Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

World's Leading Precious Metals Analyst Reveals How the Sheep Are Being Conned by Gold Pumpers

For more than ten years I have been exposing the lies and disinformation that has been pushed by the precious metals charlatan syndicate. I have published hundreds of articles, audios and videos addressing this topic. There is no one else in the world who has exposed this huge gang of filthy con artists.

Take a look at the entries when you search for "gold" on the website. You'll see over 500 in total.

Folks, if your sources of information aren't exposing the deceit, and if they aren't naming names, you can be assured that they too are part of the network of scam artists.

Make no mistake about. Not a single one of the members of the precious metals, fear-mongering syndicate has an ounce of credibility. And they're all con artists. No exceptions. Take it to the bank.

When the various clowns promoted by the kosher media as "experts" aren't steering the sheep into the gutter, they're usually making unverified claims in order to create fictitious track records. Yet no one other than myself ever seems to call these claims into question.

For instance, after a security has already soared these "experts" will appear on one of the criminal kosher media networks and tell everyone how they own it so as to convince the viewers of their "market prowess." You'll see this scam being played out on CNBC, Bloomberg, FOX Business and so on.

They'll also be featured in one or more of the various financial media publications making the same bogus claims. And the reporters who write the story go along with it. You'll see it on a daily basis in scam publications like MarketWatch, Barron's, Wall Street Journal, Forbes, Fortune, etc.

Is it just a coincidence that they never bothered to tell you they owned the stock before it soared and only tell you now after the pop in price?

Maybe they're lying. Well, not maybe. I'll guarantee you that they are in some shape or form.

If you're naive, you're not ever going to figure out the answer to this "mystery" since the media never demands its "experts" prove their claims.

More often than not, when one of the media's "experts" announces that he owns a security that's already soared, it's time to sell or even short that particular security since these guys are contrarian indicators.

Without accountability you have no rule of law.

The absense of accountability is an invariable feature found in the third and developing world. So naturally, people living in the advanced world expect accountability.

I have previously discussed one of the most common methods used by financial "experts" (aka clowns and cons) in the media to misrepresent themselves without being held accountable. I'll summarize it here.

It works something like this. A few days before being interviewed by the media the "chosen one" sends a script of their alleged achievements and/or track record to be read by the media knuckle head when announcing the "chosen one" during a broadcast interview.

This script is typically part of the media kit put together by the "chosen one" (i.e. bogus expert who is almost always Jewish).

The purpose of putting together this script is to boost the audience perception of the "chosen one" so that he is seen as an expert in the minds of the sheep who swallow the lies buried within the script.

Remember, all media is really a Hollywood production.

And all media firms are legally permitted to lie in the USA according to court rulings. And we all know who runs the legal and judicial system in the USA.

When the "expert" guest is announced to the public, the media knuckle head recites the script word for word as if the claims were true even though none of the claims have been previously verified.

In this manner, the "expert" can plead innocent if ever charged with making false claims by securities regulators or in civil lawsuits dealing with fraud and consumer protection.

Most likely this "expert" (aka con artist) will insist that he didn't make any claims. The "expert" will insist that it was the media that made these false claims about his track record.

I've discussed this tactic many times in the past. I've previously referred to it as "passing the buck." The bottom line is that it shows how the media lacks accountability for anything that it publishes. When you are receiving revenues from content you publish and the content is not true, that constitutes fraud.

Take Jim Rogers for instance. Whenever he's introduced to the sheep audience the media knuckle head will talk about what a great investor he is, and how he's done this and that without ever revealing how abysmal his track record really is.

As a matter of fact, the various media knuckle heads who interview Rogers usually cherry pick some call he made in the past without providing the proper context needed to measure the accuracy of this call, much less present a comprehensive view of his complete track record. In short, the knuckle head will almost never mention his other calls, the vast majority of which were a disaster. And when previous calls are mentioned, they're either exaggerated or not presented within the proper content. In other words, the media manipulates the truth in order to fool the audience.

This practice is very common. It's actually routine. And it's used by all Jewish media firms to promote each and every one of its "experts." The problem is that it represents fraud.

Let's dive a bit deeper into Rogers' marketing strategy and see what we find.

After all, Jim Rogers is purely a marketing "professional."

Incidentally, I find it difficult to attach the word "professional" to anyone involved in marketing (at least in the USA).

He's not an "investment luminary," as the media knuckle heads often claim. And he's certainly not anyone you'd want to listen to for investment ideas unless you're looking to do the opposite of what he says, which is the best way to profit from Rogers.

You'd be hard pressed to ever hear Rogers say anything positive about the US dollar, US economy or US stock market.

Why might this be?

Pitching the anti-USA, doom narrative constitutes the foundation of his business model because it's relatively easy to fool the crowd who eat this crap up, as they are most often conspiracy nuts who listen to Alex Jones, Ron Paul, Marc Faber, Peter Schiff and many other charlatans.

This is the same group of people who also identify with libertarians (another scam movement that seeks to screw the middle class and enrich the wealthy along with large corporations). Alternatively, they wish bad things on their own country because they feel left behind.

Pitching the doom narrative lands Rogers numerous paid speaking gigs at precious metals and commodity-related events, all while pimping his utterly useless books. Peter Schiff, ditto.

