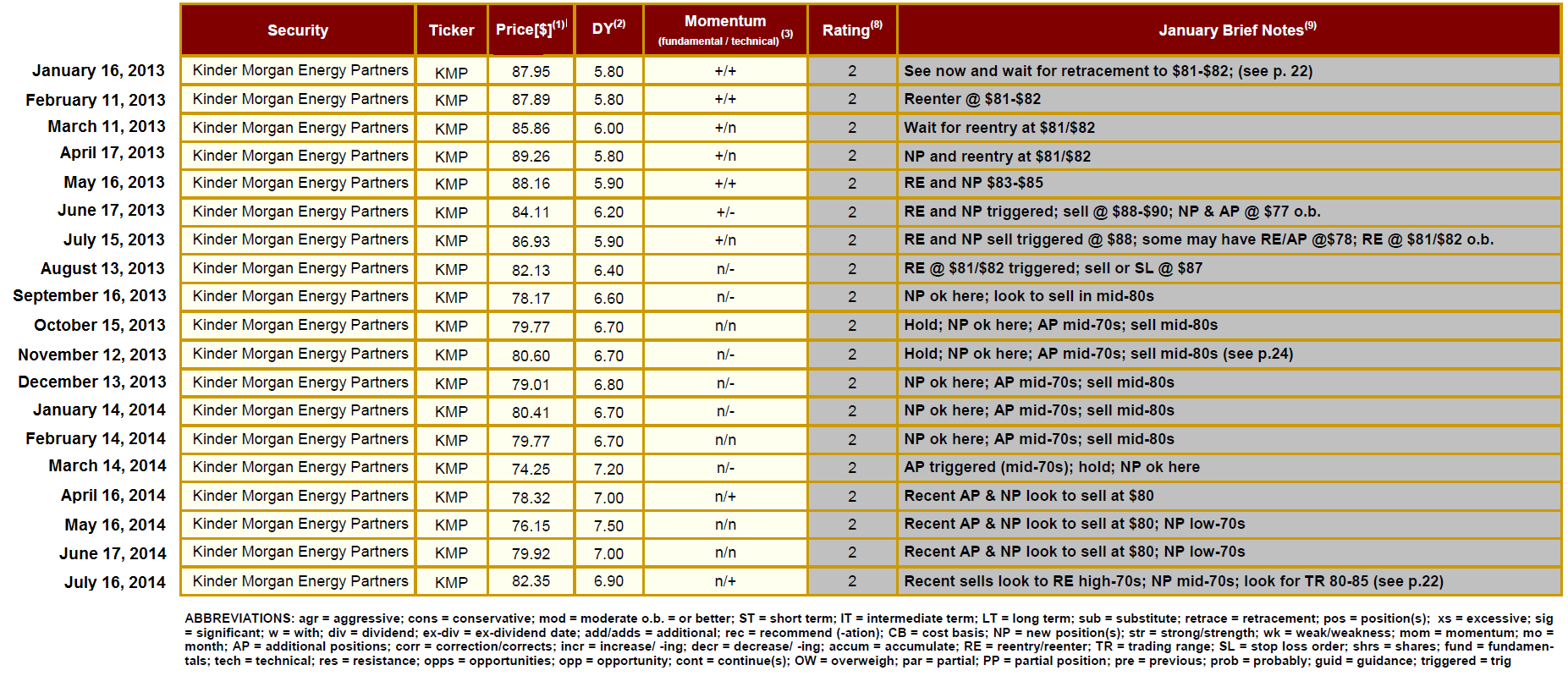

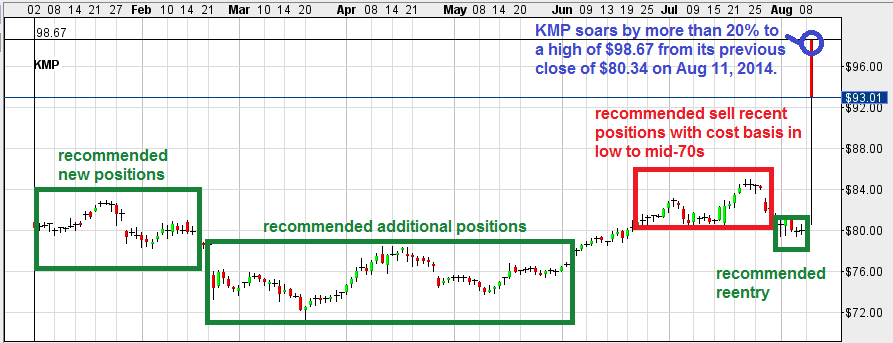

The charts below represent a brief summary of previous trading calls followed by the Brief Notes for each month.

The tables below show the Brief Notes from every month since KMP has been on the Dividend Gems Recommended List.

If you really want to get an idea how much subscribers could have gained by following the trading guidance in the Brief Notes (as well as the more detailed analysis which is indicated when a page number is mentioned), you should carefully study the price chart for KMP over this time period.

I am confident that you will not be able to find anyone else in the world who is capable of providing this level of precision, other than Mike Stathis, especially in a monthly publication.

Need I say more? If so, then you just don't know his track record.