Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Gold Propaganda from Raymond Dalio

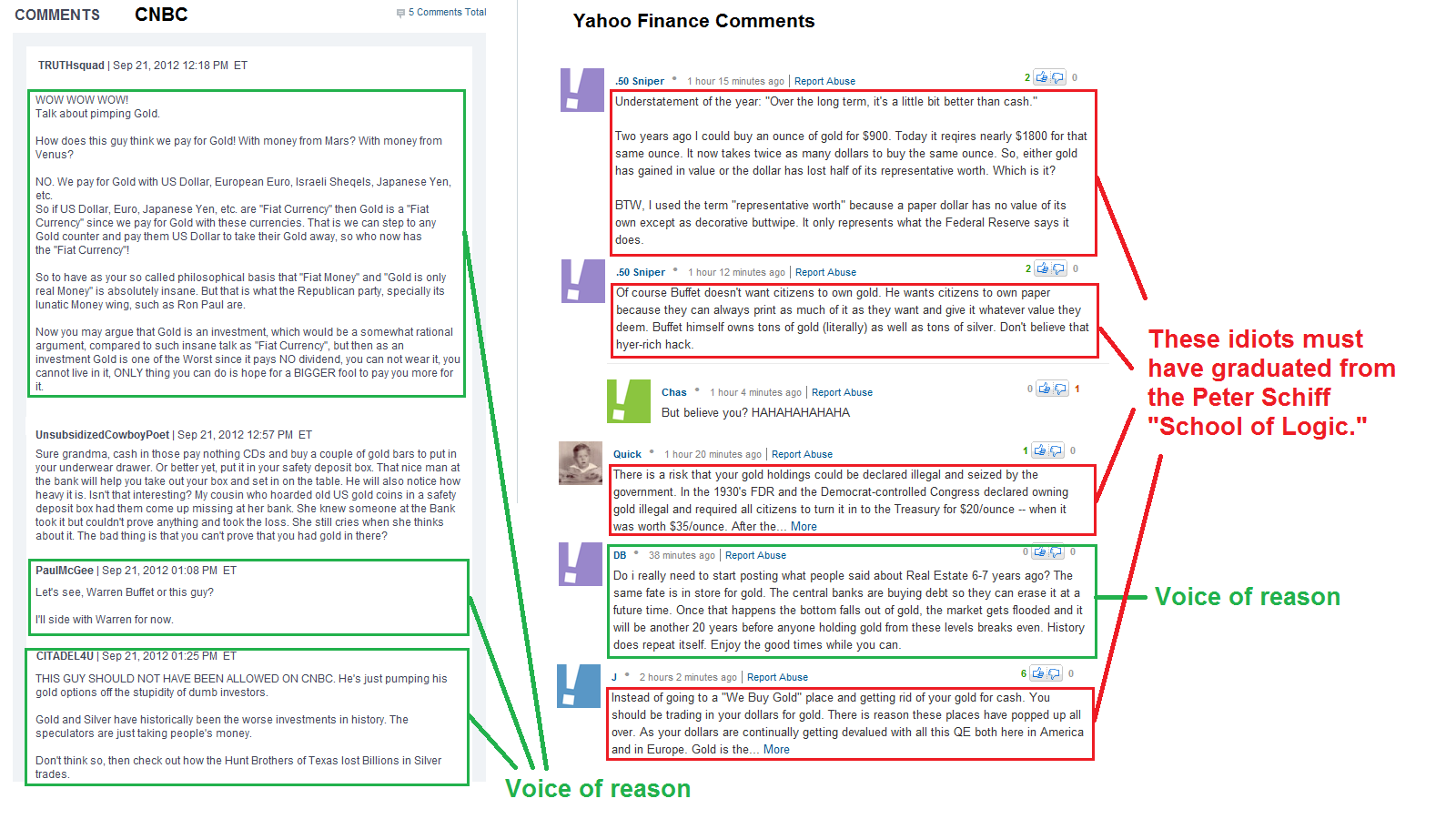

The other day I was alerted to article by a colleague who knew I wouldn’t be able to resist pointing another example of the type of inaccurate and reckless content spewed from CNBC on a daily basis.