Rogers also gets big money to serve on the board of commodities companies; not because he's knowledgeable about commodities or the economy because he really isn't. Most often the companies he's involved with are shady or located in suspect countries like Russia.

The only reason why Jim Rogers gets appointed to corporate boards is because the companies want to leverage his media celebrity. That's right. Rogers gets board positions as a result of the career he has built with the media as a predictable blabber mouth and marketing clown.

After all, the media keeps telling us that he's a great investor so he must be, right?

And if Rogers the "great investor" keeps ranting and raving about how great commodities are to invest in, following Rogers could represent your ticket to easy riches, right?

Think about the financial value of having a commodities hack like Jim Rogers pump the "commodites as a great investment" narrative if you're the management team of a publicly traded commodities or commodities-related company. It effectively ends up being a low cost means by which to land marketing and advertisements. And the best part about it is that you aren't exposing your company to any liability. You let Rogers and the other fear-mongering clowns rant and rave ridiculous claims. Again, this is a way these firms can engage in fraud without being held accountable. Unfortunately, Rogers and teh others are also never held accountable for their ridiculous statements and claims even though they're making big money in a variety of ways from these claims.

And where do you think all of this money comes from?

The suckers who fall for the scam. The fools who waste money on Rogers' useless books, pay to attend conferences to hear him talk about the same predictable BS, the money lost on the investments that are linked (directly and indirectly) to the BS narrative pitched by Rogers. Hopefully you get the point. There's always a winner and a loser. And if you're listening to guys like Jim Rogers, you're going to lose while Rogers wins.

Rogers makes the kosher media rounds on a daily basis, so naturally having him pitch this ridiculous narrative could lead to a huge pile of dumb money buying shares of your commodity-based company once the suckers find out that Jim Rogers the "great investor" is on the board.

As the dumb money flows into the stock, the share price rises, providing the company with greater financial leverage by widening access to the credit markets. Moreover, this dumb money boosts the payout for all those executives waiting to cash out on their stock options.

If this sounds like some kind of pump-and-dump routine that's because it is. And it appears to be legal.

Isn't capitalism a great thing?

Rogers even gets paid by several commodities ETFs which use his name on the funds, which further highlights why he's always pumping commodities.

Think about it. There's no way to make a "pure" investment in commodities from the securities markets. You can only trade the futures contracts.

But trading is not investing. And it can become costly to constantly roll over futures contracts in order to maintain a long-term position in commodities. And that doesn't even address the loss in value of the contract due to the price slippage that occurs when contracts are rolled over.

You can however buy a commodities ETF which will theoretically approximate an investment in commodities. And over time the total fees would appear to be modest when compared to the cost of constantly buying commodities future contracts, until you come to realize how these commodities ETFs really operate.

Let's assume that there's a commodities boom under way (which there isn't, hasn't been for nearly a decade and won't be for many years even though Rogers has been claiming the opposite for nearly a decade). So under the best of scenarios whereby we have a commodities boom, it's important to understand that the contract trading fees and contract expirations along with price resets are going to eat up a good deal of the profits (if there are any) in commodities ETFs.

If you weren't aware of the fact that it can be very difficult to make money investing in a commodities ETF even during a period when there's a bull market in commodities (for the reasons I just discussed) it's just one example of the value of having an experienced financial professional by your side.

Now back to reality. Because commodities have been getting clobbered for many years (for reasons that should be obvious) imagine how much worse you're going to do after the price of an expired commodities contract resets and contract expirations add to expenses.

As well, did I mention that transaction fees are usually not included in the expense ratio?

What a disaster. I'll show you what this disaster looks like shortly.

So if Rogers is telling the sheep how great commodities are as an investment, and if the only way to even come close to investing in commodities is to buy a commodities ETF, wouldn't you buy those that bear Rogers' name??

After all, Rogers is a "great investor" isn't he?

That's what everyone in the media always says, so it must be true, right?

And Rogers is also supposed to be an expert in commodities, isn't he?

So how much better could it get than to "invest" in a commodities ETF that's named after him?

Keep in mind that the use of his name on a commodities ETF implies that he's involved in managing the fund, which is another issue in itself. But that's what the fund prospectus is for, right? After all, everyone makes an investment decision only after having read the prospectus don't they? Never mind that most people cannot understand the language used in fund prospectus. Never mind that funds have already been psychologically sold to investors after being promoted in the media.

The fact is that the prospectus serves as more of a legal disclaimer than anything else. That's right. When you consider that the media markets funds on a daily basis without supplying a prospectus, it's actually illegal. But when has the SEC ever stopped widespread fraud on its own? I cannot think of a single instance.

If you actually believe the criminal financial media, it's either because you haven't bothered to examine Rogers' track record or because you're too dense to accurate analyze his track record.

Either way, if you believe all of the bull crap about Rogers that's pumped out by the crminal kosher media, then you're likely to jump at the chance to invest in one or more of the commodities ETFs that bear his name because he's a "great investor" with a "great track record." But this is not at all the case as I have shown in the past.

Let's take a look at one of the commodities ETFs that's named after Jim Rogers to see if you can make money by investing in it.

Think about the huge money Rogers is getting to license his name to this ETF.

Again, his name is backed by the perception that he's a great investor with a great investment track record.

And the media has helped Rogers create this perception using lies and deception. That folks, is what you call fraud.

And now think about the huge amount of money the firm that runs the ETF is making in fees.

Next, think about the huge money investors have lost if they bought this ETF.

Finally, think about why these investors bought the ETF. Thereafter, it should not be difficult to see how fraud was involved.

Now if you think you have a case against Rogers or the fund company now that I've exposed this scam, I'm sorry to disappoint you because the defense will always be the prospectus.

The SEC knows this type of scam is going on. Hell, it's been going on in different variants for decades in the mutual fund industry.

Several years ago I discussed this. I even mentioned my conversations with SEC attorneys who basically told me everything is legal so long as it's buried in the prospectus. However, the prospectus does not mention anything about the media nor the creation of false perception.

Rogers doesn't care that he's deceived millions of sheep with his constant fear-mongering con games and deception.

The only thing that matters to Jim Rogers is making money for Jim Rogers. Honesty, ethics and morals never enter the picture beccause Jim Rogers is a money-grubbing scum bag and con man.

I suppose when you worship money while lacking honesty, ethics and the ability to earn it legally through real work or even by prudent investing, you might succumb to the tactics used by Rogers.

Do you understand what I'm saying here?

Jim Rogers is working with the financial media to deceive people into thinking he's some sort of investment God despite having a terrible track record and despite never verifying the claims made by the media. And he's pulling this stunt in order to profit. That's fraud in my book.

Unfortunately, if you listened to Jim Rogers you lost your sweet ass years ago.

And I'm not just talking about his commodities recommendations.

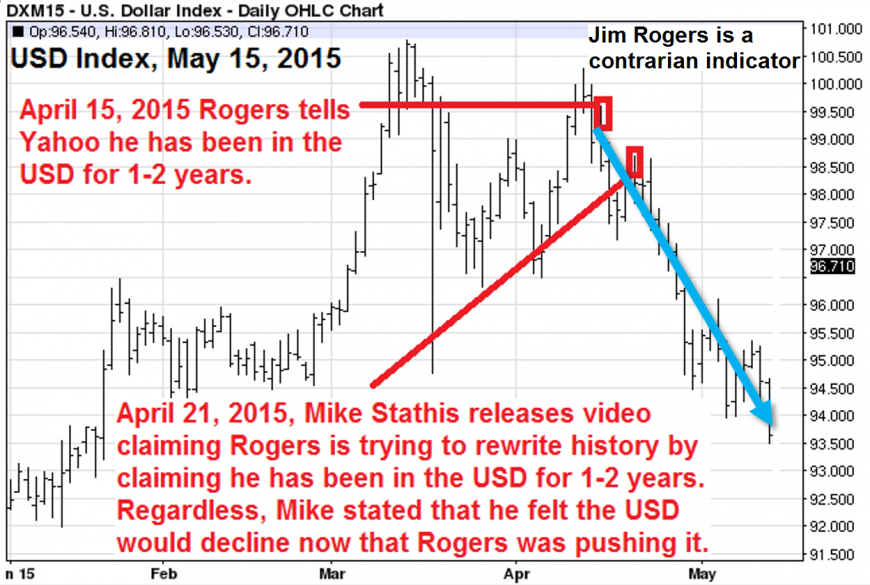

Rogers has been consistently wrong for several years about gold, the US dollar, the US stock market, US Treasury bonds and much more.

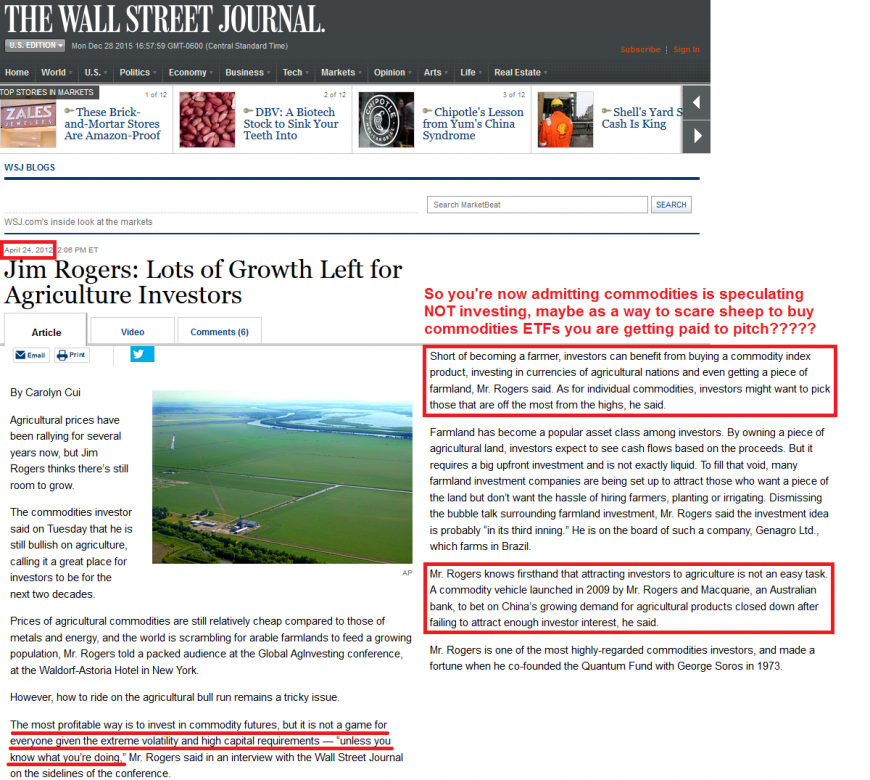

Because Rogers seems to always be telling everyone he's shorting the US dollar or US Treasuries, I took note a few years ago after he appeared on TV claiming to have been long the US dollar once it soared to multi-year highs.