I have documented the motives and tactics used by CNBC to dup its sheep audience on several occasions. Here is a partial list of articles discussing this criminal network run by the Jewish Mafia. [1][2][3][4][5][6][7][8][9][10][11][12][13][14] [15][16]

Remember, CNBC makes its money by selling advertisements. The vast majority of advertisers on CNBC represent the financial industry and publicly traded corporations, so you can imagine whose agendas are served by this criminal network.

When a stock or asset class is on the move, the various pinheads and their subordinates at CNBC make sure to ride the momentum wave. But this approach always leaves the suckers who tune into this trash BEHIND rather than IN FRONT of the curve.

This “Monday morning quarterbacking” serves only to generate advertisement revenues for CNBC. For investors, this most often leads to losses. But people keep watching this trash, which keeps the rating high, so they carry on with this approach since so-called “ratings” determine advertising revenues. Of course the entire media ratings industry represents yet another scam designed by the Jewish Mafia to make people think that high “ratings” equate to quality programming.

When gold was headed down last year, CNBC began adding some pessimistic segments. But they did not completely abandon their bullish propaganda campaign because they make a lot of money selling gold ads. And gold dealers would have pulled their ads if they stopped pumping gold.

As pointed out recently, we predicted the gold breakout in the Intelligent Investor.

Now that gold has broken out of a fairly important price resistance, CNBC is at it again, jumping on the momentum.

Apparently, today, CNBC interviewed a “famed hedge fund guru.”

For all who don’t know this by now, anytime you hear someone mentioned as a guru or any other generic designation, you need to run like hell because that term should set off your snake oil salesmen alert. In this case, CNBC actually interviewed a legitimate, although not especially sharp hedge fund manager.

Take a look at the article.

As level-headed investors might imagine, it would appear that based on his statements, Dalio appears to be either a moron or a gold pumper. I certainly don’t think he’s a moron.

Before I get into the details of Dalio’s statements, the underlying question you should be asking is, why in the hell would a real hedge fund manager waste his time with CNBC tools?

It’s called pimping your investment positions. Like others in the financial industry, Dalio knows that millions if lemmings watch CNBC with the false impression that it provides accurate information and analysis. This is by no means the case.

Let’s take a look at some key statements made by Dalio.

During the interview, Dalio states that “gold should be owned by everyone.” He wasn’t just referring to now. Dalio meant gold should be owned by everyone at ALL times throughout their investment life span.

I’m not quite sure how to put into words just how irresponsible that statement is. I cannot think of any investment that a responsible individual could recommend that everyone should own. Dalio’s statement is clearly sensationalism.

Next, Dalio stated that gold is "a little bit better than cash."

I’d say it’s fair to assume Dalio was referring to the performance of gold versus cash over time. In other words, gold only slightly outperforms cash. I’ll come back to this shortly.

Dalio then states that Gold is the “alternative money.”

This is an absolutely ridiculous statement, at least for those who use a currency that is linked to commodities, i.e. those who use U.S. dollars, and especially those living in the United States.

Although Dalio correctly states that gold does have utility in portfolio diversification, this is certainly no revelation. It’s basic knowledge. I have discussed gold’s value in diversification in the past.

If you do not know how and why gold is used for portfolio diversification, you should review these articles.

Understanding the Proper Use of Gold and Silver

The bottom line is that Dalio makes generic statements without revealing the full picture. And when someone doesn’t reveal the full picture, it is either because they are a moron, or they are trying to mislead people. Sometimes you will even come across morons who try to mislead people.

So what is it that Dalio fails to mention?

First, when stating that gold is "a little bit better than cash," Dalio fails to specifically mention the fact that gold underperforms inflation over the long run. I’m confident Dalio is well aware of this fact. He even indirectly hints at this with his acknowledgement that gold is only “a bit better than cash.” He did not say that it performs in line with or outperforms inflation. It simply outperforms cash.