But how come Rogers hadn't mentioned his dollar position before it soared?

After all, he had more than a year to tell everyone he was long the dollar.

And given that he's on TV just about every day ranting his usual vague anti-USA, fear-mongering, delusional libertarian nonsense, it seems more than odd that he waited to reveal his long US dollar position until after it reached multi-year highs.

Again, we only heard about his dollar position after it soared.

Isn't that odd, given that he's in the media just about every single day?

So the question is, was Rogers really invested in the dollar before it soared?

Or did he buy into it after it soared?

Maybe he was in the dollar before it soared but only by a small amount. If this is the case, he could claim to be speaking honestly because he owns physical US dollars, right?

Never mind that he might have only have a small amount of US dollars which he keeps in an account all of the time. Details don't really matter, right?

Wrong. Details ALWAYS MATTER.

Finally, he doesn't tell us the percentage of his investments he has in the dollar.

In other words, if Rogers is always holding all kinds of currencies he can always say he has been in the currency that's run up over the past year or two, right?

Details do matter folks.

The bottom line is that Rogers is full of shit.

And he's engaging in fraud that's being facilitated by the media.

But if you think Rogers is the only clown who's pulling this scam, you've got your eyes closed.

Most of the clowns in the media are pulling this scam.

You should never believe anything anyone says in the media unless they show evidence that's been vetted by a third party firm.

Because I already knew Rogers to be a great contrarian indicator, I was confident the dollar would sell off big time after he claimed he owned it.

Let's see what happened.

Jim Rogers Claims to Own the Dollar Now that it Has Soared!

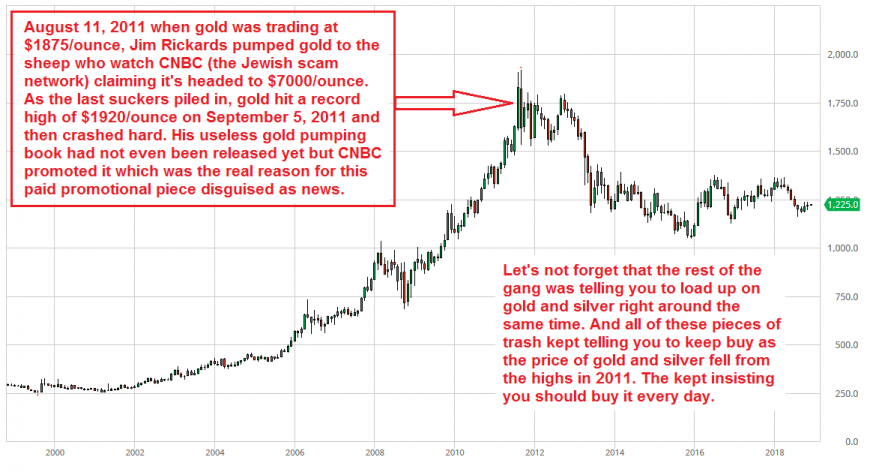

Next, take a look at Roger's call on gold and silver.

He claims to have a "gigantic short position in gold and silver right now." That was in September 2018.

I can't recall any other time in the past when Rogers stated he had a short position in gold and/or silver, which stands to reason given that he's a gold, silver and commodities pumper. Remember, Rogers is compensated through a variety of ways by serving as a pumper of precious metals and commodities.

But in September 2018 after gold and silver had been lingering, he claims to have a "gigantic short position in gold and silver."

That seems like a strange confession for a perpetual gold pumper doesn't it?

Take a look what happened to the price of gold and silver since Rogers announced his short positions.

Next, I want to show you another example of the deceitful tactic of claiming to have been in an asset or security once it has already soared without qualifying and quantifying precisely what you own, how long you've owned it, what your cost basis is, and so on.

The next individual I have chosen to highlight this tactic is Marc Faber.

The images below are meant to remind everyone that Marc Faber is just another gold-pumping clown selling fear and doom to the masses of unintelligent individuals who are too naive to realize when they're being conned.

As I've pointed out (in one of the images below) Faber tells people that his largest position is in gold ONLY AFTER it has already soared.

He makes this unverified claim in order to make you think he was in on the pop in price in advance.

But has he offered evidence of his claims? Of course not!

Maybe Faber owned gold before the recent pop in price.

If so, I'm willing to bet that he bought it at $1800 back in 2011 and has been waiting to recoup his investment all of these years while the stock market soared by 200%.

And remember, the entire time Faber has been telling the sheep to buy gold before the stock market "collapse." No one has unlimited money so if you have been telling the sheep to keep buying gold, you probably depleted your cash reserves when gold was selling for $1800, $1700 or $1600 several years ago. It all depends on how long you've been listening to this clown.

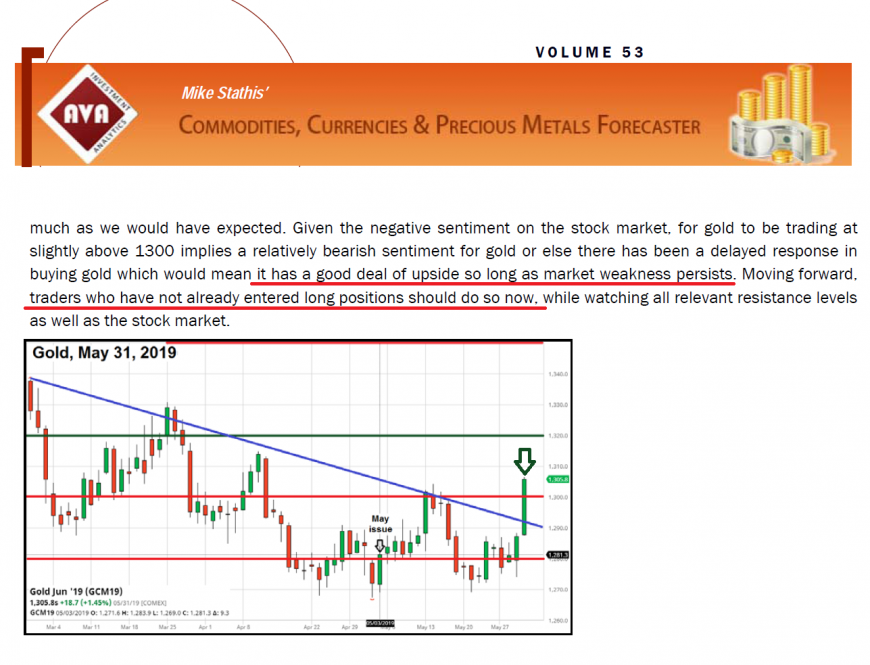

In contrast, subscribers of the CCPM Forecaster were in gold just before it soared at 1310, as shown in the chart below.

As you can see, we advised to buy gold on May 31 (June 2019 CCPM Forecaster).

And we have been recommending it since then as of September 4.

When did Faber recommend gold?

Answer: he's a gold pumper so he has been recommending it constantly for years.

Does Faber have an exit strategy for gold?

Answer: No. That means you're going to be a huge loser if you listen him.

Remember, he makes money pumping gold.

So why would any sane person take Faber seriously?

If you want to make money with gold and silver you need to trade them as securities, which is why I recommended investors buy gold and silver ETFs back in 2006.

You can also trade the futures contracts but this route is more complex and comes with greater risk for a variety of reasons.

Unlike physical gold and silver, the respective ETFs and futures contracts are associated with very small transaction costs.

They're also very liquid, making them ideal for trading.

And if you aren't trading gold and silver, you're missing out on huge volatility.

I recommended buying gold and silver ETFs in my 2006 book America's Financial Apocalypse (AFA), which is one reason I was banned by the media (that's another story).

Keep in mind that in addition to having predicted the financial crisis of 2008, AFA was released in 2006 which was BEFORE any of the gold pumping clowns released their useless propaganda books (Schiff/2007, Maloney/2010, Rickards/2011).

Unlike the gold pumping clowns who wrote books specifically to pump precious metals and to promote their business, I never pumped gold or silver. I simply made an objective recommendation to purchase these metals using ETFs.

I also discussed an exit strategy.

And I never promoted my business in my book. That shows my motives were pure. I truly wanted to help Main Street.

I never entered the precious metals business even though it would have been quite easy for me to make several million dollars in a short time span given my leading track record, the fact that I recommended gold early on, coupled with enormous demand from the gold bugs.

So why didn't I enter the precious metals business?

Answer: I value honestly and integrity over money. And I seek to help people.

Everyone in the precious metals business is a shark seeking to get as much money as they can from naive suckers.

You should also note the books written by gold pumpers are completely useless, as they did not predict anything with any reasonable amount of accuracy. Anyone who says otherwise is clueless, and that's a fact.

As a matter of fact, only a couple of gold pumpers even wrote a book pitching broken clock narratives before the financial crisis occurred.

In contrast, most of the gold pumpers released their books after the financial crisis.

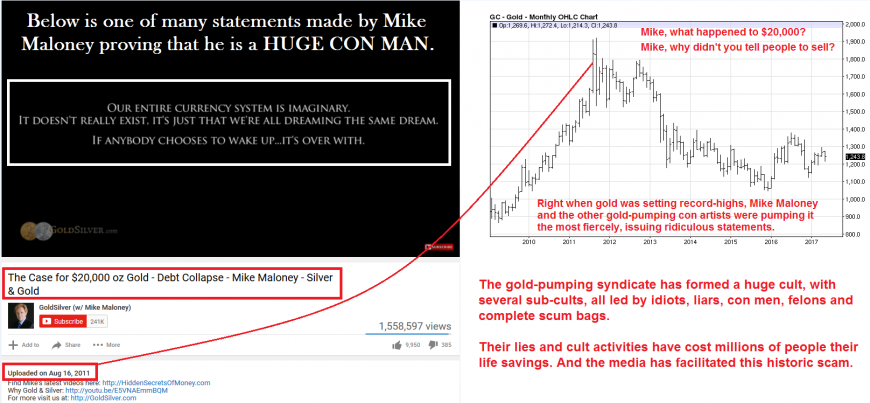

As well, Mike Maloney's ridiculously useless ghost-written book was not only released towards the top in gold and silver, the book appears to be intended for the most unsophisticated investors in existence. In fact, I would not even consider such an audience investors.