This leads me to conclude that he is trying to lure unsuspecting investors into the metal.

Second, Dalio fails to distinguish between the U.S. dollar’s linkage to commodities, versus currencies in distressed or destabilized nations points to some serious deficiencies in this logic.

I have discussed this key point ad nauseam.

Global Economic Analysis Summary June 2012 (Part 3)

Third, Dalio’s statement that gold serves as a diversification tool assumes that the audience watching CNBC consists only of fund managers.

.jpg)

Let me explain. As detailed in the Wall Street Investment Bible, for a variety of reasons, the vast majority of fund managers are not able to utilize market timing. This is especially true for mutual funds, pensions, endowments and hedge funds that are so large that they really resemble mutual funds.

I actually discussed this in some previous articles. [1] [2]

In other words, for most professionally managed funds, portfolio diversification is critical.

In contrast, portfolio diversification becomes less relevant for individual investors, and decreases in importance as the activity level of the investor increases.

In fact, diversification typically does not help prevent losses during a market collapse. The best tool to prevent losses during a market collapse is market timing, which is achieved through market forecasting. Thus, although Dalio is correct regarding the utility of gold as an asset of portfolio diversification, he fails to qualify the significance of this because he does not distinguish between the types of investors who typically use diversification as their primary asset management tool, verses individual investors and small to medium hedge funds, which have the potential to utilize market timing as their primary diversification tool.

Fourth, cash is a LIQUID investment because it is a currency. Gold is NOT considered a liquid investment according to securities laws. Thus, if an investor seeks to exchange liquid assets for illiquid ones, the expected return premium of gold must be high enough to justify the swap, otherwise it is a foolish move.

How much of a premium is needed in order to justify a swap of cash for gold?

That all depends on the investor.

However, one thing is for certain. If an illiquid asset does not outperform inflation over the long run, it makes no sense to buy it.

Right from the beginning, Dalio should have stated his fund’s gold holdings. In fact, if CNBC decided to abide by the most basic level of responsibility, it would have mentioned his gold holdings. I could argue that Dalio violated front running laws by failing to provide proper disclosure. This is nothing new, as CNBC facilitates front running by mutual funds, hedge funds and Wall Street firms on a daily basis.

Of course if the SEC went after everyone in the media who engaged in front running, they would file thousands of cases each week. Hell, they don’t even go after the most obvious, widespread cases of securities fraud.

I have mentioned the fact that gold is not considered a liquid asset on numerous occasions, only to see several unsophisticated gold bugs make claims to the contrary. This merely points to the ignorance of these individuals.

You don’t even need to consider my track record when trying to determine my statement about the illiquid nature of gold. The fact that they would question someone who has worked in the securities industry; someone who holds no bias for gold and makes no money selling gold ads or selling gold; someone who does not sell securities; someone who knows what a liquid asset is and isn’t; someone who understands the definition of liquidity…that points to just how delusional and brainwashed these gold bugs really are.

As many are aware, I have been quite successful in making accurate forecasts in gold prices, even though such forecasting is very limited and not that credible for a variety of reasons, which I have discussed in previous publications.

Finally, notice how the article makes mention of hyperinflation even though Dalio never mentions this possibility. I have addressed the impossibility of hyperinflation in the U.S. countless times. Here are a few reminders.

Why Hyperinflation Isn't Coming to the U.S.

Understanding the Proper Use of Gold and Silver

Dismantling John Williams' Hyperinflation Predictions

Golden Dreams & Delusions: (PART 7)

Kitco Senior Gold Analyst Agrees with My Views on Gold

If Dalio had mentioned the possibility of hyperinflation in the U.S., I would have to conclude that he delusional. But for now, I’ll stick with my view that he is merely trying to lure Mom and Pop into gold, so it will boost his fund’s performance.