Below you can see just one of Maloney's many cons. In this one he claims he can essentially predict the future. His pitch is to sell his cult members a paid service where he tells you when to sell your gold and silver at the top.

Hey Mike, what happened to your crystal ball?

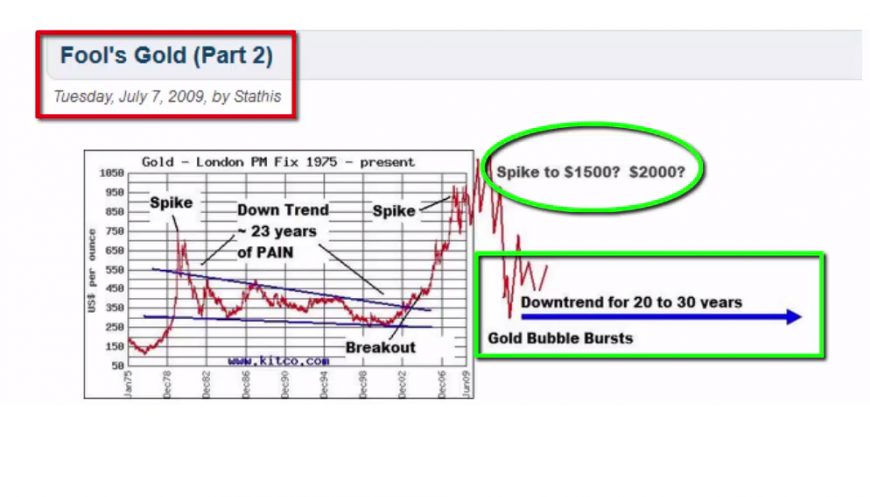

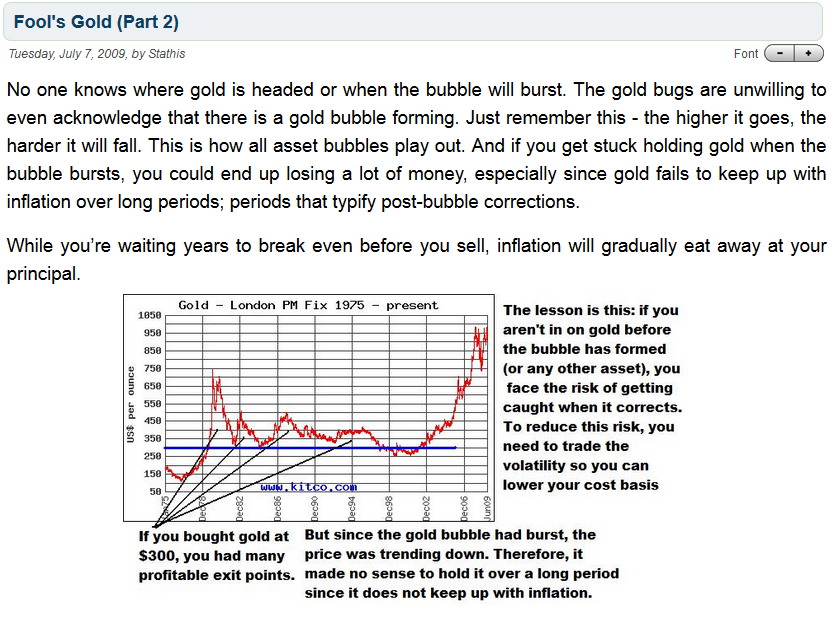

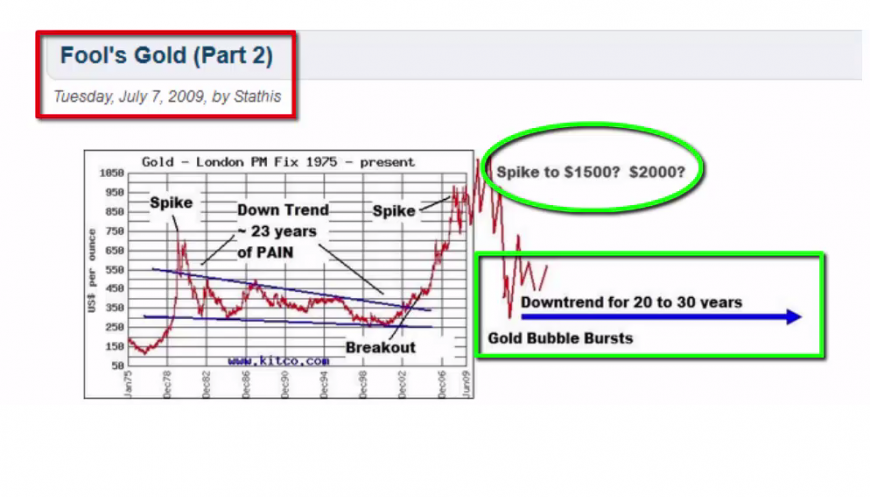

Folks, I told everyone two years in advance when gold and silver would peak. I then predicted what would happen for many years after the bubble burst in my article Fool's Gold.

Of course this was all a rough estimate, but I was right. And I had a sound basis for my claims.

And I also wasn't selling gold or silver.

Only a complete fool would listen to the pitch of someone who gets paid selling the exact thing they are pitching.

Why does anyone need a guide to invest in gold and silver anyway?

After all, there's nothing complex about buying gold and silver.

Answer: to provide disinfo and conspiracy horse shit in order to fulfill the gold pumping agendas. It's not a book, but rather pumping propaganda.

Never mind the fact that Maloney doesn't even have a high school diploma (and those who claim it's not important to at least have a basic formal education are clearly uneducated themselves).

The real issue is this.

What kind of moron would listen to someone pumping precious metals who also sales precious metals?

In the spirit of his buddy, career con man Robert Kiyoaki, Maloney keeps promoting disinformation and conspiracies that fit into the gold pumping agenda as he continues to pimp this useless book.

Incidentally, Kiyosaki also pumps gold in order to sell more of his useless books to gold bugs via the "kiss ass" approach.

Hence, one could argue that Maloney is engaged in fraud because he is profiting in a variety of ways by publishing bull shit conspiracy propaganda (otherwise known as fake news) into the public domain. The same argument applies to all precious metals pumpers.

Conspiracy Con Man and Pathological Liar Jim Rickards Enters the Scene in 2011

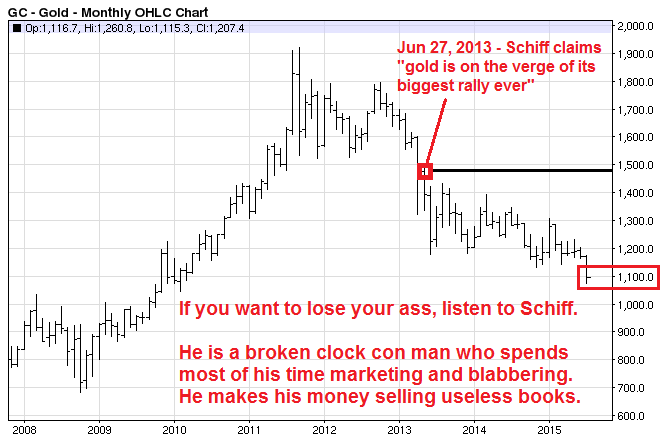

Incidentally, Jim Rickards realized how easy it would be to rake in millions of dollars by conforming to the gold pumper agenda, which is why he launched a series of useless books starting in 2011, also pumping gold.

Note: Rickards only appeared on the scene once gold was peaking in price, so if you fell for his bull shit, lies and conspiracies, you bought gold at the top.

One could argue convincingly so that Rickards is indeed the biggest parasite and liar of all gold pumpers.

As a big picture assessment, you might take some time to consider who recommended buying gold at the bottom versus the top.

I first began recommending gold in 2001 while working at Bear Stearns.

Thereafter, I remained bullish on gold for many years, which is why I recommended it in my 2006 book, America's Financial Apocalypse.

I only began to warn investors about buying gold once the various gold pumpers were manipulating the price by spewing fake news in 2010.

And then ask yourself if any of these clowns advised you to sell at the top, as I did.

Hopefully, you're beginning to see how the gold pumping game is played.

Precious metals pumpers and promotors always win even when the price of gold and silver decline because they get paid to pump, pump and pump.

As I revealled many years ago, the commissions charged for gold and silver sales are also huge. Understand that professional stock and bond funds charge around 1.0% per annum for a great deal of effort.

They also get paid to convince you to pay ridiculous storage fees. Understand that in many cases these fees are huge. This gravy train has also resulted in a good deal of disinformation and conspiracies meant to scare the sheep. In reality, storage companies should be charging no more than $200 per annum regardless of the dollar amount.

Regardless what happens to the price of gold and silver, the gold pumpers and dealers will always win.

But most of their sheep are going to lose even in many cases when the price goes up once you account for transaction fees, holding costs, taxes, and the impact on inflation during all of those years you held gold and silver without receiving any dividends.

And I won't even begin to discuss the opportunity costs associated with having money tied up in precious metals that could have been in the stock market.

Can you tell your grandchildren that you were fortunate enough to have been in the longest bull market in US history? If not, you need to figure out why.

As I've revealed for many years now, the gold pumpers won't make any money if you buy the ETFs because they don't sell ETFs. This is why they pitch physical gold and silver.

The gold and silver dealers who fund the various precious metals propaganda portals get a sweet ROI by charging huge commissions. And to encourage you to buy physical precious metals as opposed to the ETFs, they make up all kinds of crazy conspiracies in attempt to scare you.

It's funny how the gold pumpers constantly claim that fiat currencies will "soon be worthless," while claiming that the precious metals paper contracts on the COMEX are worthless. Yet many of these same pumpers are trading precious metals ETFs, or in the case of Gerald Celente, trading gold futures contracts.

Others precious metals pumpers are recommending gold and silver penny stocks; you know, stuff backed by "worthless fiat currency." That's almost as ironic as Argentina collapsing soon after Doug Casey insists that Argentina is the best place to move to in order to avoid the economic collapse coming to the USA and Canada.

Meanwhile, the sheep are too ignorant and gullible to realize the hypocrisy. They simply do as they're told as a result of greed and ignorance.

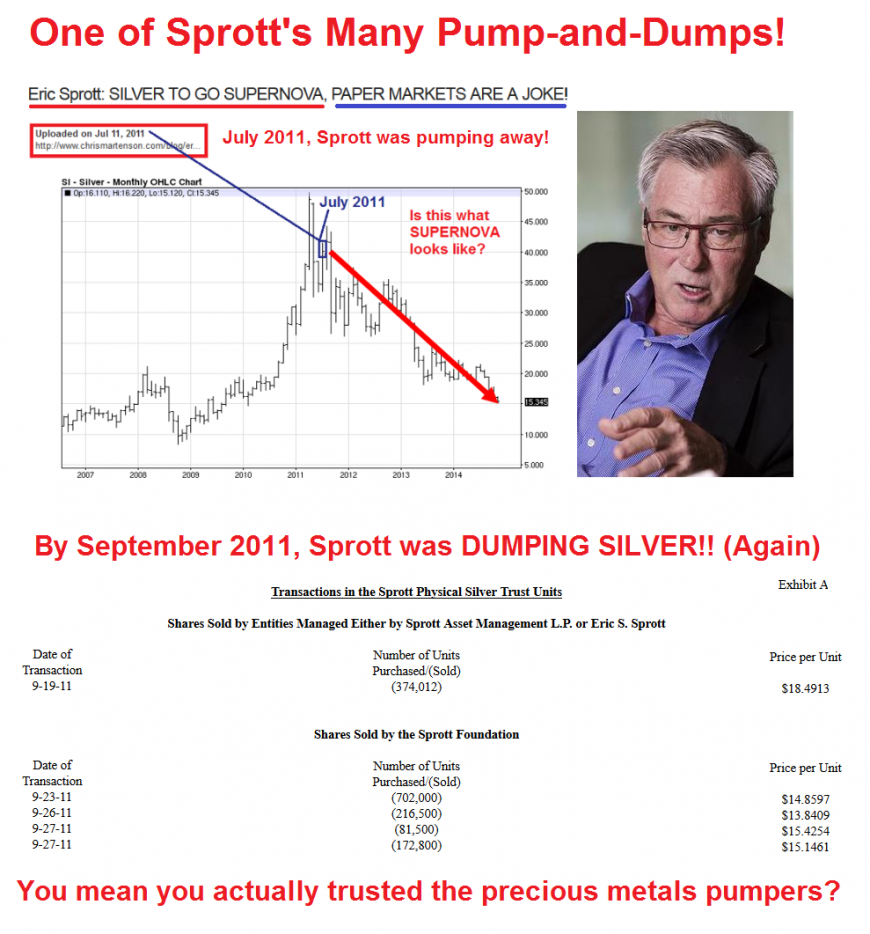

While they pump these essentially worthless companies to the sheep, they've already taken positions at low prices and are ready to dump their shares once the sheep push the prices up.

Remember that all precious metals pumpers are either precious metals dealers or they are compensated by precious metals dealers. And metals dealers own or operate every metals forum on the internet so they can create confirmation bias.

Some of these scum bags focus on pumping precious metals by making all sorts of ridiculous claims, and then dumping it after the sheep push the price up (I exposed this charlatan a few years ago).

I was the first person to expose the precious metals pumping scams starting in 2009.

I've published hundreds of articles, audios and videos revealing the many scams run by precious metals pumpers. And I've identified most of the main players, their tactics and I've debunked all of the myths they've spread.

Why do you think they panic when someone asks them to interview me?

They'll either pretend they don't know who I am (which is a lie) or they'll fabricate lies in order to discredit me for the purpose of defending themselves from being exposed as frauds.

But remember that I have the WORLD'S #1 INVESTMENT FORECASTING TRACK RECORD.

And I have backed that claim with $1 MILLION.

And let's not forget that I'm not only a seasoned Wall Street professional with vast experience in the capital markets (as a financial adviser, adviser to corporate treasury departments, hedge funds, pension fund and mutual funds, a merchant banker and venture capitalist), I also recommended gold and silver in my 2006 book.

I also laid forth an exit strategy to make sure you didn't get stuck holding the bag when it emptied.

Oh and I have no agendas because I don't sell precious metals, securities or advertisements.

And if you weren't following me, you probably got stuck.

You also probably missed out on the longest bull market in US history.

But our research subscribers have not only been in the market since the very bottom in March 2009, they've also been able to time nearly all of the major market selloffs using our research (Intelligent Investor and Market Forecaster).

Again, it's important to keep in mind that I have no agendas or bias because I don't sell gold, silver, stocks, bonds or advertisements.

I sell the world's best investment research, so I don't care where stocks, bonds gold or silver head as long as I stay ahead of the curve.

I have been ahead of the curve since I began publishing investment research back in 2006. And I have the track record to prove it.

Remember folks, these broken clocks are pitching a narrative that never changes.

You will never make money in the long run listening to broken clocks. This should be obvious at this point. If it isn't apparent by now then you have a short memory.

Or perhaps you're a youngster who's new to the game.

Either way, if you don't realize the need to stay away from broken clocks, you most likely have great deal of financial pain in your future.

Check the track records of Faber, Schiff, Rogers and the rest of this crowd and you'll see what I mean.

And if you actually think these clowns have even a decent track record, all I can say is may God help you.